Prices

October 4, 2020

SMU Reader Lays Out Supply Side Concerns

Written by John Packard

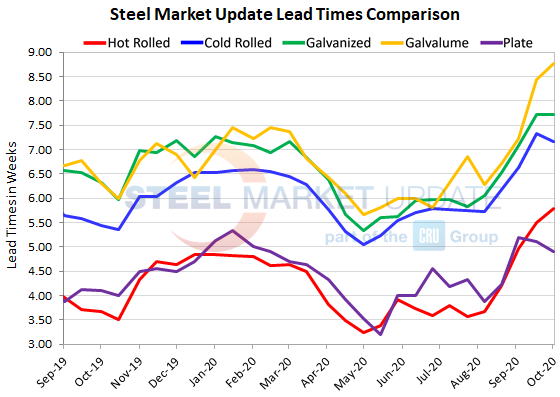

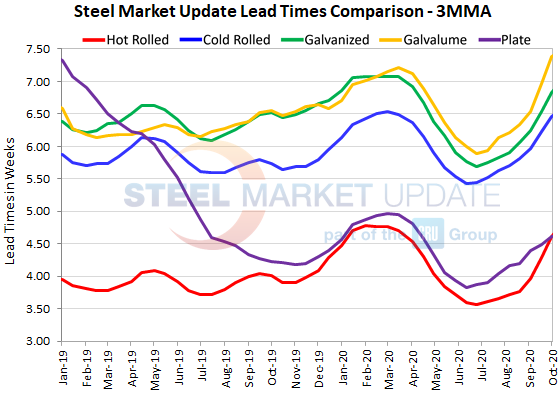

On Thursday, Steel Market Update produced an article on lead times with the headline, “Steel Mill Lead Times: Mixed Messages.” The lead times being discussed in the article come from our proprietary survey, which is produced every other week. The lead times are based on the average from the manufacturing companies and steel service centers that participated in last week’s questionnaire.

The graphics (shown below) clearly show the extension of lead times with all products (except plate) indicating lead times further out than at any time since Spring 2018. Benchmark hot rolled lead times averaged 5.78 weeks last week, even with a sluggish energy market.

One of our readers communicated with SMU on Friday, pointing out that he believes too much energy is being focused on demand and not enough on supply. The following is what was shared with SMU, and we think our readers would appreciate this executive’s viewpoint:

![]() Let me lay out my supply side concerns.

Let me lay out my supply side concerns.

There was mention in one of the SMU newsletters a few issues back about USS not being able to start up any new blast furnaces until December at the earliest.

So, if USS, AM and Cliffs don’t start any new furnaces up…BRS is a non-issue for several months…Nucor and SDI are already at full capacity…and several mills will have outages this quarter as you’ve laid out in a previous SMU issue, then we are facing a severe domestic shortage of steel.

Someone said to me yesterday that ArcelorMittal will be financially hamstrung prior to its transaction closing with Cliffs in December. No new capex. Keep inventories low. Keep working capital minimal. All of the typical things a company does before selling itself.

I haven’t seen any articles that try to quantify the magnitude of HOW short this market is. Most want to talk demand, demand, demand.

So, here’s my 40,000 feet view:

U.S. market is producing 400kt per WEEK less y-o-y, and importing 500kt less per WEEK y-o-y And there are numerous mill outages that will add to that supply shortage .

U.S. market is normally supplied with 1.9M tons of weekly production and 700kt weekly imports = 2.6M tons of supply per week during normal times.

Current U.S. supply is now 1.4M tons weekly production and 300kt weekly imports = 1.7M tons of weekly supply.

That indicates a supply decrease of 900kt per WEEK.

Even if Q4 steel demand is down 20 percent vs. Q1 (it’s not), we still would be 400kt short per WEEK instead of the mind boggling 900kt short per week.

By Halloween, U.S. supply will be 3.6M tons less than today assuming we are back to pre-Covid demand levels. At those rates of consumption and pre-Covid demand, by Thanksgiving we will have a full-out supply chain problem — not unlike what the lumber market went through earlier this year. Lumber was not a demand-driven price event. It was a supply-curtailment-driven price spike.

In 2011, the only thing that stopped the runaway train in steel prices was steel imports. We and others were importing HRC from Brazil and Europe in 2011 hand over fist. The import supply chain today is empty. No one is willing to stick their neck out due to the tariff uncertainty. The cavalry is not coming.

Put another way:

In Q4 we will be producing 75M tons per year run rate domestically, and importing at 12M ton per year run rate = 87M ton supply run rate.

Versus a 125M demand consumption rate.

95M normal steel production (100)

30M normal imports (35)

In Q4, we are digging a hole of 3M+ tons per month with no steel import cargoes coming, nothing on the water headed our way.

BRS extra 30kt per week isn’t gonna move the needle in a market that’s 400-900kt under-supplied per week.

U.S. prices will have to get high enough to attract imports with the 25 percent duty added. But from the time the first cargo is ordered, it will take three months to arrive. Or we get a new president that removes the tariffs. But that wouldn’t happen until February at the earliest.

Maybe Mexico and Canada steelmakers can crank it up? U.S. usually sells HRC to Mexico, not vice versa.

All of us in the steel market are usually focused on demand. But this worsening supply situation, particularly because of what’s happening at the integrated mills, compounded by tariffs, lack of slabs, and lack of finished imports, is like nothing I’ve ever seen in 30 years. I don’t know how this movie ends. I can’t point to a historical precedent. This market has always been oversupplied.

Steel Market Update will be reaching out early this week to get opinions on the current supply situation and whether it will be resolved over the near term by the additional tonnage coming on at Big River Steel (or other mills) or if will it become worse in the coming weeks and months.