Market Data

November 2, 2020

Revised: Shipments and Supply of Steel Products Through August

Written by David Schollaert

Editor’s note 11/3/20: Some of the data as originally published in Table 1 was incorrect due to a spreadsheet error (specifically the change in shipments 3M Y/Y column). The table has been updated with the correct information below.

Mill shipments and supply of sheet products have turned, albeit slightly, since reaching bottom in June.

This analysis is based on steel mill shipment data from the American Iron and Steel Institute (AISI) and import-export data from the U.S. Department of Commerce. The analysis summarizes total steel supply by product from 2008 through August 2020 and year-on-year changes. The supply data is a proxy for market demand, which does not take into consideration inventory changes in the supply chain. Our analysis compares domestic mill shipments with total supply to the market. It quantifies market direction by product and enables a side-by-side comparison of the degree to which imports have absorbed demand.

Although a steady turn has been seen across shipments and supply of steel products, the sharp decline during the second quarter of 2020 is still being felt. Three-month moving averages (3MMAs) as well as year-over-year figures are down noticeably. A trough was speculated in mid-summer, though it will likely take a prolonged period to repair the economy and return activity to pre-pandemic levels. Speculation and concerns surrounding the outcome of the pending U.S. election have added to the market’s struggles to find sure footing. Nevertheless, most believe the bottom was reached in June, and now it’s simply a matter of how long this correction will take.

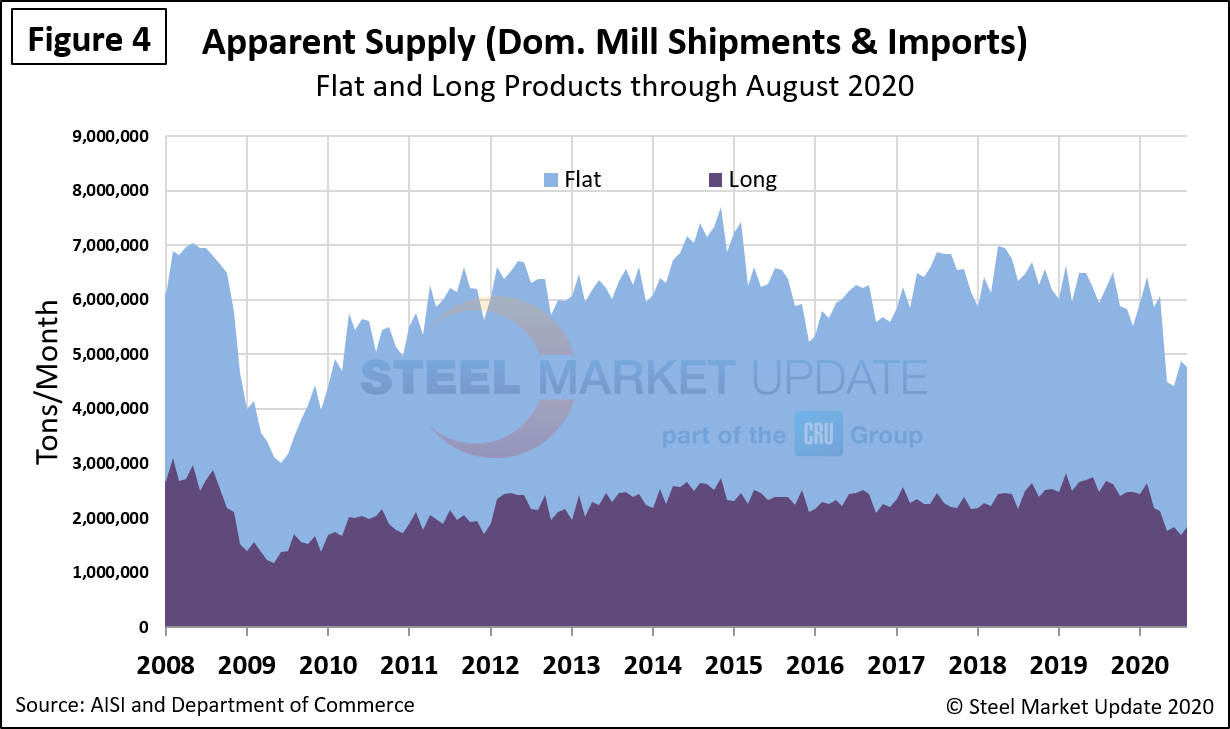

Figure 1 shows the abrupt decline in raw steel production that began in February and mirrors the rate of decline experienced in late 2008, though the total decline this time has not been as severe. The year-over-year decline in 2020 maxed out at 37.3 percent in the week ending May 16 and has since improved to negative 17.7 percent in the week ending Oct. 24. Back in 2009, the maximum rate of decline year over year was 54.3 percent in the week ending Jan. 17, 2009. These are four-week moving averages and are based on weekly data from the AISI.

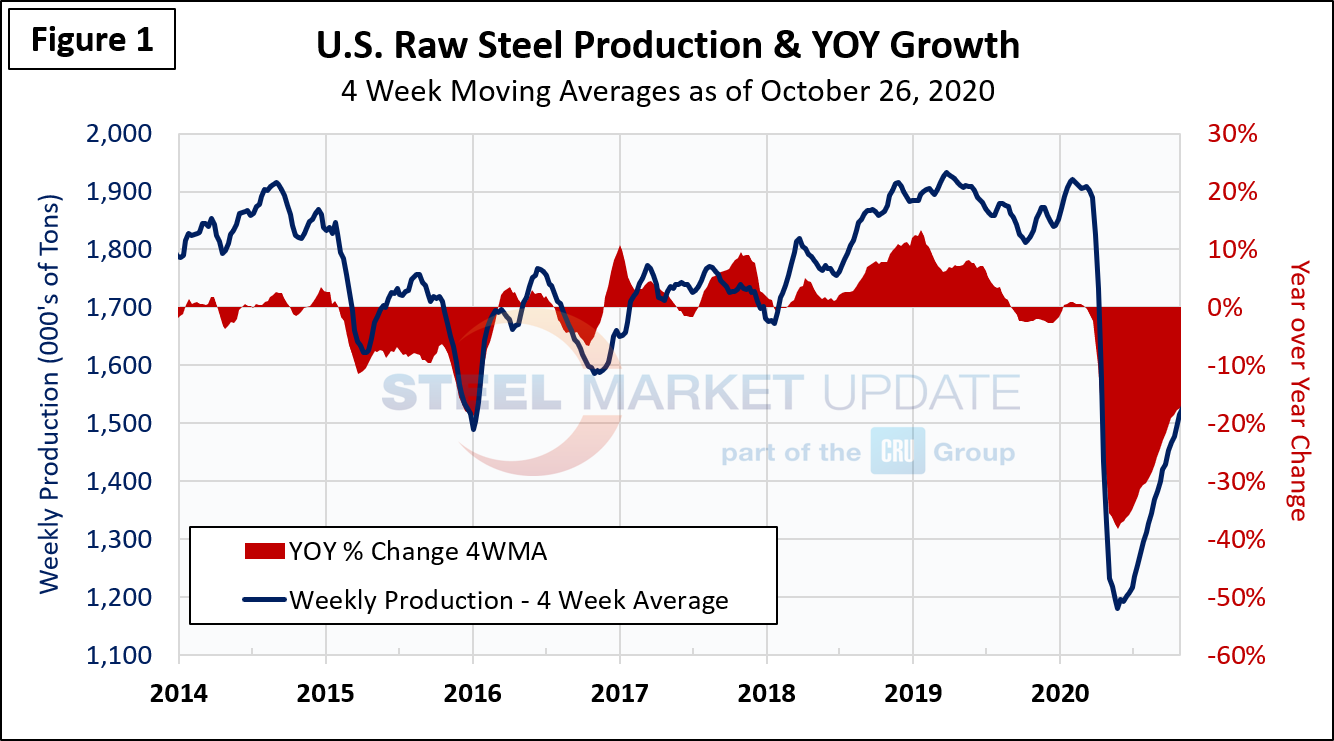

This shipments and supply report is based on monthly shipments by product as reported by the AISI, plus import and export data from the DOC. Figure 2 shows the monthly shipment data for all rolled steel products. In the long run the trajectories of growth in Figures 1 and 2 are comparable, both seeing a turn and slight rise since the bottom was reached in June. Through the August three-month moving average of the monthly data, the improvement has been limited, nonetheless.

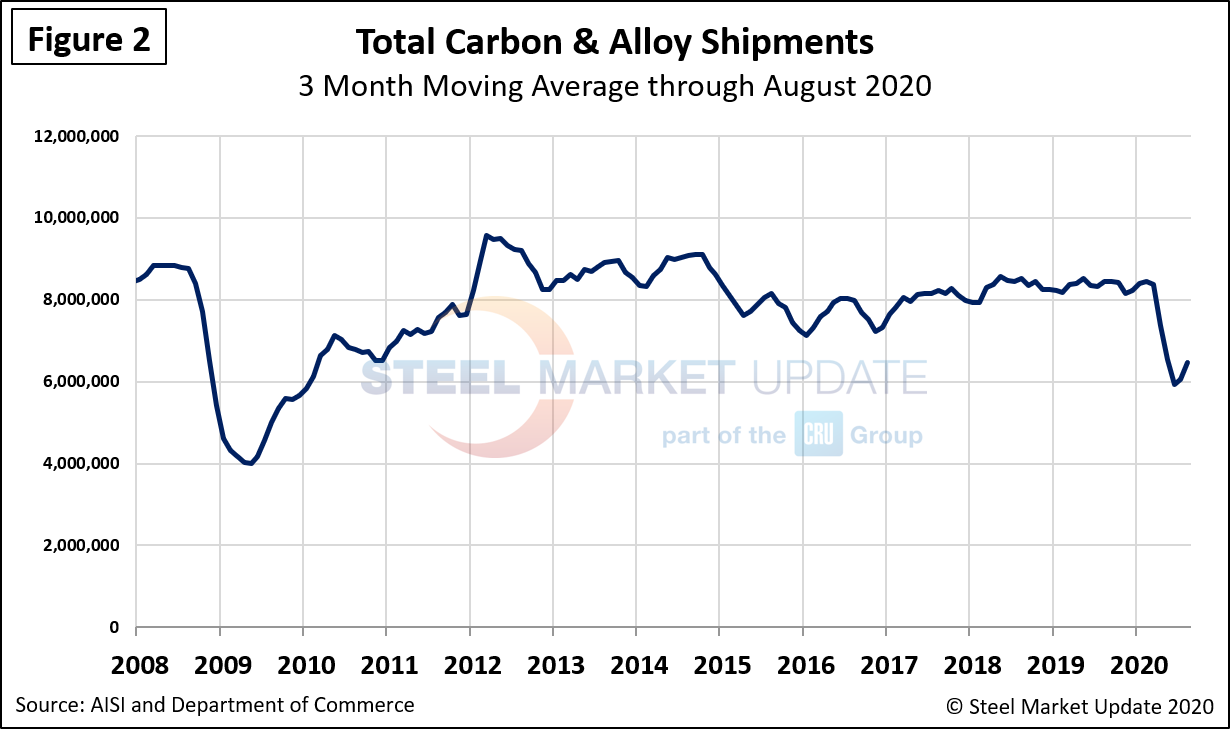

Table 1 is the shipment and supply details for all product groups. Total supply (proxy for market demand) as a 3MMA was down by 24.6 percent year over year. Apparent supply is defined as domestic mill shipments to domestic locations plus imports. Mill shipments were down by 23.4 percent, meaning that imports took a particularly higher market share in the three months through August year-over-year. There is a big difference between products. Tubular products performed the worst; however, all products have remained in a similar decline. The supply of sheet products was down by 16.1 percent in three months through August year-over-year, and domestic mill shipments were down by 17.7 percent. The total of long products supply was down by 31.4 percent and shipments were down by 30.9 percent.

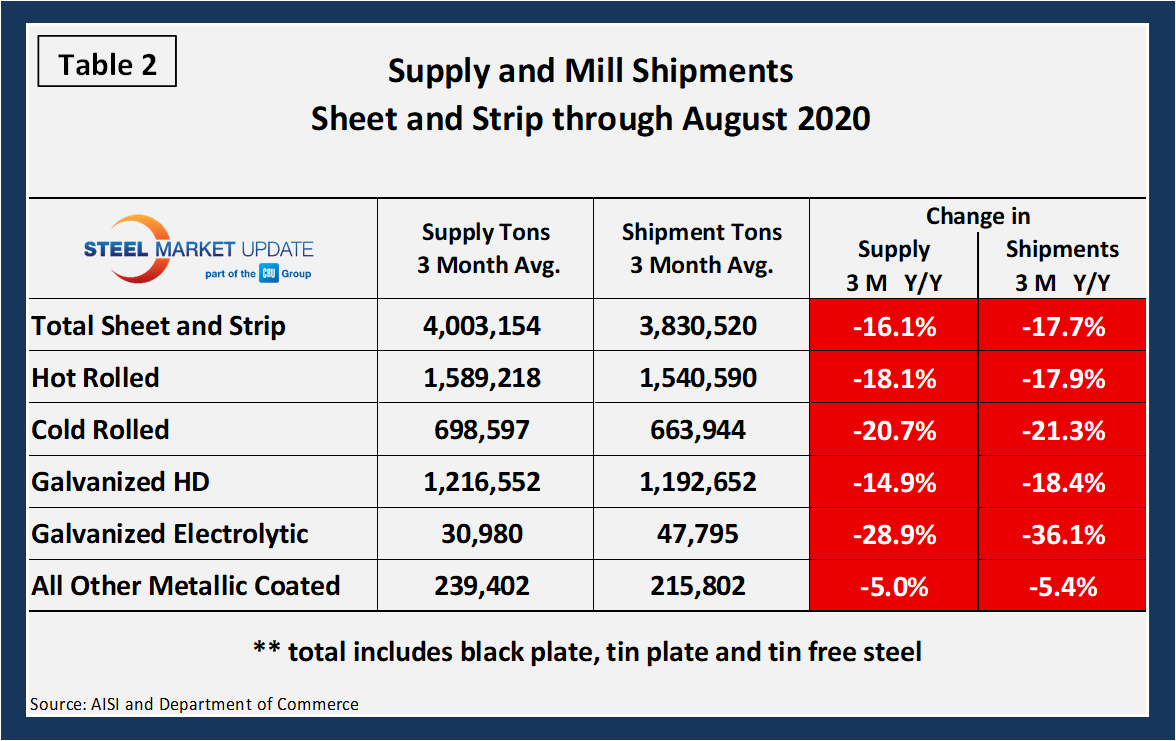

Table 2 describes both apparent supply and mill shipments of individual sheet products (shipments includes exports) side-by-side as three-month averages through August with year-over-year growth rates for each. All sheet products are down considerably across the board. Other metallic coated was by far the least impacted for both supply and shipments, however, down 5.0 percent and 5.4 percent, respectively. Of the three major product groups, electrolytic galvanized was down the most for both supply and shipments. Hot-dipped galvanized supply was down the least, while hot rolled shipments were down slightly less, when compared to the others. In the three months through August 2020, the average monthly supply of sheet and strip was just over 4.003 million tons. There is no seasonal manipulation of any of these numbers. By definition, year-over-year comparisons have seasonality removed.

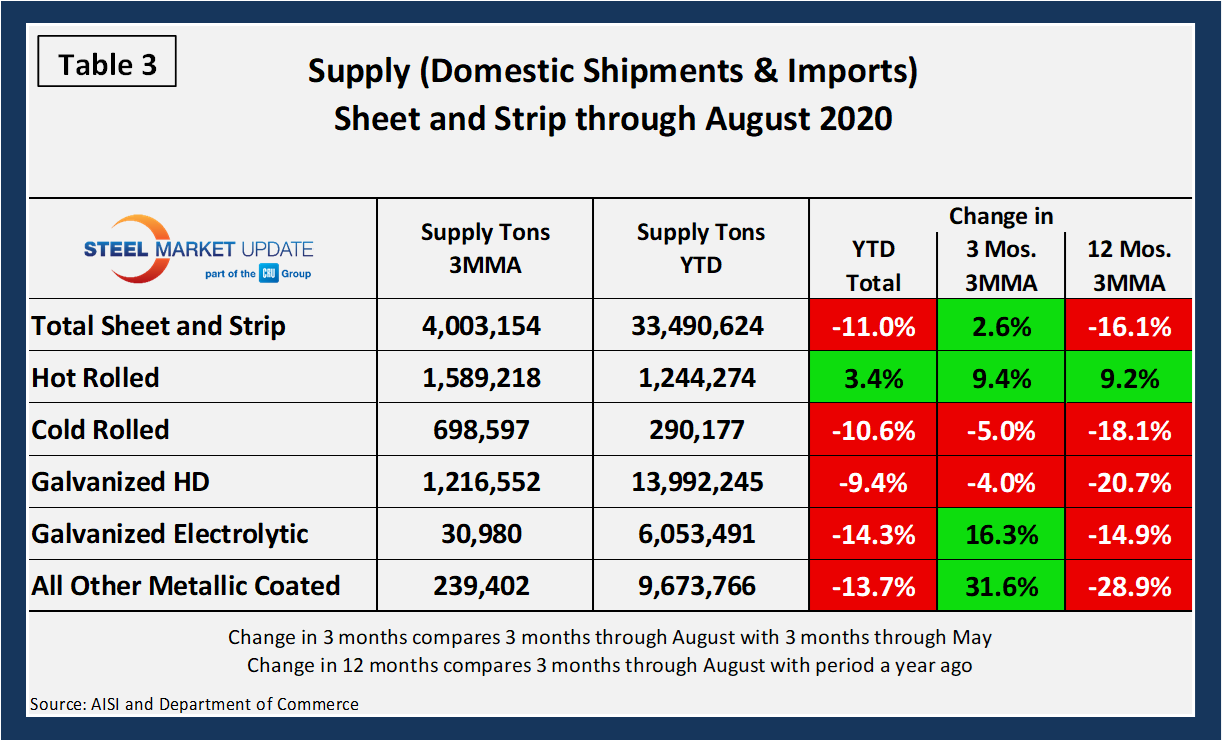

Table 3 shows that total sheet and strip products were down by 11.0 percent year to date compared to 2019. Overall, all sheet products were down, except for hot rolled, which was the sole bright spot experiencing a slight rebound after steady falls through June. The noted impact fails, however, to recognize the severity of the second quarter of 2020. The two far right columns compare the second quarter with the first and the second quarter with Q2 2019, respectively.

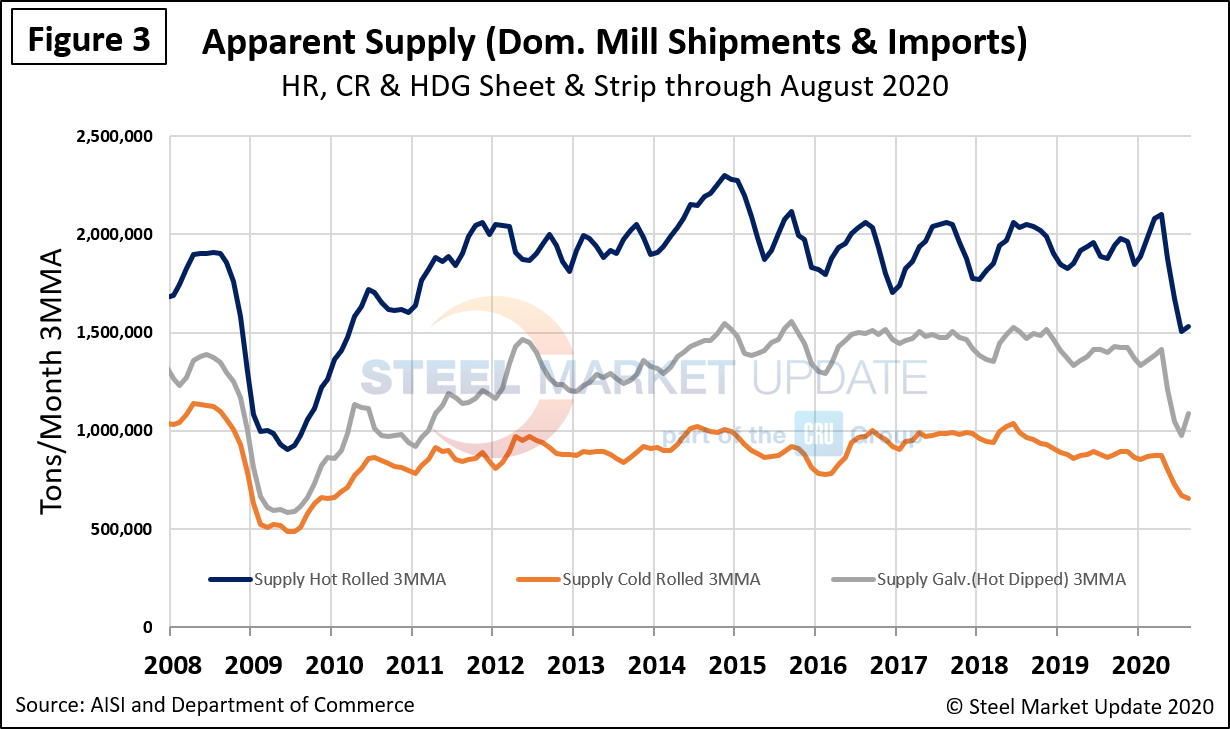

Figure 3 shows the long-term supply picture for the three major sheet and strip products—HRC, CRC and HDG—since August 2008 as three-month moving averages. Both hot rolled and hot-dipped galvanized have turned since reaching bottom in June. Cold rolled has yet to experience the same.

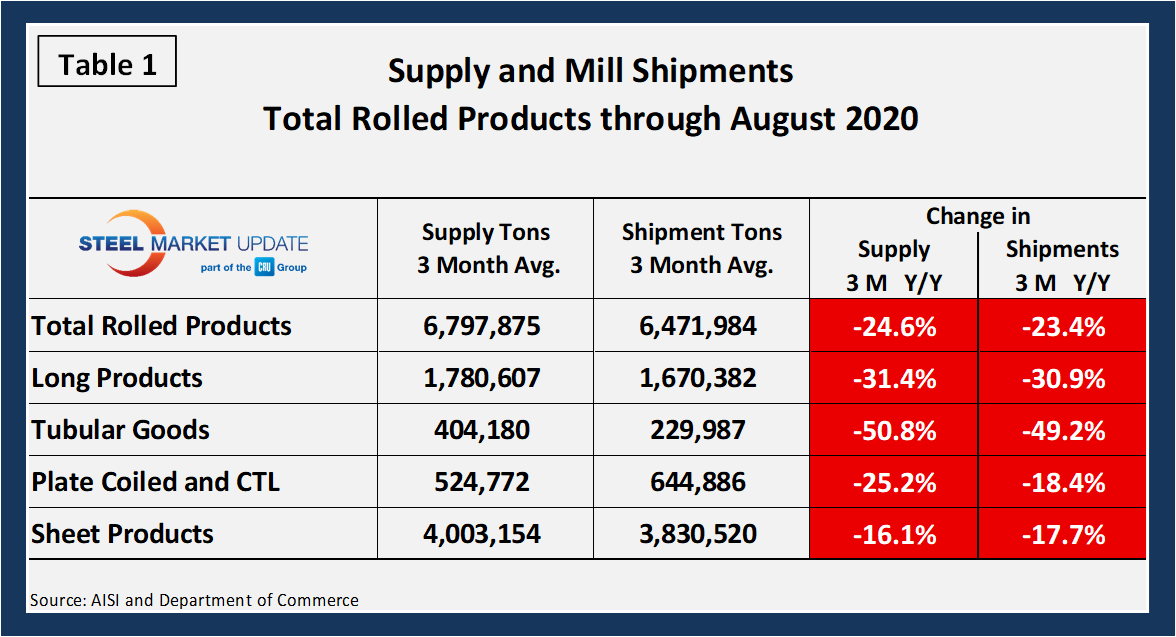

Figure 4 shows the long-term comparison between flat and long products. These are monthly numbers (not 3MMAs), and clearly show the trend difference between longs and flat products including plate.