Market Data

November 15, 2020

SMU Market Trends: When Will Market Peak?

Written by Tim Triplett

Steel Market Update’s check of the market this week shows that the flat rolled mills are extremely busy and operating near full capacity. More than 80 percent of the service center and OEM executives responding to SMU’s questionnaire said they are seeing late deliveries from their mill suppliers. More than 60 percent expect a shortage of at least some products in the next few months. Various factors point to even higher steel prices.

The vast majority (86 percent) said they are expecting another round of price increases from the mills soon, whether a formal announcement or an informal push, and many are not happy about it:

“The mills have raised prices for January absent price increase letters.”

“They haven’t really needed to announce increases, they are able to get them by default.”

“I think another round of increases is inevitable, whether it’s a formal announcement or not, but there is still blood in the water.”

“Hopefully they will give the market a breather. Have they forgotten about 2018? Binge and purge mentality at the mill level.”

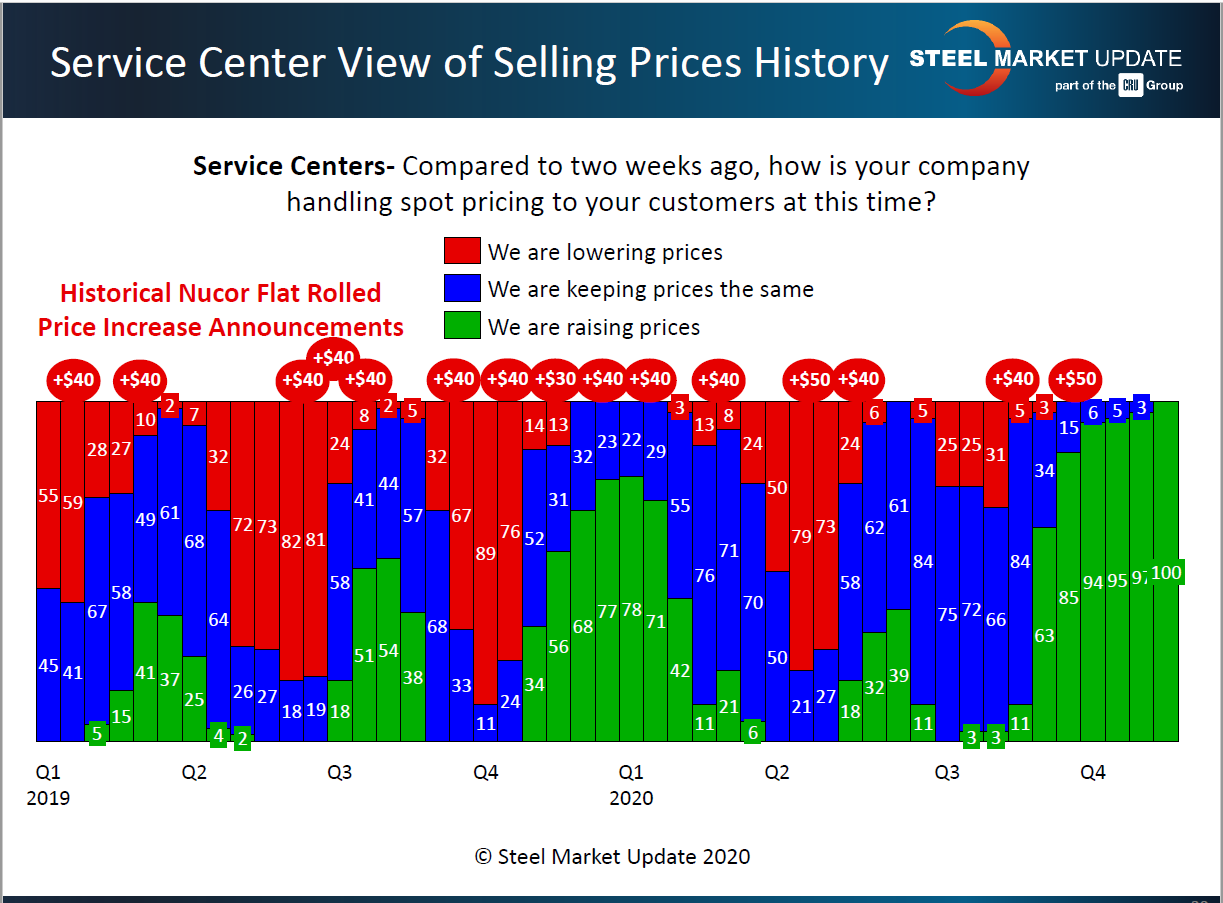

The mills’ quest for higher prices is getting plenty of support from distribution. About 70 percent of the service centers polled said they are having little trouble passing along higher prices to their customers. Service center have been raising prices for the past three months. “If you have what they want, most are paying, but we have reached a critical point in pricing where business will stall with more price hikes,” commented one service center exec. “Price is not the issue, it’s getting supply,” added another.

About 62 percent of respondents believe there will be a shortage of supply in the next few months. “We are already there on Galvalume, pretty close on galvanized. I do not think we will see it on hot roll unless the energy markets return with a vengeance, which is highly unlikely in a Biden administration,” commented one respondent. “Mills have already allocated for the December order books. Most new contracts do not have a plus/minus variance in tons now,” said another. “Contract tons will be very tightly managed in 2021,” added one exec.

Some expect any allocation to be temporary. “It depends on the product. Maybe cold rolled and coated, but it should be short-lived,” said one exec. “Weakness in commercial construction and year-end slowdown will allow mills to catch up, plus imports are on the rise!” said another. “Prices are getting to the point where buying will remain hand to mouth. Stock building is dangerous,” added a third.

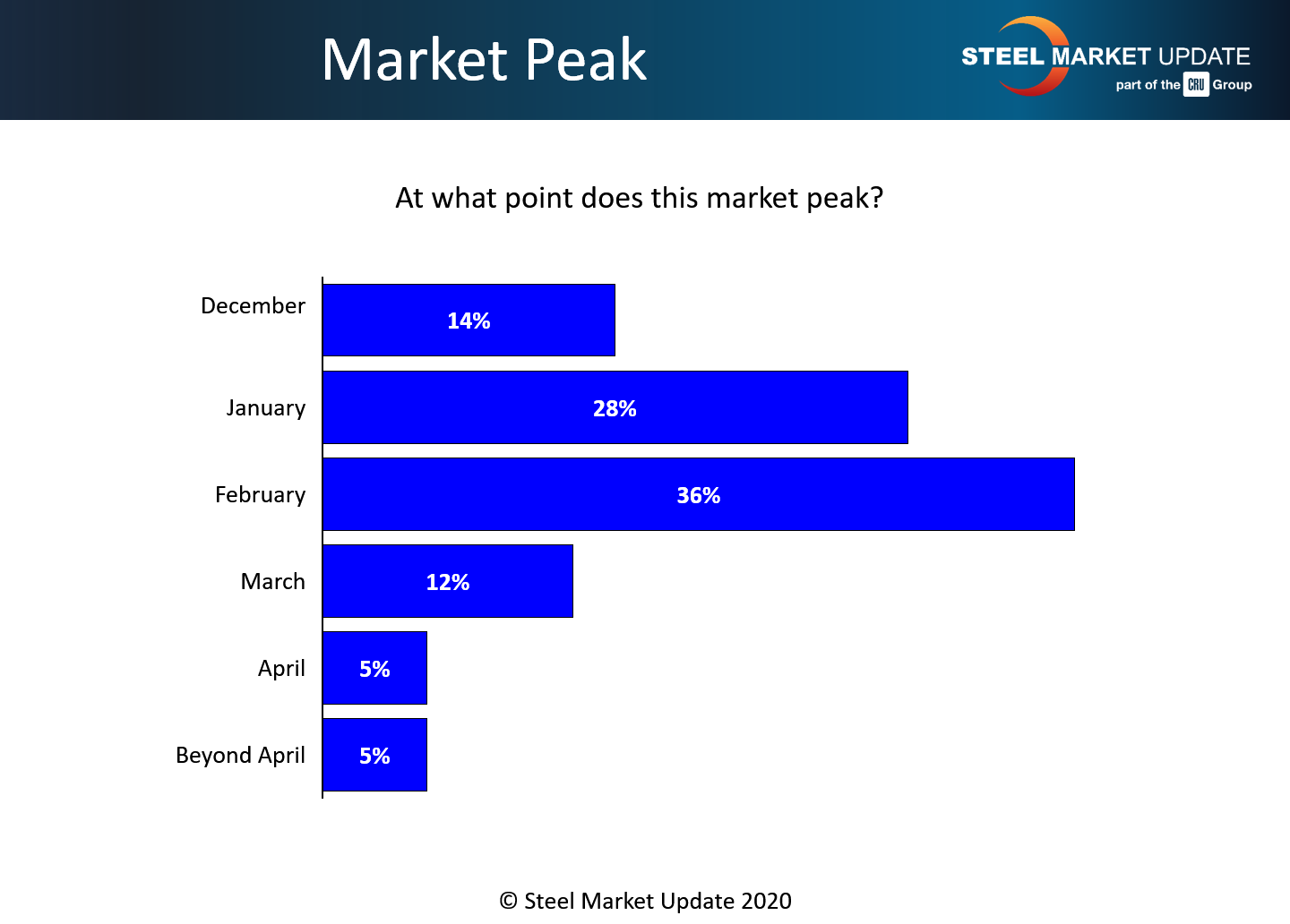

The big question that remains: At what point will this market peak? There is no clear consensus, but most believe it won’t happen until the first quarter, perhaps around February.

Here’s what a few respondents had to say:

“Nobody knows the timing of the peak.”

“There are a lot of uncertainties out there, but I’d say first quarter for hot roll, and mid-late second quarter for coated.”

“Prices could peak by late first quarter on most products, but HRC could soften sooner if more capacity is added as expected.”

“Covid-19 could change all of this.”