Prices

December 17, 2020

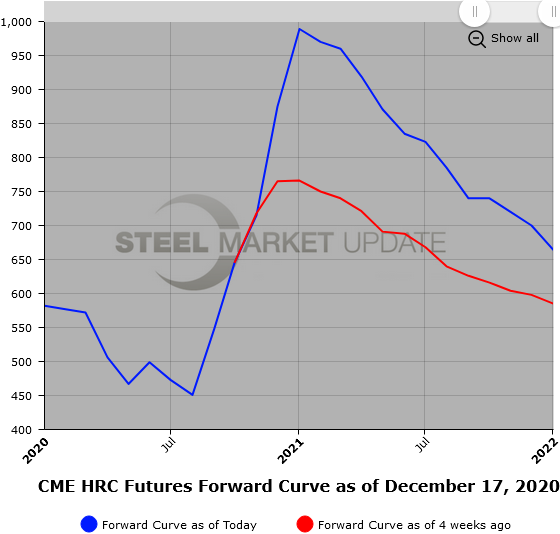

Accelerating Price Velocity in Hot Rolled Futures Leads to Unbalanced Futures Liquidity

Written by Jack Marshall

The following article on the hot rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Hot Rolled

Hot rolled futures markets have experienced high velocity upward price moves along the futures curve in conjunction with spot over the last two plus weeks. The spot index as reported for the CME HR contract has risen $138/ST, which is 140% of what it has risen monthly over the last few months. The moves in the futures curve are reflected in the change in the Q1’21, Q2’21, Q3’21, and Q4’21 HR futures quarters from Dec. 1 through Dec. 16, which are up $153/ST, $125/ST, $83/ST, and $93/ST, respectively. The forward curve has risen significantly, but at the same time gotten more steeply sloped backwards. Buyers of further out periods are getting a larger discount to the near date futures. In a Jan’21 to Dec’21 example, a seller of Jan’21 HR and a buyer of Dec’21 HR would have paid $63/ST less for the same calendar spread from Dec. 1 to Dec. 16. The backwardation slope of the HR futures for the period Jan’21 to Dec’21 has steepened by $63/ST [Dec. 1 ($850/ST Jan’21-$618/ST Dec’21)=$232/ST, Dec. 16 ($995/ST Jan’21-$700/ST Dec’21)=$295/ST].

Features of the latest futures markets include the accelerated velocity in price volatility, which is reflected in the very compressed number of days that it took HR futures prices to jump. HR futures markets have been getting a bit less liquid the further the price has moved higher and also as a function of nearing year end. Physical HR spot markets continue to remain extremely tight. Lead times remain at record levels. Forecasting has continued to be difficult given ongoing market dislocations globally in the steel space. While there is some supply side relief expected sometime in the first quarter, markets remain very nervous and unbalanced. It has been reported that some HR spot tons have traded at or above $1,000/ST levels, which we have not seen in some time.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

The BUS futures market continues to lag the strength in HR futures markets, but we are seeing signs that is changing. The Q1’21 BUS quarter is almost up $60/GT in the first half of December with Q2’21 and Q3’21 up around $30/GT. The backwardation slope of the HR futures for the futures period Jan’21 to Dec’21 has steepened by $35/GT [ Dec 1 ($405/GT Jan’21-$365/GT Dec’21), Dec. 16 ($460/GT Jan’21-$385/GT Dec’21)]. BUS trading volumes have been brisk and are increasing due to increased positioning in the nearer futures months as participants look for a narrowing of the metal margin spreads, which have widened out due to the lagging price increases in BUS as compared to HR futures.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.