Prices

November 3, 2020

CRU: Iron Ore Rising on China’s Pre-Winter Push

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

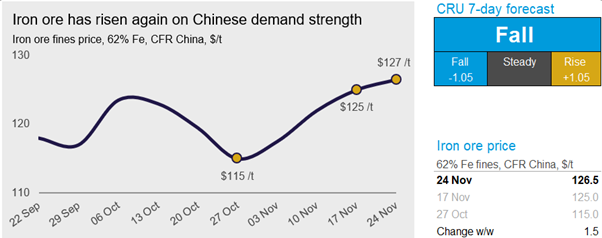

The bullish sentiment in the Chinese steel industry has resulted in continuous strong demand for iron ore. Meanwhile, iron ore supply from Australia has been weak throughout November and inventories in China have remained at a low level as a result. On Tuesday, Nov. 24, CRU assessed the 62% Fe fines price at $126.5 /dmt, up by $1.5 /dmt w/w.

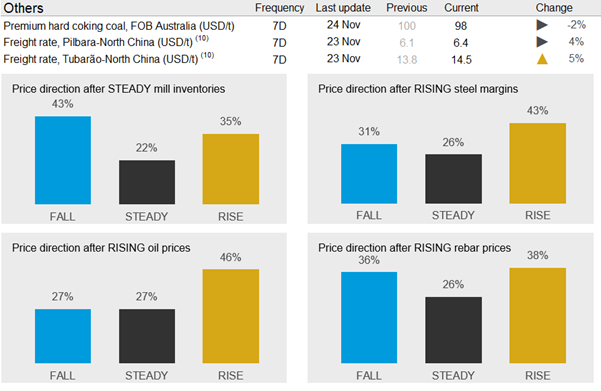

In China, steel prices have rallied in November and steelmakers are now enjoying EBITDA margins over 15%. Part of the reason is a mild start to the winter, which has extended China’s pre-winter construction push. Rebar prices have been particularly strong and are now trading higher than HRC for the first time since May this year. At the same time, we are seeing steel production decline slightly as winter production cuts have intensified in northern China. That is leading to lower BF utilization rates as well as high demand for pellets. The Chinese pellet premium is now trading at close to $30 /dmt, while the lump premium is stuck around the USc7 /dmtu level. Steelmakers have been reluctant to raise lump rates in the BFs as it would increase coking coal consumption while also impacting productivity if lump rates go too high.

Australian shipments remain weak with Port Hedland registering another week of shipments below 10 Mt. Roy Hill’s shipments have resumed after its two-week maintenance, but BHP has reported a drop in shipments in the past week. Meanwhile, Rio Tinto and Vale have shipped at a steady rate in the past week, just below last year’s levels. Unusually high rainfall in northern Brazil due to La Niña is starting to impact iron ore supply in the region.

In India, iron ore exports have started declining due to low availability of ore while steel production and iron ore demand continues to rise. There are also concerns among steelmakers about the price of domestic pellets. In the past weeks, the price of pellet has surged to the highest level on record, closing in on pellet prices in other parts of the world.

We do expect the recent supply weakness in Australia to be short-lived. Current forecast suggests a low chance of weather disruptions in the coming weeks and our sources have hinted at strong shipments in the coming week. Steel prices in China appear to have turned around in the past few days as a wave of cold air is sweeping across northern China, casting doubts of the sustainability of current construction activities. With that, we expect iron ore prices to decline in the coming week.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com