Prices

December 3, 2020

HRC Futures: Another Rocky Week as April HR Takes the Title

Written by David Feldstein

Editor’s note: SMU Contributor David Feldstein is president of Rock Trading Advisors. David has over 20 years of trading experience in financial markets and has been active in the ferrous futures space for over eight years. You can learn more at www.thefeldstein.com or add him on twitter @TheFeldstein and on Instragram at #thefeldstein.

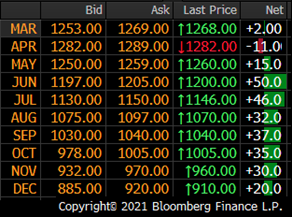

Today’s CME Midwest HRC market:

This market is an extremely difficult one. March will be the seventh straight month of sizeable MoM gains in domestic flat rolled prices. On Wednesday, the April CME future traded above $1,300 to an all-time high of $1,313/st.

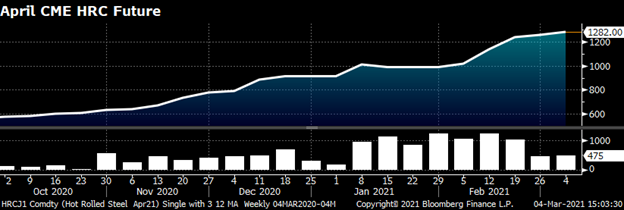

Often, I have been asked if I have a study or if I could run a backtest or create a model on hot rolled price data. This could provide a historical perspective that would offer one the perception of predictability and perhaps control. Any sense of safety these analytics might have produced has proven to be illusory. The week before last, the futures market saw gains of $80 to $130 depending on the month. Last week, the market became extremely quiet and moved higher week-over-week by a paltry $20. Transactions and volumes decreased significantly. It was somewhat of a nice break from the weeks and months of hyper-volatility. This week, the drop in liquidity has remained, but the volatility has come roaring back with a vengeance. The chart below shows the price of the April CME HRC future with the weekly volume in the bottom panel. Notice the sharp drop-off.

“You stop this fight, I’ll kill ya,” said Rocky Balboa to Mickey as he stood up from his stool to fight the 15th round of his first bout with Apollo Creed. If you remember the end of this iconic scene and you can picture what Rocky and Apollo’s faces looked like, then you can understand how service center hedgers, market makers and sellers of hot rolled and busheling futures over the past seven months feel.

Every study, every model and every backtest has said and continues to say sell this market, which is almost $400 above the 2018 highs ($920) and almost five standard deviations away from the 12-year average flat-rolled price. Yet if you have listened to those analytics and sold futures, then you have experienced significant losses. Between the realized and unrealized losses, the massive capital drain required to meet never-ending margin calls and the fellow co-worker’s animosity, it’s not a surprise this small group of folks within our industry is a bit sheepish to sell more despite $1,300 hot rolled and $635 busheling.

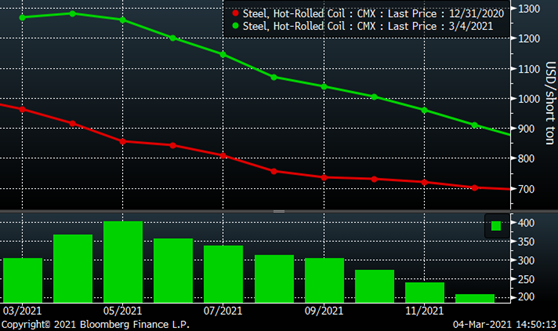

This chart shows the CME Midwest HRC curve on Dec. 31 (red) and March 4 (green). The CME HR futures have a contract for each month (x-axis) going out 36 straight months. The settlement price is plotted (y-axis) and then the curve is created connecting the dots. The histogram in the panel below shows the 2021 gains for each of the contract months starting with March and ending with December. May, which has gained $400/st in 2021, is leading the pack closely followed by April and June.

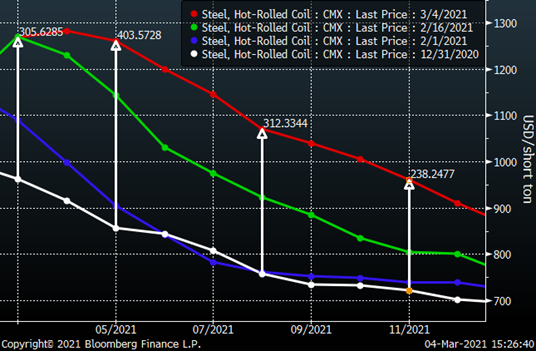

The same kind of chart below shows the curve’s evolution throughout Q1. Comparing the white and blue curves, you will see initially the front months pushed higher while the back months sat still. Then in mid-February, shortly after learning about the unplanned disruptions to multiple steel mills caused by the harsh winter storm, the back end of the curve started to increase in price. Looking at today’s curve (red), you can see the front months of the curve flattening. With the back-end months of the curve also moving higher, the spread between the front and back of the curve is starting to converge.

Some of the gains in the later months could be in part due to the decline in sell-side illiquidity as buyers simply look for any opportunity to buy. The rally in the back months is also, in part, due to physical buyers locking in not only relatively attractive pricing, but also guaranteed availability later in the year with domestic lead times already out to May. Despite gaining over $100 so far this week, the third-quarter futures still remain $200 below the March future. The fourth-quarter futures have gained between $55 and $90 so far this week, but remain $300 below the March future.

Today’s CME busheling market:

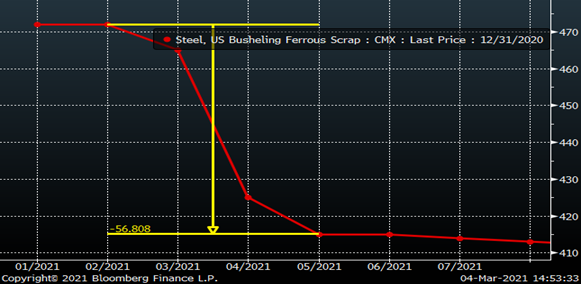

The liquidity in the CME busheling futures market has all but dried up over the past few weeks. At the end of last year, the busheling futures curve was steeply backwardated (downward sloping). The January and February futures were $57 above the futures for May and beyond.

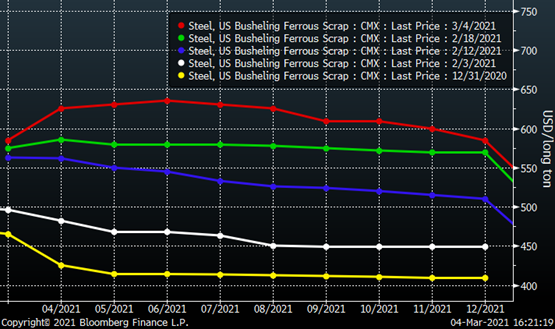

On Feb. 3, the busheling curve continued to be backwardated. Then, the curve has slowly flattened out with the back-end moving abruptly higher on extremely light volume. One unpleasant reality of illiquidity is the market lends itself to be easily manipulated. Fundamentally, it makes no sense that the busheling curve should be flat into year-end not only due to fundamentals in the scrap business, but also considering the Midwest hot rolled, Turkish scrap, iron ore and Chinese hot rolled futures curves are all steeply backwardated.

Hot rolled at $1,300 and $635 busheling failed to draw much selling interest. These markets are exhausted.

It’s not “this time it’s different,” but rather this period of time we are in is like no other we have seen before. Models use previous data to forecast the future, but the present is unlike any other period in the futures data set going back to 2008. There is no magic formula to manage through the volatile price risk now and in the months ahead. However, the principle “if the market ain’t goin’ up, then it’s goin’ down” remains secure and this market has definitely been going up again this week. Will it go the distance? How much farther and longer can it go until it reaches its breaking point? When will it stop going up and start going down?

Despite all I have said, I can appreciate you might not be satisfied. So, what is my prediction for the rest of 2021? As Clubber Lang put it, “My prediction???……PAINNN”!!! Whether you work for a service center, OEM, mill or scrap yard, you’re just gonna have to duke it out.

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Mr. Feldstein should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.