Prices

December 8, 2020

CRU: Steel Price Surge Causes Global Metallics Prices to Spike

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Metallics Monitor

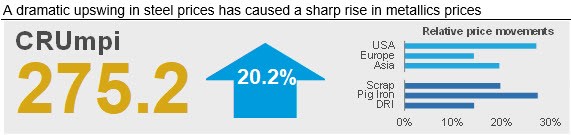

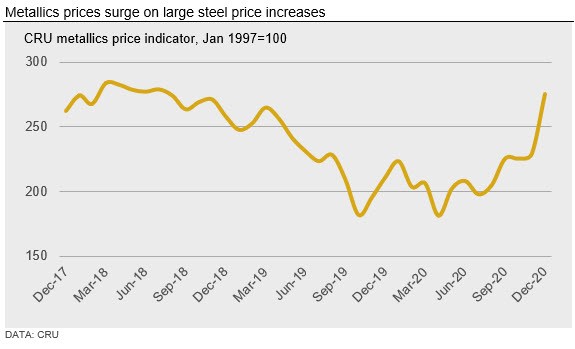

The CRU metallics price indicator (CRUmpi) rose by 20.2% m/m in December to 275.2. This large increase was driven by a rapid acceleration in global finished steel pricing. Even with this large m/m increase for December, we again expect metallics prices to rise in January as steelmakers compete for material in increasingly tight markets.

The accelerated rate at which finished steel prices are rising across the world has caused metallics prices to spike in December. Because steel prices are so elevated, mills in most areas of the world are currently more concerned about securing material inflows than they are about input costs. As a result, they are aggressively bidding against one another to prevent potential output curtailments. For scrap, Chinese domestic prices have hit their highest point since 2012, while those in Brazil reached yet another record-high level. Meanwhile, U.S. prices rose by ~30% in a single month. Ore-based metallics are undergoing even larger increases m/m as traditional buyers compete with Chinese demand for material.

Strength in Chinese steel markets, in addition to adverse weather conditions, has driven scrap prices there to rise to an eight-year high. With relatively mild winter heating season restrictions this year, both EAF and integrated mill production (and by extension scrap demand) have been strong. Concurrently, winter weather has begun affecting scrap collection and transportation in the northern part of the country, and this too has helped support prices.

In other parts of Asia, a recovery in domestic scrap demand in Japan and reduced availability from the U.S. have tightened markets and led to higher prices. Vietnam-based scrap buyers witnessed a $55 /t m/m increase for HMS 1/2 80:20. Vietnamese steelmakers are keen to pass on the higher scrap costs to buyers through higher priced offers, and Vietnamese billet export prices are rising in line with other large m/m price increases in Asia. In contrast, steelmakers in Bangladesh are having a tougher time passing on higher scrap costs because of tepid steel demand conditions.

With Chinese steel producers focusing on their domestic markets, rising prices have provided openings for Turkish steel exporters in other parts of Asia. As prices for their exported products rise, producers in Turkey have also been willing to increase imported scrap prices. From the first week of November until the first week of December, Turkish scrap import prices rose by $67 /t CFR for HMS 1/2 80:20; the highest price level since May 2018.

Pressure from the international scrap market is adding to intense competition for material in the U.S. market between domestic mills. There, while higher prices are now helping spur scrap flows, weaker prices than expected by many in the market in prior months kept the pace of scrap collection slower than it might otherwise have been. As a result, shredded scrap prices have now risen to levels mirroring the peak of 2018’s price rally following the implementation of Section 232 tariffs.

While prices also increased in Europe, it was generally the weakest market we track with prices only rising by ~€20-30 /t m/m. Still, sellers there are hanging on to material in anticipation of yet more price hikes in January, especially given that pig iron prices there rose by more than $100 /t m/m in December.

Indeed, increases in the international pig iron market were substantial m/m. Chinese buyers remained in the market even as traditional buyers, who had largely shied away from the market due to high price levels, returned. In the U.S., bids became quite aggressive as buyers there sought to pull material away from China. Moreover, pig iron input costs have risen substantially in recent weeks and this has helped propel prices further still.

Outlook: Yet More Upside Price Pressure Ahead

Tightness in the finished steel market appears set to continue for the short term, meaning that competition for scrap will continue to be high. With finished steel prices also rising, mills across the globe are likely to accept a push by sellers looking for even higher prices in January (albeit at a smaller m/m increase). As such, we see essentially only upside risks for global metallics prices next month.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com