Prices

December 3, 2020

HRC Futures: The Show Goes On

Written by David Feldstein

Editor’s note: SMU Contributor David Feldstein is president of Rock Trading Advisors. David has over 20 years of trading experience in financial markets and has been active in the ferrous futures space for over eight years. You can learn more at www.thefeldstein.com or add him on twitter @TheFeldstein and on Instragram at #thefeldstein.

For some time, I have been writing that for domestic mills to maintain their lead times and spot pricing power, new purchase orders not only have to match the previous week’s, but also exceed it by the incremental increase in capacity. I was surprised to see that they were successful in this regard in December, actually increasing their backlog of orders received from service centers. The show goes on.

Today, the February CME Midwest HRC future made another new record high trading $1,155/st.

Upon learning about the further increase in mills’ backlog last week, it was surprising to see the March future under pressure as it traded down to as low as $986/st. Settling last week at $1,035, the March future looked to be undervalued, which I find to be a shocking thing to write. Since last Friday’s settlement, March has traded to a new high of $1,098/st, a gain of $63 so far this week.

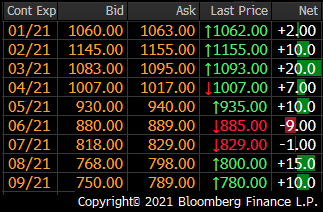

This is where the HRC futures market was at 2 p.m. Thursday afternoon.

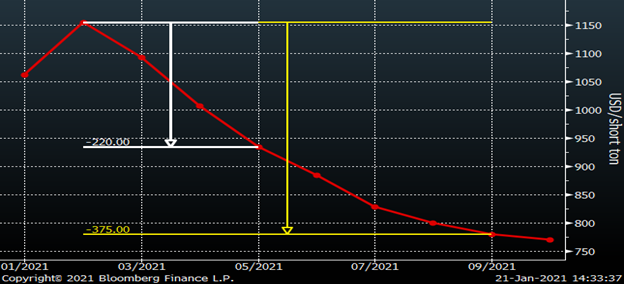

In my last SMU article, I showed the double black diamond steepness of the HRC curve and the spread between January and August being $232. The spread between February and September (so seven months in both instances) is $375, a $140 increase in three weeks! Meanwhile instead of having to go seven months out for $232 worth of backwardation, you only need to go three months out from February to May. Again, it has only been three weeks!

CME Hot Rolled Coil Futures Curve $/st

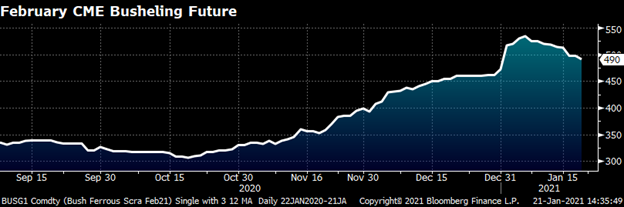

After peaking at $534 on Jan. 7, the February CME busheling future has steadily traded lower as expectations have adjusted from up $30-40 down to $0-20 with some rumors in the market today that it would be down MoM.

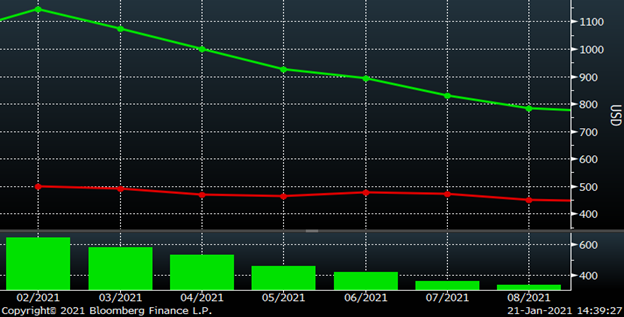

This is a head scratcher as the metal margin, i.e. the difference between HRC and busheling, remains in record profit territory. Steel production is increasing. How many scrap yards are emptying their yards? With multiple brand-new EAF mills coming online throughout 2021, scrap demand is poised to be strong. So, what gives?

Metal Margin – CME HRC $/st – CME Busheling $/gt

The pressure on busheling doesn’t look to be coming from iron ore as the February SGX iron ore future continues to hold steady settling today at $167.60/t.

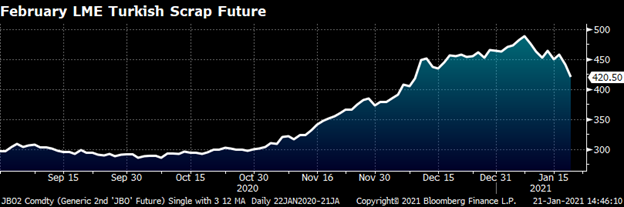

Here we go. Turkish scrap looks to be the culprit. The February LME Turkish scrap future closed today at $420.5/t, having fallen by almost $70 since settling at the record high of $488/t on Jan. 7. This looks to be the main driver behind the downward pressure in the busheling futures market. Is this transitory? Is this enough to disrupt the flat rolled market?

Will this rally ever stop and where? What happens if there is an unplanned supply disruption? After last year’s experience, you have wonder what other unpredictable events await. What month will the market peak? Will March end up trading above February? Once the market falls, will it fall by the $375/t indicated in the future’s curve or will it fall by even more?

There is no disputing that Midwest flat rolled overshoots on the way up and on the way down. Buckle your chinstrap because this is going to be a very interesting year.

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Mr. Feldstein should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.