Market Data

September 19, 2020

CRU: Fed Raises U.S. Outlook, Interest Rates Stay at Zero Until 2023

Written by Jumana Saleheen

By CRU Chief Economist Jumana Saleheen and Economist Anissa Chabib

The U.S. economy has seen a faster than expected resumption of economic activity since the “stay at home” orders ended in May. Most notable has been the improvement in the labor market. The number of people who lost their jobs in March and April was 22 million, but since then an astonishing 11 million (nearly 50 percent) have returned to work. The unemployment rate has fallen to 8.4 percent in August, from its April high of 14.7 percent. Other indicators of economic activity have been positive, too, including retail sales and housing market activity.

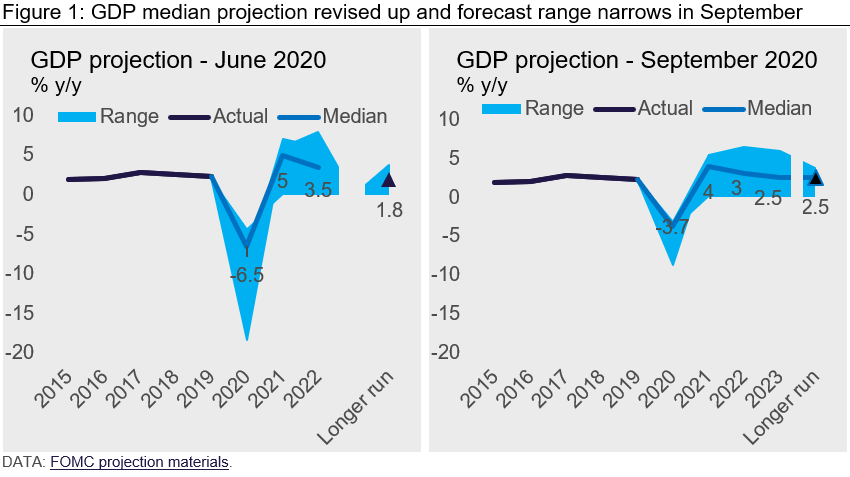

These developments have led the Fed to reduce the projected depth of the recession in 2020 to 3.5 percent, from the 6.5 percent contraction projected in June. The range of forecasts, which varies across FOMC members, is also much narrower now (Figure 1). The unemployment projection has also been lowered to reach 7.5 percent in 2020 down from their earlier estimate of 9.3 percent.

Fed Struggles to Return Inflation to 2 Percent

This was the first meeting since the Fed has announced its move to a new average inflation targeting framework at Jackson Hole. Powell delivered “strong and powerful” forward guidance that interest rates would remain at current lows of 0-0.25 percent until 2023.

It is surprising that such rock bottom interest rates and continued purchase of agency and mortgage backed securities (QE) were insufficient to push inflation above 2 percent before 2023. The Fed’s own projections show inflation reaching 2 percent in 2023. Some interpreted this as a struggle to return inflation to target. Powell denied that the Fed had run out of monetary firepower. The specter of Japan (low growth and deflation/low inflation) loomed high on the minds of sceptics.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com