Prices

October 1, 2020

Hot Rolled Futures: Volatility - Here to Stay?

Written by Tim Stevenson

SMU contributor Tim Stevenson is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Tim’s previous role, he was a Director at Cargill Risk Management, and prior to that led the derivative trading efforts within the North American Cargill Metals business. You can learn more about Metal Edge at www.metaledgepartners.com. Tim can be reached at Tim@metaledgepartners.com for queries/comments/questions.

Recent movements in the futures markets have been violent. We’ve seen a surge in the past few days in the U.S. HRC curve as mills implemented a fresh round of price increases. We’ve been thinking about volatility lately, and what drives it. We think there are a number of structural reasons for the volatility that seems to be inherent in the ferrous markets. First off, the way iron ore and met coal is priced has changed significantly. Back in the 1980s and 1990s both of these commodities were commonly sold on long-term fixed-price deals from the suppliers. This enabled steelmakers to give their customers long-term fixed prices without taking a huge margin risk in doing so. When demand from China started to explode in the early 2000s, some of the big ore and coal producers decided they’d rather not do these long-term deals, and instead wanted to sell on more of a spot basis. This was the start of a surge in volatility, as ore and met coal pricing saw massive increases and decreases. Futures markets, particularly in ore, gave buyers and sellers a way to manage this volatility. However, it required a new set of skills to properly structure the trades. This new way of marketing ore and coal has become the way business is done in many parts of Asia, but has had a ripple effect into our markets here in the U.S. Many of the Cliffs ore supply contracts had escalators built into them tied to the seaborne ore price. This made it tougher for U.S. mills to offer as many fixed-price deals as they used to. Ore also caused scrap to become more volatile, and thus impacted the minimills’ ability to manage price risk as well. One other reason is the tendency for buyers to cut inventories to extremely low levels in down markets and then build too much inventory into the peaks. This exacerbates volatility because when inventories are high and prices seem to be peaking, buyers disappear, and the slide down gets exaggerated. We don’t see these underlying pricing mechanisms changing—and thus we will likely continue to see pretty wild swings in pricing. Couple this with the potential for more buyers to shy away from contract deals and go to spot, and 2021 could be interesting. The good news is that the futures do offer you tools to manage at least some of the market swings.

You can see from the below chart that the HRC active contract broke out of its long-term downtrend in mid-August, and then just recently broke out above the “resistance” line at just over the $600 level. While we aren’t expert chart readers, the next resistance level looks to be around $640.

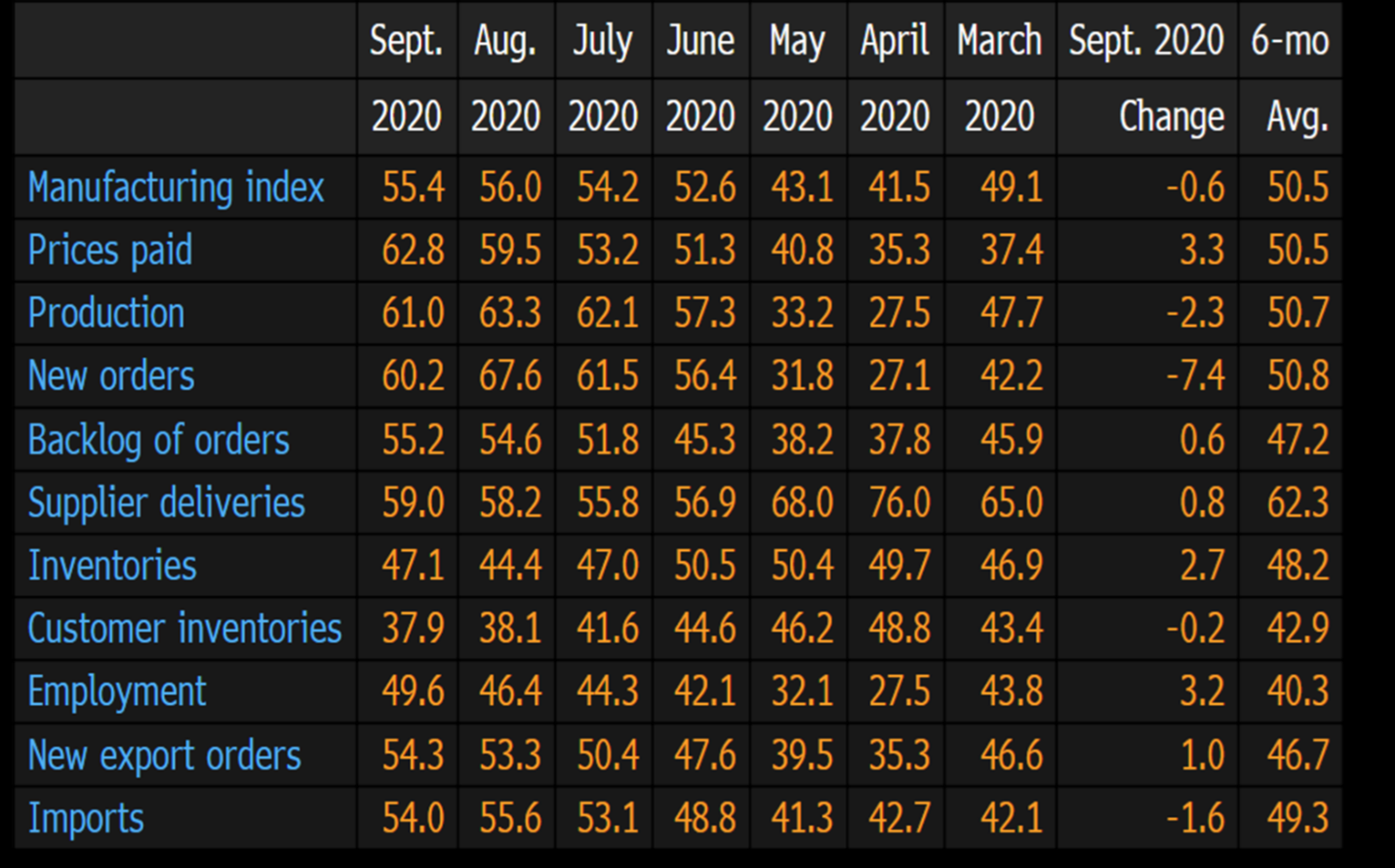

Thursday’s ISM release gave us some insight into the health of the manufacturing economy. The overall index slipped to 55.4 from 56.0 last month, and the new orders component also fell back. Readings over 50 signal expansion, but it certainly looks as if some of the strength we’ve been seeing may indeed be starting to slow a bit. We’d also note that the inventory component moved up. This is still below 50 (47.1 was the latest reading), but seems to indicate that inventories are starting to rise a bit in the manufacturing sector.

Source: Institute for Supply Management, Bloomberg

The chart below shows how much the curve changed in shape over the last week. The curve has moved into “backwardation,” which occurs when prices farther out in the future are lower than the nearby months. When the curve is shaped like this, it can offer some attractive opportunities for companies to lock in lower prices in the future vs. what they are paying in the spot market. Also, the magnitude of the moves is worth noting, with the November contract rising almost $30 in a week!

September volumes were also strong on the HRC contract, with over 400,000 tons trading on the exchange for the second month in a row.

Perhaps just as interesting was the movement in the busheling scrap curve, which actually moved lower in all of the 2021 months.

While we don’t know, it’s possible that busheling may have been reacting to iron ore, which sold off a bit in the past week or two. While still at pretty low levels in absolute terms, ore inventories in China have been trending higher. This has been somewhat surprising as we’ve just come out of the rainy season and demand was expected to be stronger. In recent days there was another permit-related shutdown of one of the Vale mines, so we will see if that helps stabilize pricing at all for ore.

We also like to compare busheling, Turkish scrap, and ore prices from time to time. The chart below shows the 3-month forward contracts of each commodity. You can see that despite the lack of an uptick in the spot ore price in the above chart, the 3-month forward ore contract has moved back up (red line). Busheling (green) and Turkish material (white) have also had a slight uptick. Clearly, until ore prices give back a significant amount of the recent gains, it should be generally supportive for scrap and other steelmaking raw materials.

It seems unlikely that volatility will go away unless some of these more structural characteristics of the ferrous market change. Throw a global pandemic into the mix, and it seems like wild swings in markets will be likely for some time to come. Luckily, the futures contracts give us some tools to try to manage through it!

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information