Prices

November 4, 2020

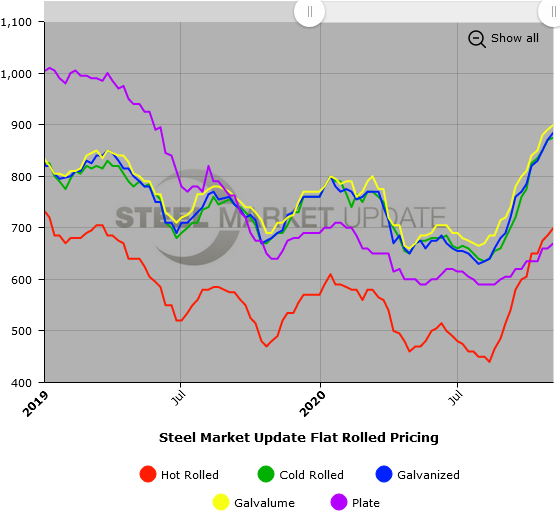

SMU Price Ranges & Indices: Hot Rolled Reaches $700

Written by Brett Linton

Steel Market Update’s check of the market this week puts the average price for hot rolled steel at $700 per ton, a psychological milestone for the steel sector as the economy continues to make progress from the severe early effects of the COVID pandemic. This marks the 12th week in a row that flat rolled steel prices have risen as a result of improving demand and persistently tight steel supplies. How much longer the uptrend will continue depends on how soon the mills bring more capacity to the market. Meanwhile, OEM and service center execs tell SMU demand continues to surprise to the upside. SMU’s Price Momentum Indicator is pointing toward even higher flat rolled prices in the next 30 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $680-$720 per net ton ($34.00-$36.00/cwt) with an average of $700 per ton ($35.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $15 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 5-9 weeks

Cold Rolled Coil: SMU price range is $850-$900 per net ton ($42.50-$45.00/cwt) with an average of $875 per ton ($43.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week, while the upper end was unchanged. Our overall average is up $5 from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 6-10 weeks

Galvanized Coil: SMU price range is $850-$920 per net ton ($42.50-$46.00/cwt) with an average of $885 per ton ($44.25/cwt) FOB mill, east of the Rockies. The lower end of our range was unchanged compared to one week ago, while the upper end increased $30 per ton. Our overall average is up $15 from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $919-$989 per ton with an average of $954 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-12 weeks

Galvalume Coil: SMU price range is $880-$920 per net ton ($44.00-$46.00/cwt) with an average of $900 per ton ($45.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $10 per ton compared to last week. Our overall average is up $10 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,171-$1,211 per ton with an average of $1,191 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-12 weeks

Plate: SMU price range is $640-$700 per net ton ($32.00-$35.00/cwt) with an average of $670 per ton ($33.50/cwt) FOB delivered to the customer’s facility. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $20 per ton. Our overall average is up $10 from last week. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 5-6 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.