Market Segment

September 29, 2020

ArcelorMittal Repositions NAFTA Assets

Written by Sandy Williams

ArcelorMittal’s divestment of U.S. assets to Cleveland-Cliffs completes the company’s $2 billion asset portfolio optimization and strategically repositions its North American platform.

“This transaction is a unique opportunity for ArcelorMittal to unlock significant value for shareholders while retaining exposure to the North American economy through our high-quality NAFTA assets alongside a participation in what will be a stronger, better integrated, U.S. business,” said Chairman and CEO Lakshmi Mittal.

ArcelorMittal sees the divestment as a strategic move for its North American assets, a positive financial impact on the balance sheet that will reduce net debt and strengthen capital and credit metrics, and an opportunity for returning cash to shareholders. The acquisition announcement coincides with a $500 million share buyback program that will allow ArcelorMittal to redistribute proceeds from the sale of the U.S. assets to shareholders.

Although ArcelorMittal becomes a 16 percent shareholder of Cleveland-Cliffs by the sale, it will not be represented on the board or make decisions for the company.

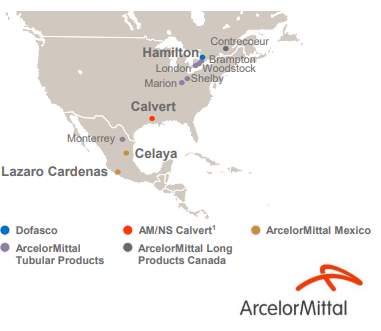

ArcelorMittal’s remaining footprint in North America will include its joint venture finishing facility AM/NS Calvert, ArcelorMittal Mexico and Dofasco in Canada. Upgrades at the three facilities, including an EAF designated for Calvert, will focus on capturing automotive market share. Pre-COVID, ArcelorMittal’s automotive contract business was in the range of 5-6 million tons annually. AM/NS Calvert represents about 40 percent of that number, said President and CFO Aditya Mittal in a conference call on the acquisition.

The company will retain its R&D centers, ArcelorMittal Tubular Products, ArcelorMittal Long Products Canada and its mining and pelletizing facilities in Canada. The Canadian mining operations have 26 million tons of concentrate capacity and 10 million tons of pelletizing capacity. Iron ore from the divested U.S. mining assets was consumed internally by the U.S. operations.

The AM/NS Calvert facility will be strengthened by the addition of an electric arc furnace, which will eventually provide slabs for the operation. For the present, Indiana Harbor, now part of Cleveland-Cliffs, will continue to supply slabs to Calvert under the current five-year contract.

Investments in Canada and Mexico include a new hot strip mill and galvanizing line at Dofasco and a new rolling mill at ArcelorMittal Mexico.

Aditya Mittal said that the NAFTA market remains very important. “We have exited a big chunk of that, but still have a substantial presence.” He called the divestment “not a change in philosophy, vision or direction, but a strategic repositioning of our assets.”