Prices

October 24, 2020

CRU: Global Steel Prices Rise to 17-Month High

Written by Josh Spoores

By CRU Principal Analyst Josh Spoores, from CRU’s Steel Monitor

Reflecting a basket of finished steel prices, CRU’s global finished steel CRUspi reached 162.9, its highest level since May 2019. This indicator, which covers Asia, Europe, and North America, increased 5.2% m/m and is now up 9.9% y/y, the first y/y increase since November 2018. Higher prices continued to be assessed in both Europe and North America, while prices in Asia fell for the first time since May.

Declines in Asia were limited to domestic Chinese and Southeast Asian import markets, with gains assessed in others including India. Finished steel prices in East Asia, depending on the specific product and market, have increased since April. In September, though, Chinese finished steel prices started to plateau, if not decline, ahead of the Golden Week national holiday. Since then, price volatility has returned as initial price gains, at least in China where domestic prices have been relatively very high compared to historical norms, have started to fade.

Meanwhile in Europe and North America, underlying demand has continued to improve from the Q2 lows, while mill production has been slow to return. For sheet products specifically, strong price gains have been recorded in both markets as automotive activity has led overall demand higher, while mills have been reluctant or measured in bringing idled blast furnace capacity back online.

Longs: Costs Push U.S. and EU Longs Prices Up as Asia Waits for China

Long product prices increased across most markets this month as strengthening demand combined with higher costs, notably scrap. This trend of stronger demand was not uniform as prices did weaken in Southeast Asia and China.

Overall, the Global Long Products Price Indicator (CRUspi Longs) increased by +1.4% m/m to 162.9 in October 2020. After the strong rises in Asia in recent months, it is higher prices in Germany and the USA that drove the index up this month.

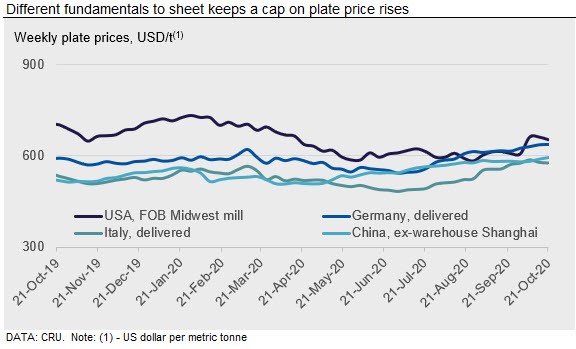

Sheet: Global Sheet Rebound Continues as Demand Outpaces Supply

Global sheet prices have continued to increase across most markets with increases in North America continuing to outpace gains elsewhere. Like longs, price gains were notably absent from China and Southeast Asia as prices fell ahead of the recent holiday period. For North America, U.S. Midwest prices rose at the fastest pace on record over the past two months.

Overall, CRU’s Global Flat Products Price Indicator (CRUspi flats) rose by 7.3% m/m, reaching 162.9 in October, the highest level since May 2019.

Outlook: Global Prices May Again Follow China’s Lead on Prices

Since bottoming out in the first half of 2020, global demand for finished steel products has turned higher. This trend was initially seen in China and Asia where Covid-19 lockdowns first eased and later in North America and Europe. Early data so far in 2020 Q4, has shown prices in China and Southeast Asia falling back from recent highs, while prices elsewhere continue to trend higher. However, with the seasonally slower period of demand for steel products in sight, we expect that recent gains in finished steel prices will again follow the lead of China and soon turn lower. Furthermore, increased Covid-19 infection rates across multiple markets may soon limit the overall rebound in demand, even without a full return to emergency lockdown measures implemented in 2020 Q2.

Even without this downside risk of further pandemic-related restrictions limiting the demand recovery, the growth rate of industrial activity has already started to slow from recent levels. This topic was covered in more depth by our economics team in an insight titled: “Global recovery loses momentum,” located here.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com