Prices

December 3, 2020

HRC Futures: Buyer’s Bonanza with May and June Trading $1,430/st

Written by David Feldstein

Editor’s note: SMU Contributor David Feldstein is president of Rock Trading Advisors. David has over 20 years of trading experience in financial markets and has been active in the ferrous futures space for over eight years. You can learn more at www.thefeldstein.com or add him on twitter @TheFeldstein and on Instragram at #thefeldstein.

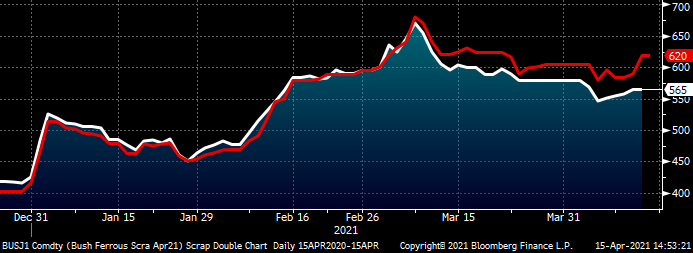

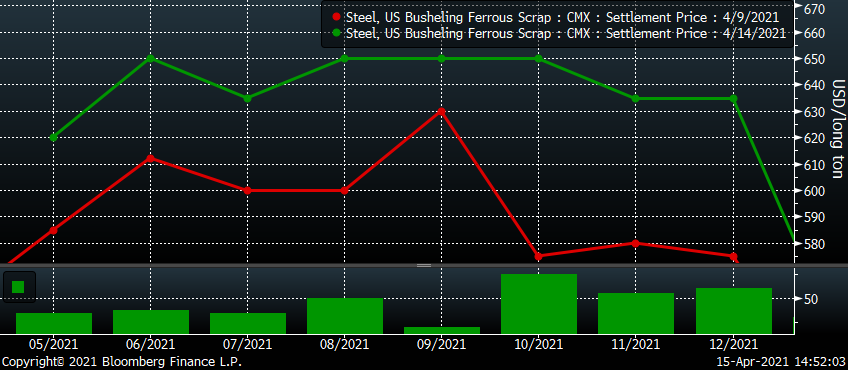

This week, the April CME Midwest busheling scrap future’s final contract settlement, which is equal to the AMM’s No. 1 Busheling Index, settled up $13.66 at $564.98. While $564.98/gt sure seems a lot for scrap, the fact that it was only up 2.5% MoM was surprising considering flat rolled prices. The May BUS future has moved up rather quickly already, pricing in a $55 or almost 10% MoM increase. Now a 10% increase, well that’s more like it because…

April (white) and May (red) CME Midwest Busheling Scrap Futures $/GT

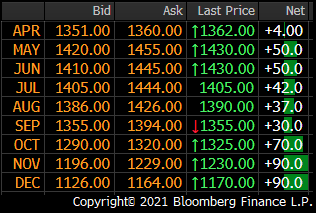

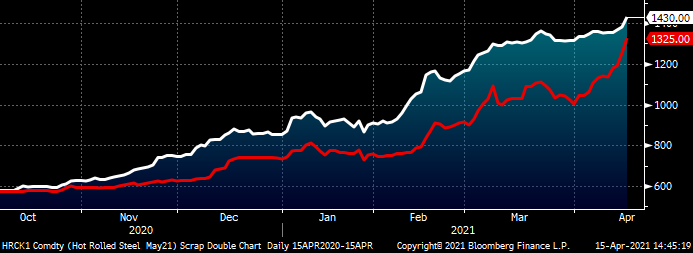

…look at these hot rolled futures!!! They are unstoppable! Hot diggity dog…$1,430 for hot rolled!! The prices below are from 3 p.m. CST Thursday and the net change in price on the right, that is just since yesterday!!!

CME Midwest HRC Futures

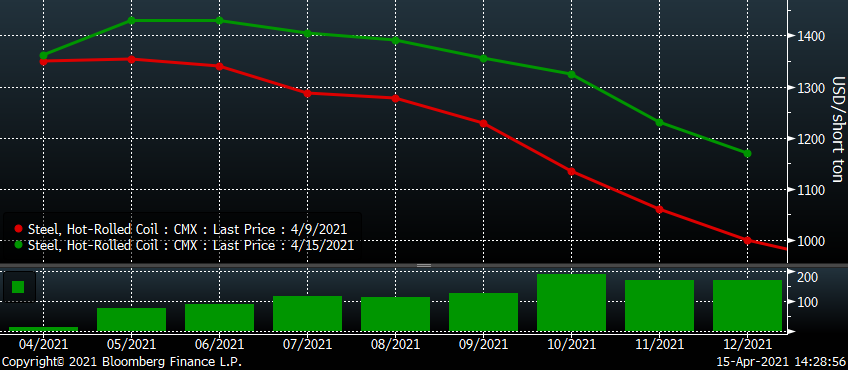

In fact, since just last Friday, hot rolled futures have gained between $100 and $200 per ton depending on the month. This chart shows the CME hot rolled futures curve. The CME has a hot rolled future for each month for the next 36 months. Every night, each month’s future has a settlement price and if you connect the dots, it creates the curve. These futures are financially settled at the CRU’s average Midwest HRC Index for each month.

CME Midwest HRC Futures Curve $/st

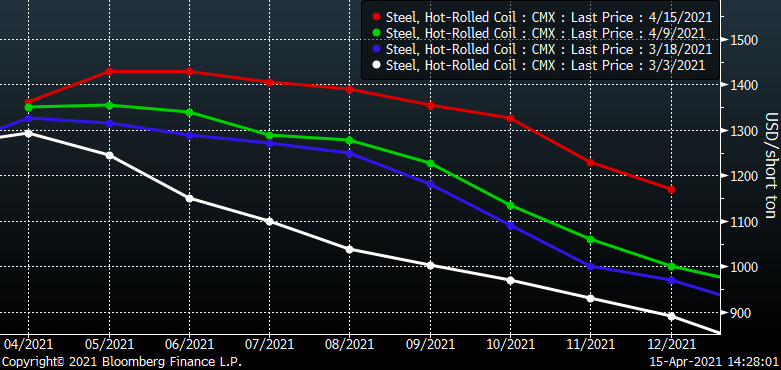

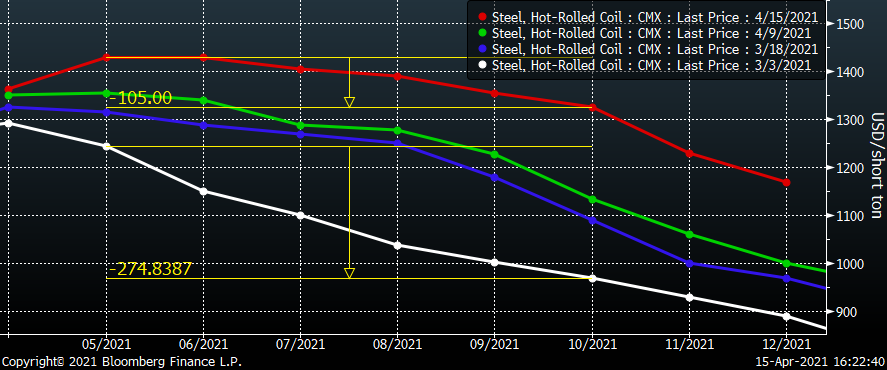

The last time I wrote an article for SMU (3/18), I pointed out that the HR curve had been flattening likely due to those with expectations or concerns that the current tight market conditions will continue buying forward to lock in value anywhere they could. The chart below shows the CME HRC curve on four dates starting on March 3. On March 3, the August future was $1,038 and the September future was $1,003. April was $1,300, so August was $262 below April, while September was about $300 below April. Through March and into April, buyers have been scooping up those August and September futures, which are now above April at $1,390 and $1,355, respectively. In fact, August is above all of the physical indices and September is above half of them.

CME Midwest HRC Futures Curve $/st

With the low hanging fruit quickly picked, buyers set their attention on the fourth quarter, which is up $180 so far this week (see above). This next chart shows the evolution of the May and October future. As you can see, the May future separates itself from the October future starting in February through the end of March. Then, down the stretch they come with October’s future galloping like Silky Sullivan into today’s close.

May (white) and October (red) CME Midwest HRC Futures $/st

This chart shows the spread (y-axis) between the May and October futures by subtracting the May from the October future. Up until last September, these two contracts were so far in the future and lightly, if not barely, traded, they were priced within $5 to $10 bucks of one another. Once the rally started in September and some market participants began trading Q2 and May, the spread started to open up. By the end of 2020, May was trading $857 and October $732 for a spread of $150. As hot rolled prices exploded higher, the spread expanded to where October was $300 below May. Since April started, Silky Sullivan HRCV1, the October future, has recaptured two-thirds of that and is now only $105 below May.

CME Midwest HRC October ’21 Minus May ’21 Spread $/st

Here are those curves from above again now comparing the spread between May and October on March 3 (-$275) and today (-$105). This is curve dynamics or basis risk. The curve can be in contango/upward sloping, flat, or in backwardation/downward sloping, and as it moves around like a live wire, there’s a whole lot of action, opportunity and risk. But don’t tell the Bitcoin or Reddit crowd, I don’t think they are up for it.

CME Midwest HRC Futures Curve $/st

I love busheling scrap. I love a good scrap yard. Great folks, fresh air and dumpster fires. What’s not to like. Turns out my Papa, Papa Dave, had a scrap yard back in the ’40s, so it’s in my blood. With all due respect, however, busheling follows hot rolled and while sometimes it is the tail wagging the dog, at $700-$800 below hot rolled, the busheling futures curve is on the move higher following right behind the HRC futures curve. As you can see below, the CME busheling futures curve has also flatted out with the largest gains so far this week, $55-75, also in the fourth quarter.

CME Midwest Busheling Scrap Futures $/gt

With mill backlogs continuing to grow in March, delayed deliveries and lead times at the edge of the horizon, it’s hard to see what will resolve the domestic steel shortage in the short term. The steel and manufacturing industries returned from spring break and the holidays to find themselves now in Q2 and forced to make some hard decisions for Q3 and the balance of 2021. It is clear from the Midwest HR futures price action that there are a lot of participants who expect the steel market to continue to remain tight for many more months ahead.

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Feldstein should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.