Prices

October 13, 2020

CRU: Iron Ore Holding Steady at $124

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

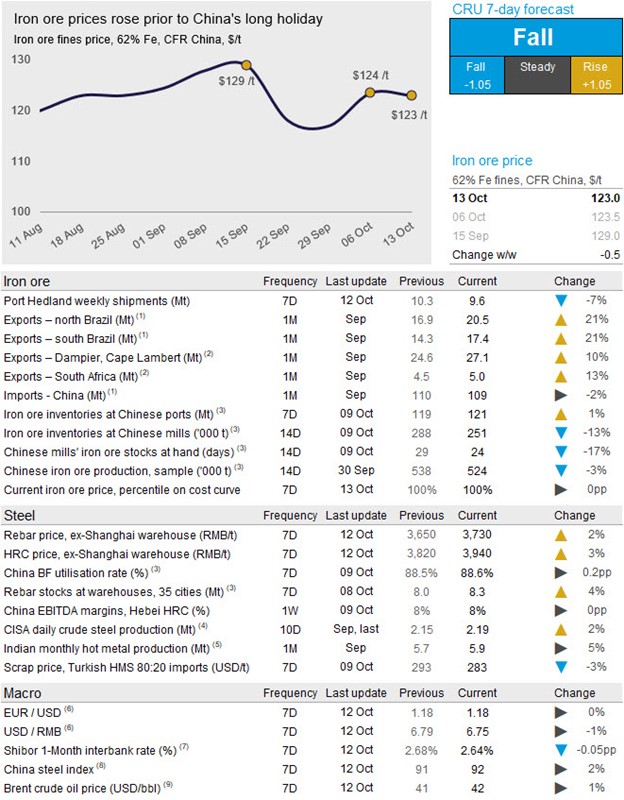

Iron ore prices have remained steady in the past week as a price increase last Thursday was met by similar falls in the past few days. Steel prices in China have risen after the holidays on an optimistic demand view, but iron ore availability has improved in the past week with port stocks exceeding 120 Mt for the first time since March. On Tuesday, Oct. 13, CRU has assessed the 62% Fe fines price at $123.0 /dmt, down marginally w/w.

The Chinese steel market reopened with strong price upticks after the country’s Golden Week holidays in early-October. Between Sept. 30 and Oct. 12, domestic HRC and rebar prices rose by RMB120 /t and RMB80 /t, respectively. Although business activity slowed during the eight-day holidays, resulting in a build-up of steel inventories, buying activity recovered after the market reopened driven by post-holiday restocking. Meanwhile, market sentiment became positive, providing upward pressure on asset prices including commodities such as steel and steelmaking raw materials.

While some independent EAF steelmakers cut production in response to the lower steel demand and scrap supply during the holidays, integrated steelmakers had in general operated stably with surveyed BF capacity utilization rates at ~89%, maintaining iron ore and coke demand. Despite intensive port outflow, iron ore port inventories slightly built up over the holidays as a large number of arrivals of vessels to China resulted in port inflow sustaining at high levels. In addition, a consultation paper for China’s upcoming Winter Heating Season (WHS) policy was issued recently, which looks similar to that in 2019 in terms of the way it is conducted. This is in line with our estimates and we stick to our view that there will be WHS restrictions, but the impact would, however, be small. These restrictions would be conducted more accurately on a facility basis.

Seaborne supply remained steady in the past week, with Port Hedland shipments dropping, while Rio Tinto managed to deliver the strongest week of the year. At the same time, shipments from northern Brazil held steady at a high level to offset a drop in exports from Minas Gerais. The steady seaborne supply is a significant improvement y/y as exports fell sharply at the start of October in 2019.

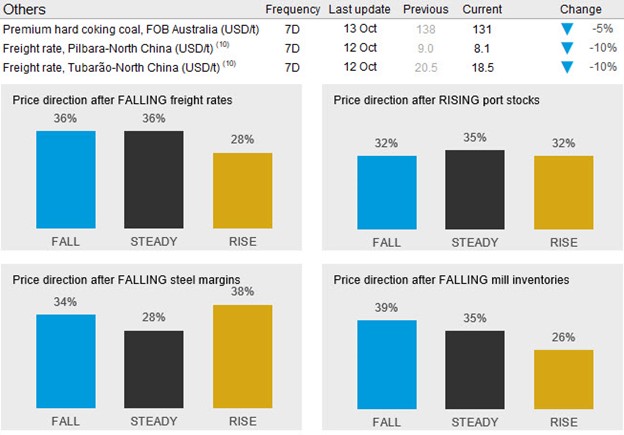

Prices have begun falling at the start of this week and we hold the view that the negative momentum is going to continue as steel margins have come under pressure and the availability of ore is improving. Port stocks are rising and seaborne supply has beaten expectations in the past week.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com