Prices

December 14, 2020

SMU Market Trends: Do Prices Have More Upside?

Written by Tim Triplett

How much higher can steel prices go? It’s impossible to know, but given the current lead times, level of demand and the support higher prices are getting from distribution, and it appears prices may have some more upside.

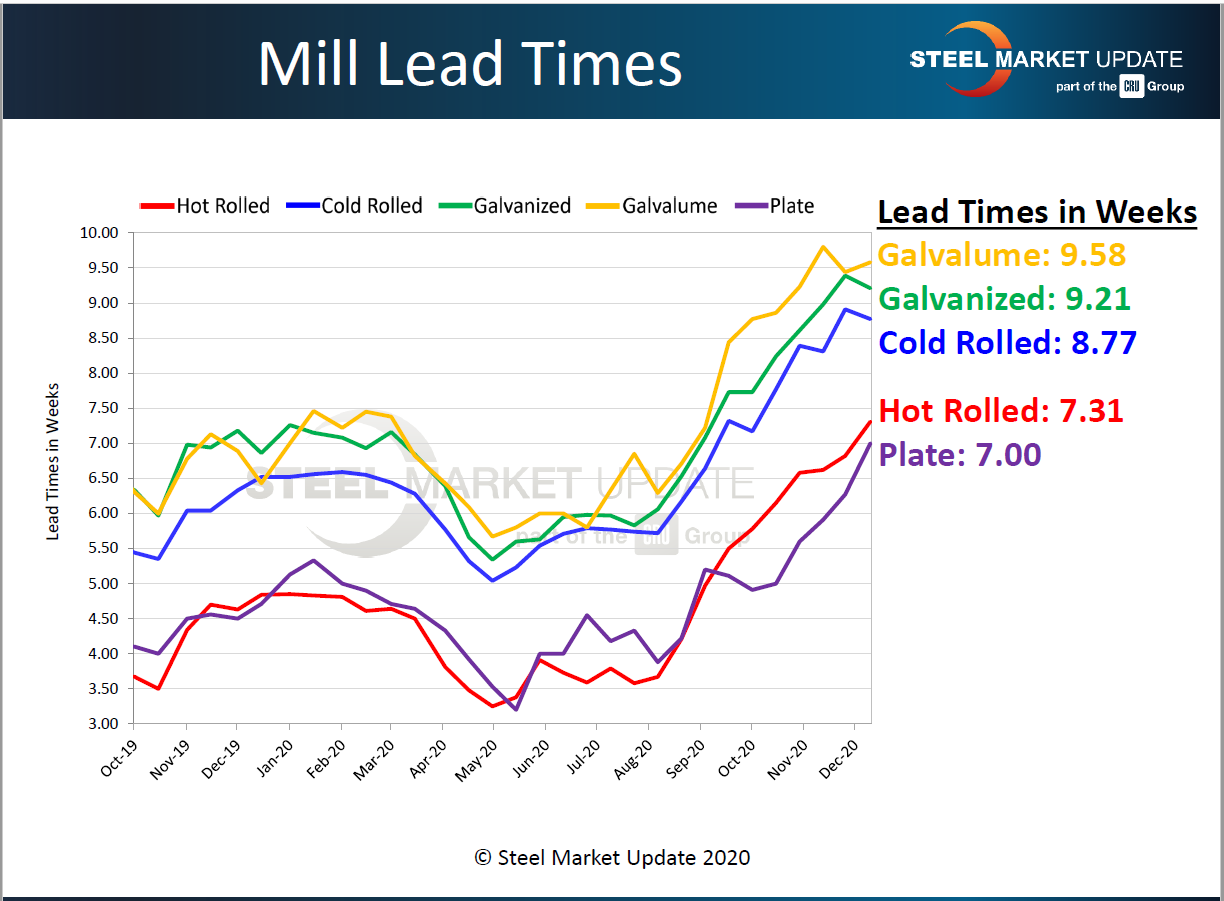

Steel Market Update estimated the average HRC price this past week at $865 per ton, with reports of offers well above $900. The mills are extremely busy, with lead times for delivery of spot orders topping seven weeks for hot rolled and nine weeks for coated products (see chart below) after rising sharply since mid-2020.

Outlook on Demand

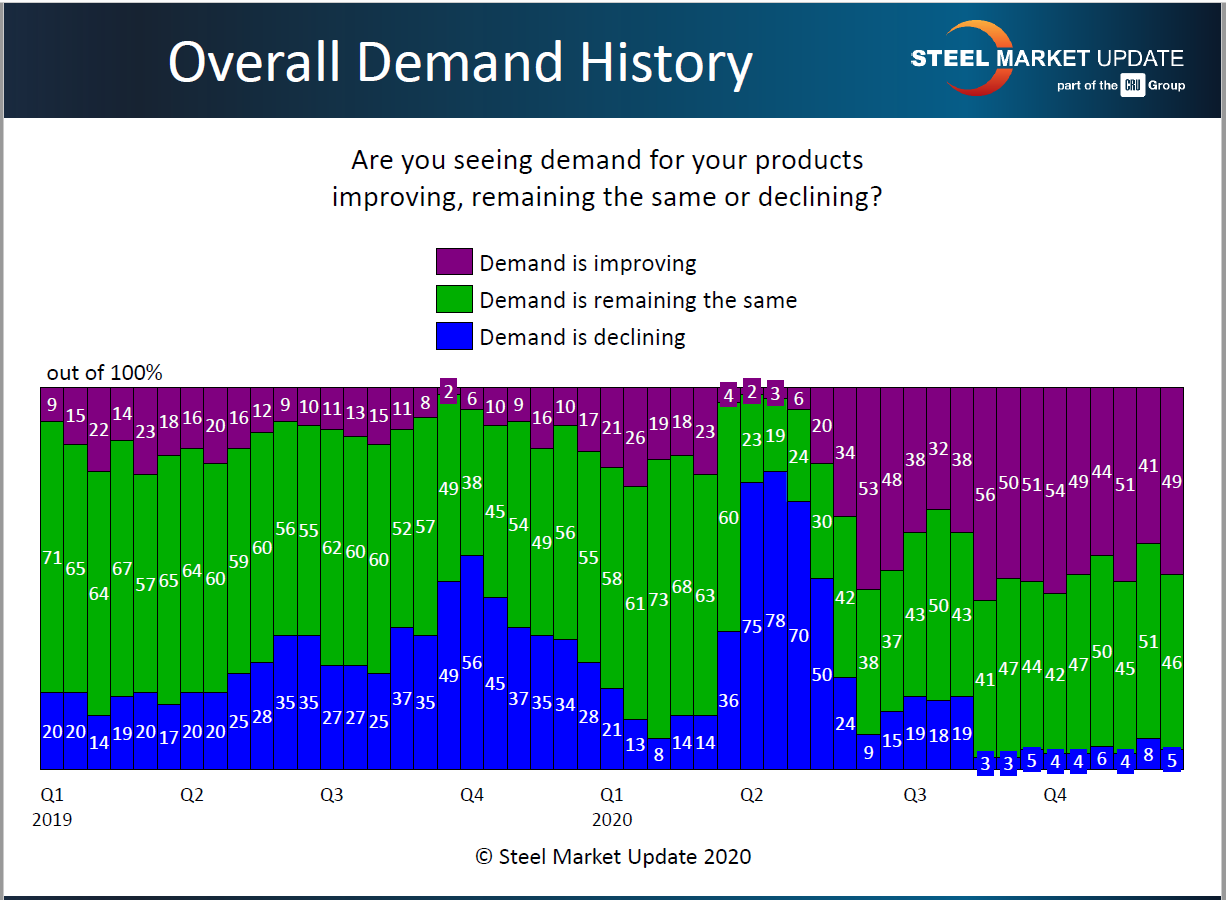

Does the current steel demand represent real consumption or is it primarily a response to the tight steel supplies? About 49 percent of the buyers responding to SMU’s questionnaire this week still report improving demand, even as steel prices hit extreme highs, while another 46 percent see demand remaining stable. Only 5 percent said demand from their customers is declining. That prevailing view of the same or rising demand has seen little change since October (see chart).

Comments from buyers vary on the staying power of current demand:

“Demand has been strong and we expect it to continue through 2Q21.”

“There’s probably a fair amount of panic buying.”

“Business is not slowing for the holiday season as it usually does.”

“Demand is up, but only because of the current tight availability.”

“We’re not sure if the end-user is spooked and the other shoe will drop once the pipeline is full. There’s lot of moving parts.”

“Demand has gone through the roof, but is this true demand or is this OEM customers hedging their bets and placing multiple orders with multiple suppliers to see who can satisfy the orders first, then canceling the orders with the other sources? This is our greatest fear.”

“Everybody is only buying what they need short-term or know they have it sold and can cover the high cost and still make money.”

“The improvement is related to auto and heavy truck that continue to show increased schedules.”

Support from Service Centers

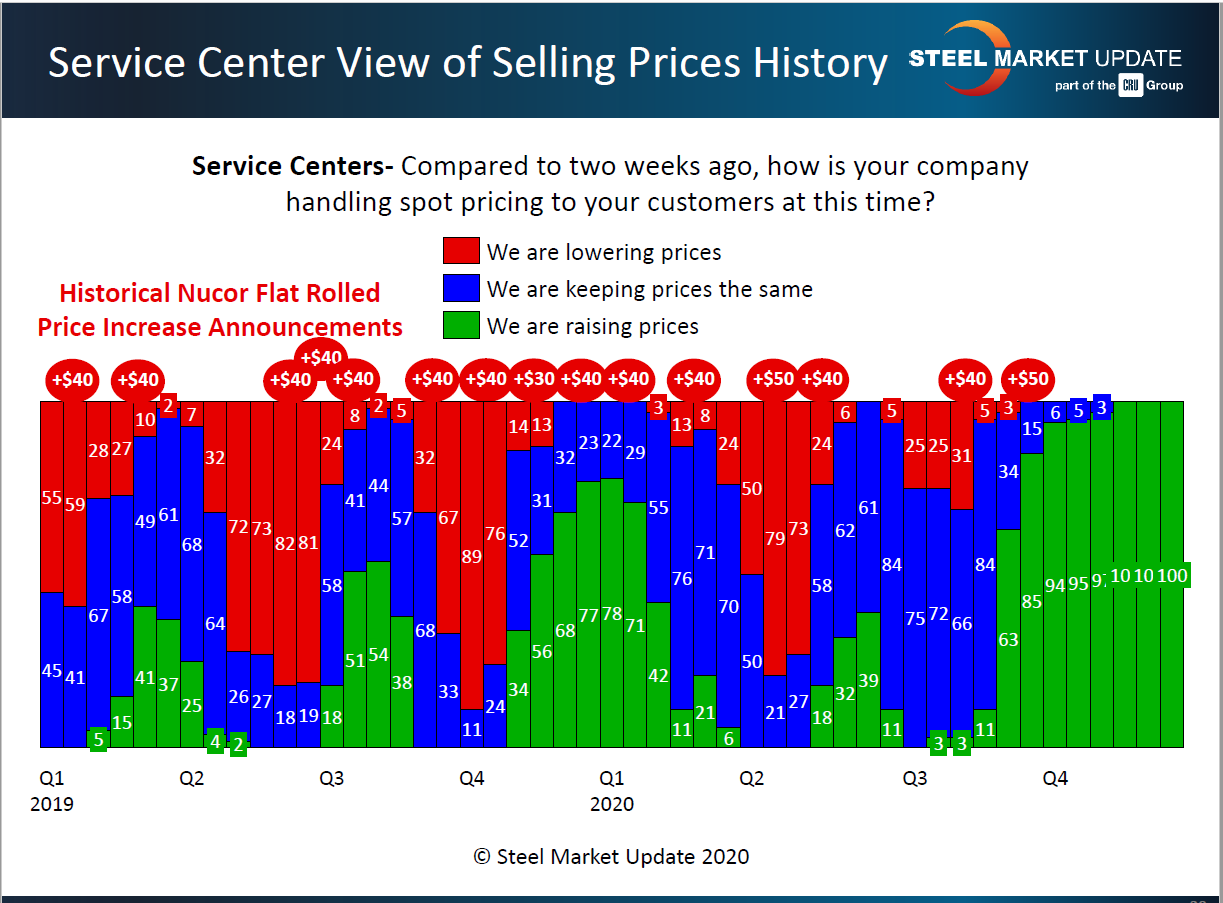

Importantly, service centers have been very supportive of the mills’ efforts to raise steel prices. As the green bars in the chart below show, virtually all service centers have been raising prices to their customers since the third quarter.

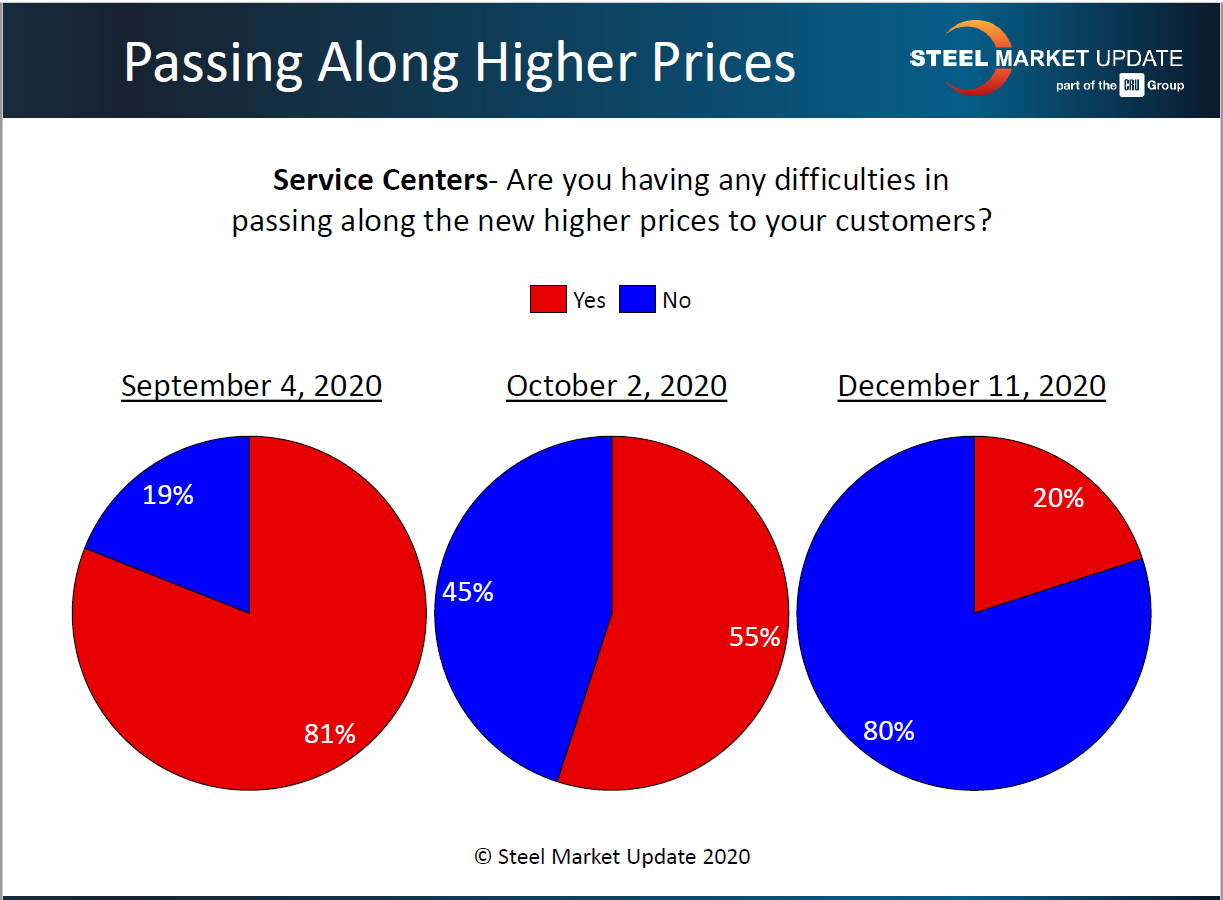

And with considerable success. Eighty-percent of the service centers polled by SMU this week said they are not having difficulty passing on higher steel prices to their customers—which is another indication that current demand is for real.

Where Will the Market Peak?

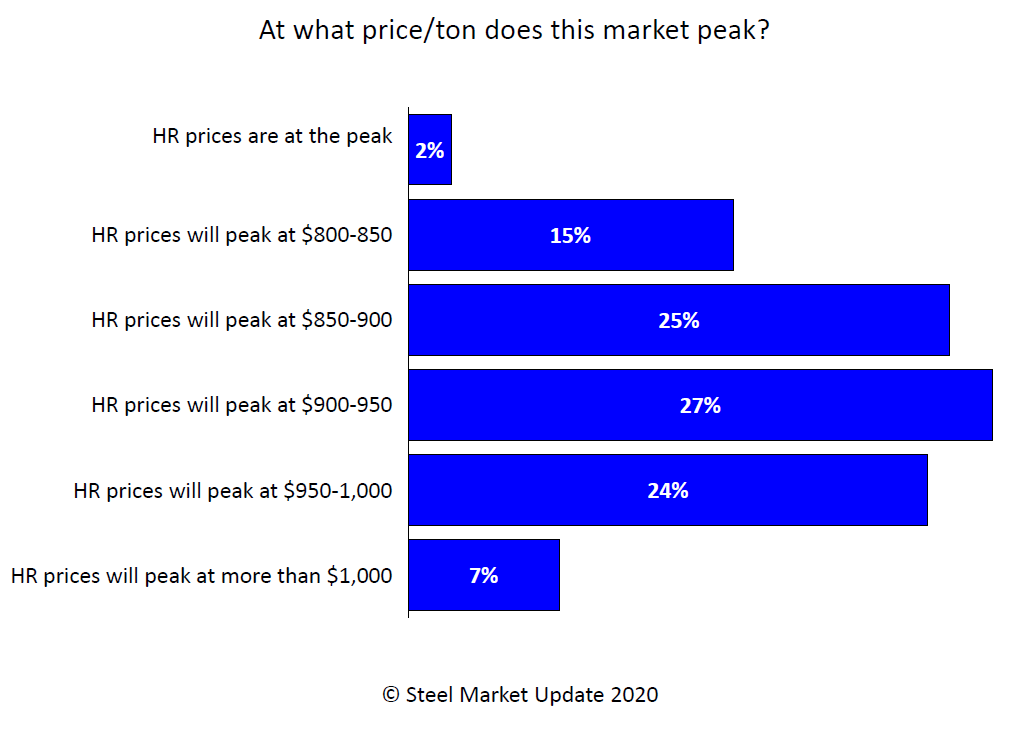

SMU also asked in this week’s questionnaire: At what price/ton will this market peak?

Around 42 percent of respondents said hot rolled will top out in the $850-900 range or less, which effectively would mean the market has already peaked. Another 27 percent said they expect the price increases to level out in the $900-950 range, while 24 percent put the peak at $950-1,000. A small minority (6 percent) can envision hot rolled at more than $1,000 per ton, a seldom-reached level that last occurred in the boom year of 2008.

Here’s what some steel execs had to say about the current pricing environment:

“It’s hard to believe, but HRC is already being quoted at $960 and we are not even past January.”

“This is 2004 and 2008 combined. Everyone is scrambling for steel, so they are doubling up on orders. Even OEMs have customers that are placing multiple orders because they are hedging their bets on who can get them the end product faster. Once that end product ships to them, they will cancel their order with the other OEM, and then this will ripple back through the steel supply chain. I truly see a possible 2008 price curve setting up. Remember, scrap and iron ore were also extremely elevated during 2008. Look at what the analysts are projecting for 2021. It all looks very familiar.”

“2021 is going to be a record year on the upside and the downside.”

“The domestic supply/demand imbalance, coupled with a foreign supply/demand imbalance, warrants these high prices. Add higher raw material costs for EAFs and BOFs and you have a perfect storm. This is not synthetic like 2018.”