Market Data

October 8, 2020

SMU Market Trends: Most Execs Upbeat About Q4

Written by Tim Triplett

Nearly three out of four (72 percent) of the service center and OEM executives responding to Steel Market Update’s questionnaire last week said they feel upbeat about their company’s prospects in the fourth quarter. Yet SMU received twice as many negative comments as positive ones. Clearly, even the optimists are concerned about COVID and the sustainability of steel prices.

Positive Comments

“We are very busy. No concerns.”

“We can sell anything not bolted to the ground at this point, because inventory positions are low.”

“There’s sufficient supply at reasonable replacement levels.”

“Our fourth quarter is set. Bookings are strong. Demand has returned, though there are supply-driven limitations.”

“We’re cautiously optimistic. We think the pent-up demand will carry over into the fourth quarter.”

“The stars are lining up.”

Negative Comments

“There are continued steel games to limit supply with a 65 percent utilization rate.”

“I fear a price collapse and a contested election.”

“The market will soften in the fourth quarter.”

“I am W.O.R.R.I.E.D. Who wins the election? Ongoing consumer perceptions. Rising COVID problems. Regional economic challenges. I am concerned about the first quarter. Downward future construction estimates (ABI).”

“Pricing will continue to rise. It will make imports of manufactured steel goods even more competitive than U.S. made products, putting our company at risk.”

“I’m concerned about availability of hot bands.”

“I’m concerned about a resurgence of COVID-19 and political unrest leading to business shutdowns.”

“The mills have pushed prices up and are only concerned with the short-term gain. They will chase each other to the bottom in Q1.”

“The uncertainty of a COVID-19 second wave, natural disasters, the presidential election and social unrest and violence worry me.”

“I’m afraid of COVID rates going back up during the winter and further lockdowns or a downturn in consumer confidence.”

“Steel mills are running prices up too fast. Construction will be weak in the first half of 2021. The election.”

“Lack of commercial construction projects starting up is a huge concern for us.”

“Steel prices are climbing faster than we can pass on the increased prices to our customers.”

“Margin compression.”

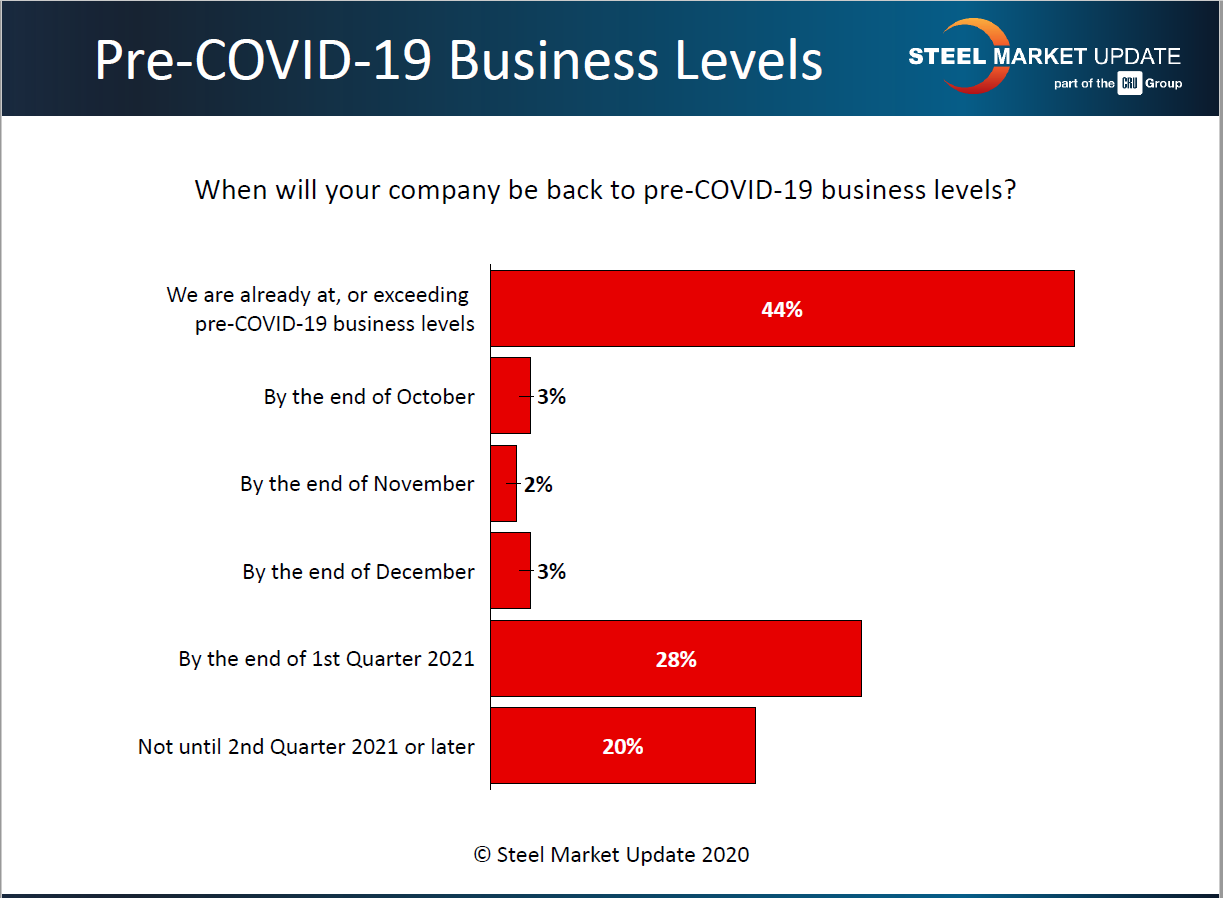

Back to Pre-COVID Business?

SMU also asked: When will your company get back to pre-COVID levels? About 44 percent of those responding say their business is already back. Another 8 percent expect a return to normal by the end of the year. About 28 percent expect a return to pre-virus levels by the end of first-quarter 2021. The remaining 20 percent see recovery lagging until the second quarter or even later. The first time SMU asked this question back in mid-May, half expected business to return to normal by the end of September and about 70 percent expected the virus to run its course before the end of the year.

Here are some respondents’ comments:

“We never left pre-COVID business levels. We’re actually exceeding last year’s numbers.”

“It depends on the business segment. Some are already at pre-COVID levels. All segments should be there by the end of Q1.”

“It’s a little difficult as work force shortages have caused some issues.”

“If business level is sales dollars/profits, then we are already there. But key customers have shifted. Many construction/manufacturer customers are still off by 20 percent, but growth among those related to warehousing and distribution have increased.”

“We are exceeding pre-COVID-19 business levels, but it’s too early to know if it’s a ‘one-off’ as the spot market positions itself on rebalancing inventory levels and price increases.”

“Strong demand across all business segments, with capacity sold out the rest of year on all our tube mills.”

“So many variables, it’s really hard to predict.”