Community Events

October 8, 2020

Tanners: Merger May Throw Curve at Steelmageddon

Written by Sandy Williams

The Cleveland-Cliffs/ArcelorMittal merger may throw a curve at the Steelmageddon theory, said Bank of America steel analyst Timna Tanners during Wednesday’s Steel Market Update Community Chat Webinar.

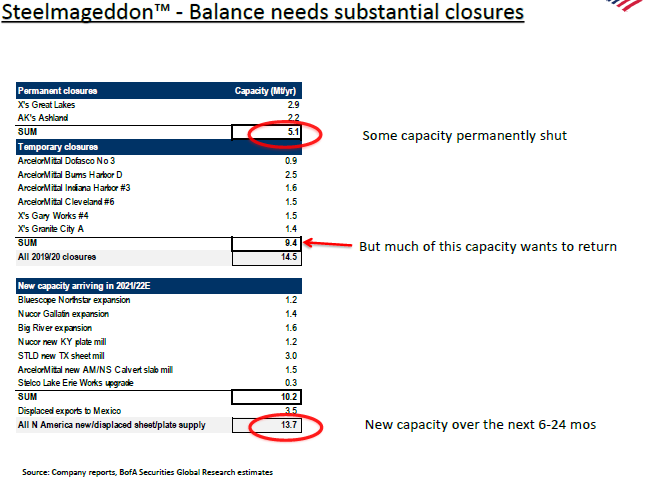

The Cliffs/AM combination includes two mills that are more than 100 years old and another that is 50 years old. A move by Cliffs to permanently close some older blast furnace production could offset some of the new EAF capacity coming online, resulting in better steel prices than projected in Tanners’ Steelmageddon scenario, which predicts excess capacity will lead to drastically lower prices over the next few years (see chart below). Cliffs has made no indication of such an intent with its newly acquired assets.

Tanners said she was surprised to see some idled industry capacity staying offline as long as it has, although she was not sure if that was due to steelmaker discipline or functional problems.

If next month’s election results in a change to a Biden administration, it’s not likely to result in a repeal of Section 232 tariffs. Over time the tariffs could be watered down, said Tanners, but Democrats will have bigger issues on their plate than tariffs. Democrats are not inherently opposed to tariffs and are more concerned with the potential abuse of presidential power in imposing the Section 232 measures. Biden does promise a repeal of the Trump tax cuts, which would raise taxes for corporations such as steel mills. If Trump remains in power, anything is possible regarding what he may do in trade, said Tanners.

An infrastructure bill is likely if Democrats sweep Congress, but would not benefit the industry until 2022 and may not be as steel intensive as hoped due to the inclusion of funding for tech and broadband.

Steel imports are down and are not likely to rebound soon, Tanners said. Higher steel prices could become a risk factor, but a new administration is not expected to impact import policy. New steel capacity in Mexico will likely reduce steel exports from the U.S.

Steel prices rebounded after falling to a low in August as the auto industry made a surprisingly quick recovery. Construction remained strong during the first half, but is starting to slow other than residential. Energy remains weak but most other sectors are doing well. Global prices for steel are quite high, Tanners said.

She noted that executives on an AIST panel recently complained about China’s excess supply, but China was a net importer of steel for three months in a row, consuming all of its steel production and then some. The cure for high prices is high prices, said Tanners. With new and existing capacity starting or returning, it is prudent to be cautious going forward.

The Bank of America forecasts HR prices will average around $490 per ton in 2021 and $475 in 2022. New capacity will put pressure on prices and North America will be largely self-sufficient. Galvanized pricing could fall a bit due to galvanizing capacity rising in Mexico and the U.S.

“Costs will go to the marginal cost of production and scrap-plus will set the floor of the market; the peak of the market will be at a level where imports make sense. So, we think there will be a shift to a lower level of pricing for that time frame,” said Tanners.