Market Data

September 23, 2020

CRU: Zinc Demand from U.S. Steel Mills Increases

Written by Helen O’Cleary

By CRU Senior Analyst Helen O’Cleary and found in CRU’s Zinc Monitor

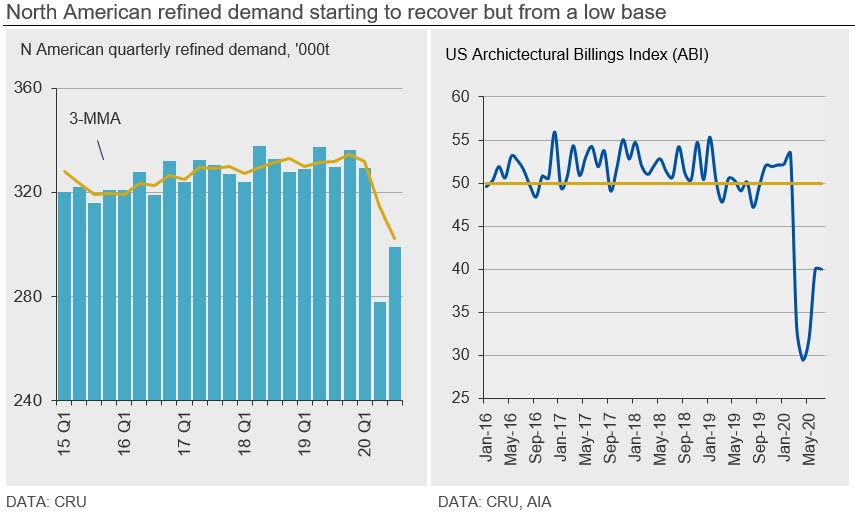

US steel mills have reportedly been taking more refined zinc over the past few weeks and the outlook for Q4 is looking slightly more positive according to market contacts. There have been suggestions that the uptick in spot demand from mills could be partly due to lower spot premia on offer compared with long term contracts, providing an incentive to take the minimum on contract and then purchase additional spot tonnage. However, a producer in North America confirmed that some steel mill customers were taking the maximum on their contracts in September and have been asking for additional spot tonnage as they have been caught short by improving demand from the automotive sector. It is important to note that this is from an exceptionally low base, as US light vehicle output fell 33.8% y/y in H1 according to LMC Automotive. HDG coil prices have also increased throughout August, with lead times being extended, due to the uptick in automotive demand.

As has been the case in most regions, demand from general galvanisers has been much more robust throughout the pandemic and demand in recent weeks has remained stable. In the USA, we estimate that construction output will contract by just 1.3% in 2020, a far less severe contraction than in other end-use sectors but significantly weaker than our forecast of 2% growth at the start of the year. The key risk is that construction is impacted in several months time due to new projects being placed on hold. The forward-looking architectural billings index remained stable but in contraction for a fifth straight month in July, suggesting that construction demand will remain weak into next year. In general, zinc demand from brass mills has reportedly improved in August and been stable in September according to market contacts. We estimate that US output of Cu alloy rods, bars and sections (RBS) declined 10.6% in H1. We understand that alloyers and oxide manufacturers have also been taking slightly more refined zinc over the past few weeks.

North America refined production strong in Q2 & Q3

Overall, North American smelter output has been strong this year, increasing 4.6% y/y during Q2 and forecast to rise 14.7% y/y in Q3, despite weaker Q2 output from Peñoles’ Torreon smelter in Mexico and concentrate market tightness in Q3. This strong Q3 forecast assumes that Peñoles will increase output in line with their expanded capacity and that AZR will be producing as expected. We still have a 4% smelter disruption allowance in Q3 to capture the risk posed by Covid-19.

US refined imports remained strong in July, increasing 23% y/y and bringing the year-to-date increase to 16% y/y. Imports from Canada and Peru declined 10% and 20% respectively year-to-date in July, yet the loss has been more than offset by higher imports from Mexico, Brazil, and Spain, with 20 kt coming from the latter in July. At the time of writing, net inflows into US LME warehouses have been ~50.5 kt (as of 11 September). According to LME off-warrant data, unwarranted zinc in New Orleans declined by 22kt in July, to 29.6 kt, which may have been part of the warranting of 26kt into US LME warehouses in July. We have not heard of any tightness in the US market over the past month, yet with demand improving and zinc cash-3mth spreads in contango, premia have increased by around a quarter cent to 7.5 ¢/Ib Midwest delivered.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com