Market Data

November 16, 2020

Revised: Shipments and Supply of Steel Products Through September

Written by David Schollaert

Editor’s note 11/17/20: The data in the “Supply Tons YTD” column on Table 3 didn’t populate correctly, and therefore, was in error. Table 3 has now been updated accordingly.

Mill shipments and supply of sheet products continue to see slight yet steady growth since reaching bottom in June.

This analysis is based on steel mill shipment data from the American Iron and Steel Institute (AISI) and import-export data from the U.S. Department of Commerce. The analysis summarizes total steel supply by product from 2008 through September 2020 and year-on-year changes. The supply data is a proxy for market demand, which does not take into consideration inventory changes in the supply chain. Our analysis compares domestic mill shipments with total supply to the market. It quantifies market direction by product and enables a side-by-side comparison of the degree to which imports have absorbed demand.

The sharp decline in shipments and supply of steel products during the second quarter of 2020 is still being felt across the U.S. domestic market. The steady rise, albeit limited, since June has been a welcome sign; however, the three-month moving averages (3MMAs) as well as year-over-year figures are still down noticeably. The slow but steady turn is a reminder that it will take a prolonged period to repair the economy and return activity to pre-pandemic levels. Despite the unhurried growth, most remain confident that the bottom was reached in June, and the market can only go up from there.

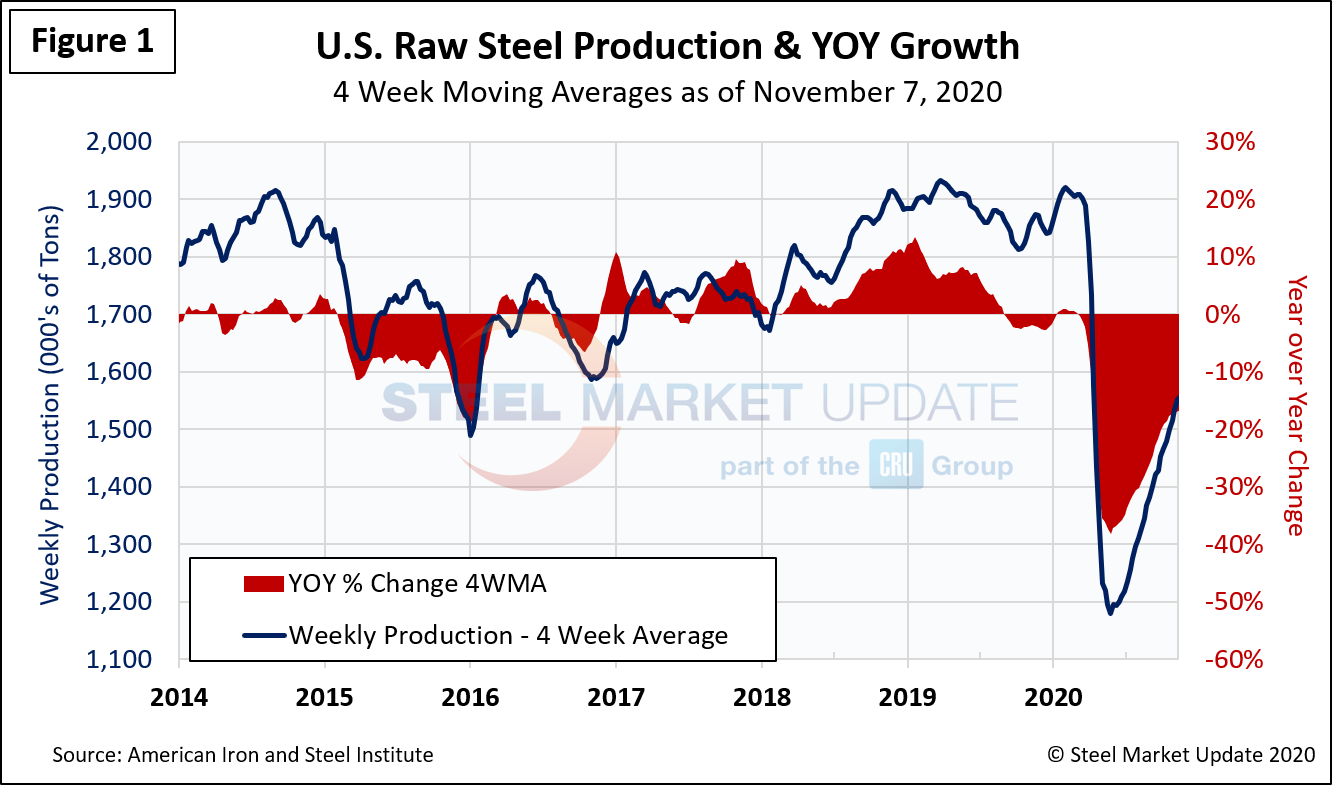

Figure 1 shows the sudden decline in raw steel production that began in February and mirrors the rate of decline experienced in late 2008, though the total fall this time has not been as significant. The year-over-year decline in 2020 maxed out at 37.3 percent in the week ending May 16 and has since improved to negative 16.8 percent in the week ending Nov. 7. Back in 2009, the maximum rate of decline year over year was 54.3 percent in the week ending Jan. 17, 2009. These are four-week moving averages and are based on weekly data from the AISI.

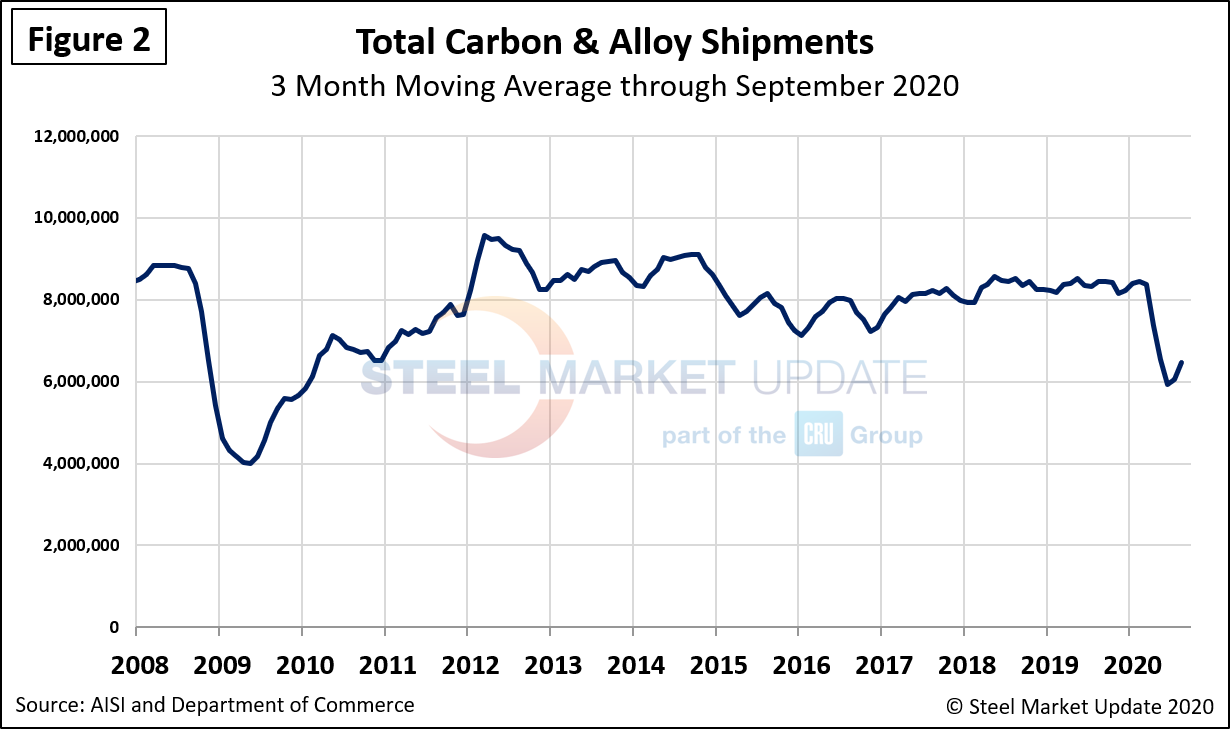

This shipments and supply report is based on monthly shipments by product as reported by the AISI, plus import and export data from the DOC. Figure 2 shows the monthly shipment data for all rolled steel products. In the long run the trajectories of growth in Figures 1 and 2 are comparable, both seeing a turn and slight rise since the bottom was reached in June. Based on the September three-month moving average of the monthly data, gains have been consistent, even if limited. Again keeping overall market sentiment that the rebound timetable may be at a crawl, but a rebound nonetheless.

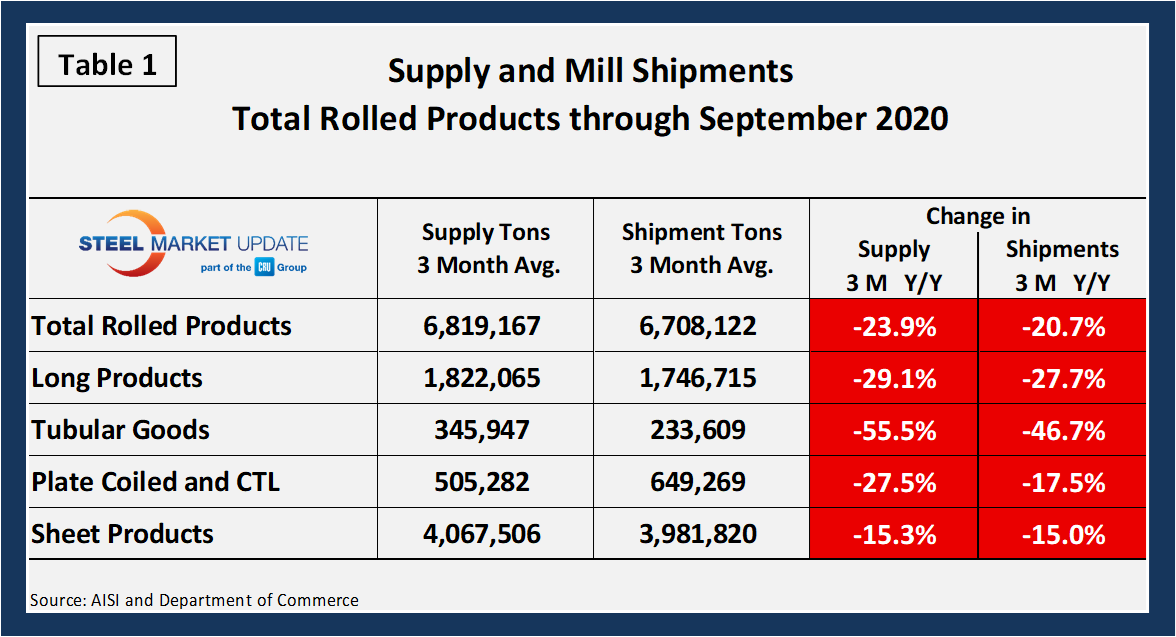

Table 1 is the shipment and supply details for all product groups. Total supply (proxy for market demand) as a 3MMA was down by 23.9 percent year over year. Although down, it has seen a steady improvement month over month. Apparent supply is defined as domestic mill shipments to domestic locations plus imports. Mill shipments improved to a negative 20.7 percent, compared to negative 23.4 percent the month prior. This result indicates that imports continued to take a noticeable market share in the three months through September year-over-year. There is still a major variance between products. Tubular products continue to be the biggest loser, yet a decline was seen across all products. The supply of sheet products was down by 15.3 percent in three months through September year-over-year, and domestic mill shipments were down by 15.0 percent. The total of long products supply was down by 29.1 percent and shipments were down by 27.7 percent. Despite the notable negative trend, improvements were seen across all products month/month.

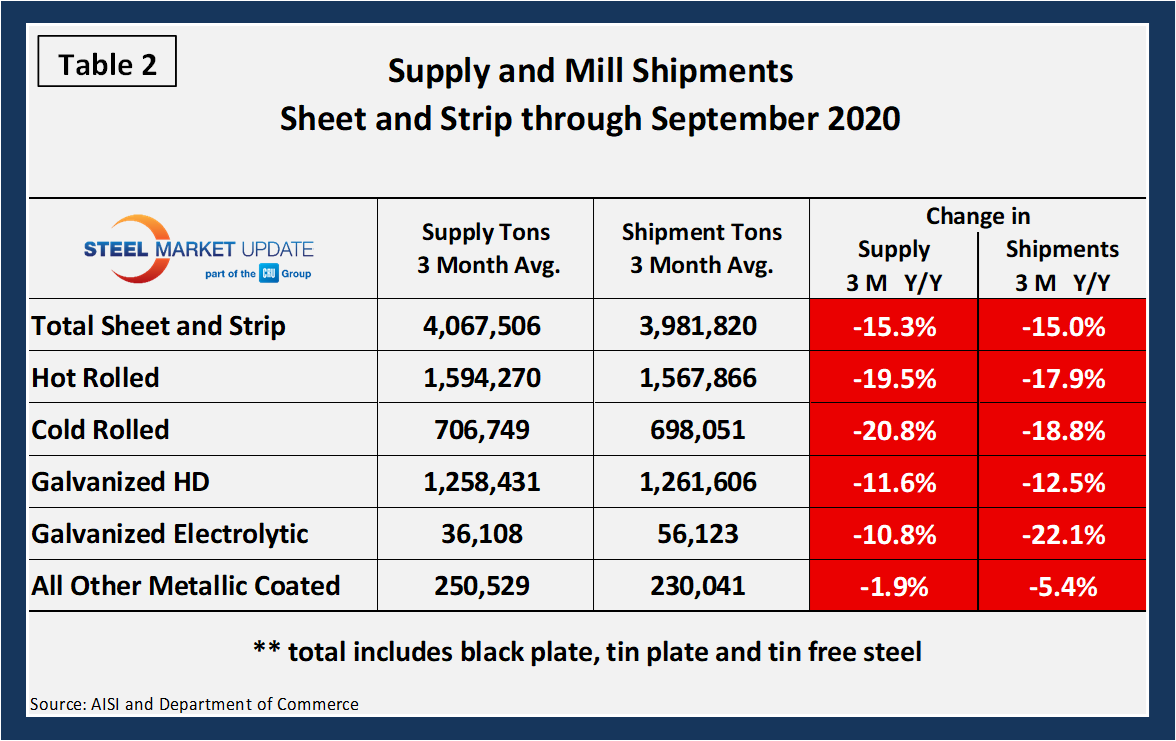

Table 2 describes both apparent supply and mill shipments of individual sheet products (shipments includes exports) side-by-side as three-month averages through September with year-over-year growth rates for each. All sheet products are down considerably across the board. Other metallic coated was by far the least impacted for both supply and shipments, however, down 1.9 percent and 5.4 percent, respectively. Of the three major product groups, electrolytic galvanized was down the most for shipments at 22.1 percent, while the supply of cold rolled was down by 20.8 percent. In the three months through September 2020, the average monthly supply of sheet and strip was 4.067 million tons. There is no seasonal manipulation of any of these numbers. By definition, year-over-year comparisons have seasonality removed.

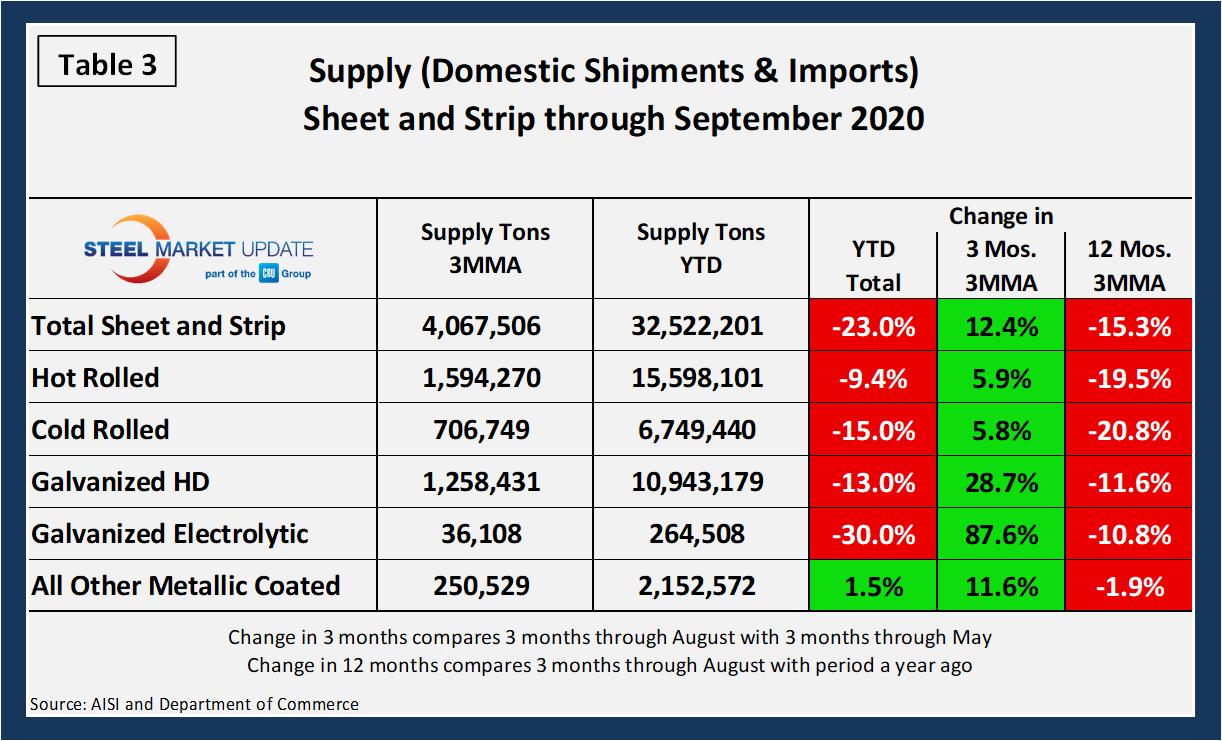

Table 3 shows that total sheet and strip products were down by 23.0 percent year to date compared to 2019. Overall, all sheet products were down, rather noticeably year over year. As a 3MMA, however, it’s important to note that all products have continued to turn, in some cases, markedly. Despite the severity of the second quarter of 2020, data continues to support the cautious but optimistic market sentiment. The two far right columns compare the second quarter with the first and the second quarter with Q2 2019, respectively.

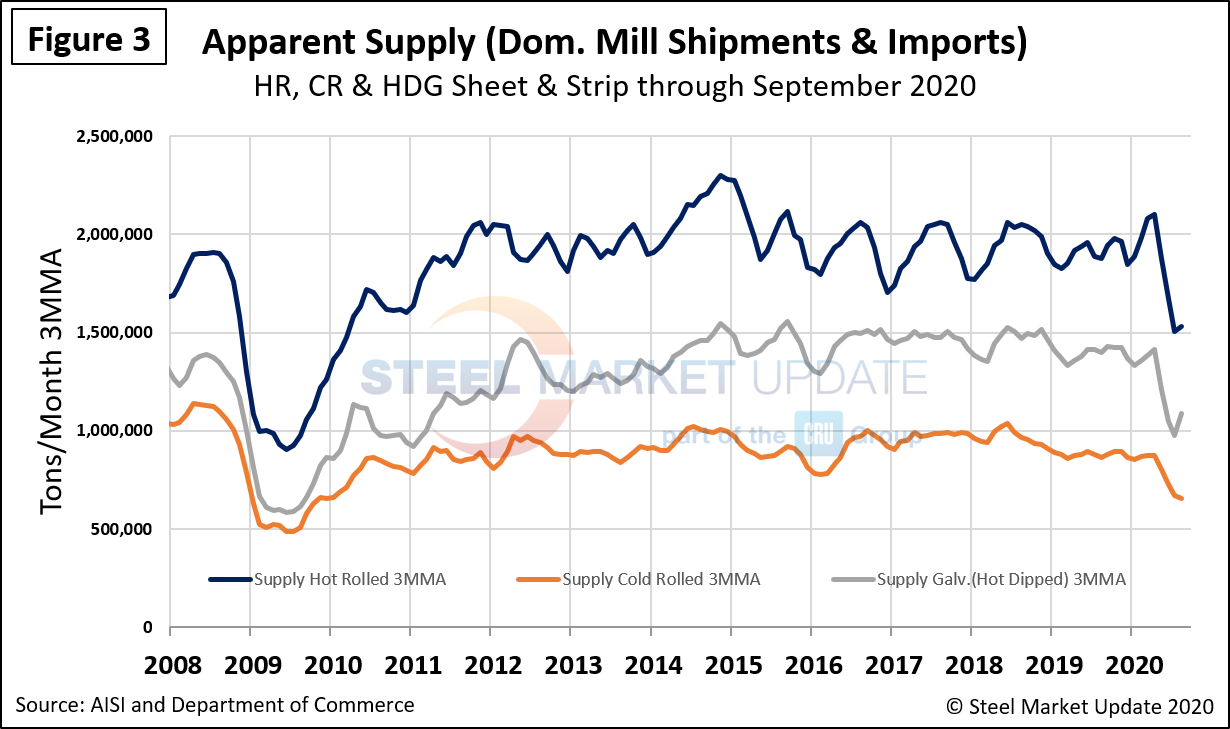

Figure 3 shows the long-term supply picture for the three major sheet and strip products—HRC, CRC and HDG—since August 2008 as three-month moving averages. Both hot rolled and hot-dipped galvanized have turned since reaching bottom in June. Cold rolled has yet to experience the same, but a trough may soon be seen.

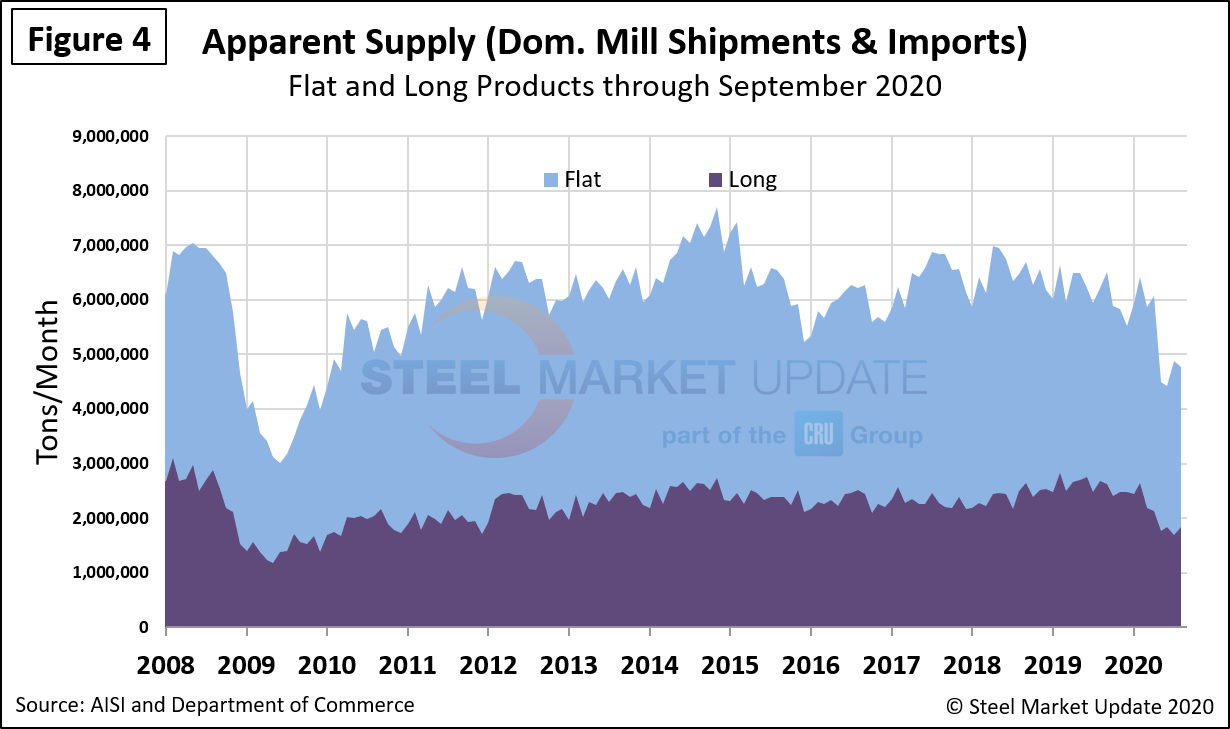

Figure 4 shows the long-term comparison between flat and long products. These are monthly numbers (not 3MMAs), and clearly show the trend difference between longs and flat products including plate.