Prices

November 18, 2020

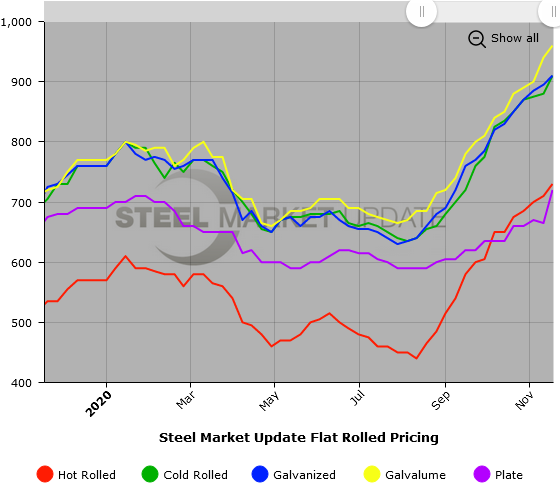

SMU Price Ranges & Indices: Prices Just Keep Rising

Written by Brett Linton

Plate prices have finally gained some traction, seeing a notable jump this past week to an average of $720 per ton, according to Steel Market Update’s latest check of the market. Nucor and SSAB Americas announced plate increases this week in hopes of maintaining that upward momentum. Flat rolled prices continued their relentless climb, with the benchmark price for hot rolled reaching $730 per ton. The uptrend in prices is as much about the tight supplies as it is about the strong demand in many markets as the economy recovers from the worst of the pandemic. Sources are beginning to express concerns about lack of availability for some products and possible allocation by the mills. SMU’s Price Momentum Indicators continue to point higher in anticipation of further increases in the next 30 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $710-$750 per net ton ($35.50-$37.50/cwt) with an average of $730 per ton ($36.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to one week ago, while the upper end increased $10. Our overall average is up $20 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 5-9 weeks

Cold Rolled Coil: SMU price range is $880-$940 per net ton ($44.00-$47.00/cwt) with an average of $910 per ton ($45.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $30 per ton compared to last week. Our overall average is up $30 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 6-12 weeks

Galvanized Coil: SMU price range is $900-$920 per net ton ($45.00-$46.00/cwt) with an average of $910 per ton ($45.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to one week ago, while the upper end was unchanged. Our overall average is up $15 from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $969-$989 per ton with an average of $979 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 7-12 weeks

Galvalume Coil: SMU price range is $940-$980 per net ton ($47.00-$49.00/cwt) with an average of $960 per ton ($48.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $20 per ton compared to last week. Our overall average is up $20 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,231-$1,271 per ton with an average of $1,251 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-12 weeks

Plate: SMU price range is $700-$740 per net ton ($35.00-$37.00/cwt) with an average of $720 per ton ($36.00/cwt) FOB delivered to the customer’s facility. The lower end of our range increased $60 per ton compared to one week ago, while the upper end increased $50. Our overall average is up $55 from last week. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 5-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.