Prices

September 15, 2020

CRU: Iron Ore Touches $130 /dmt

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

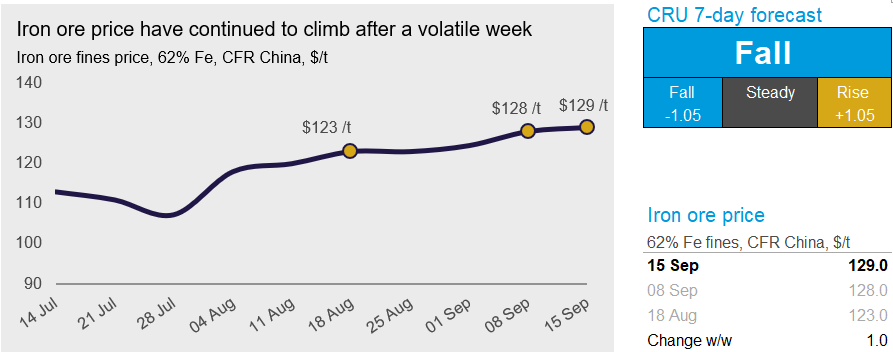

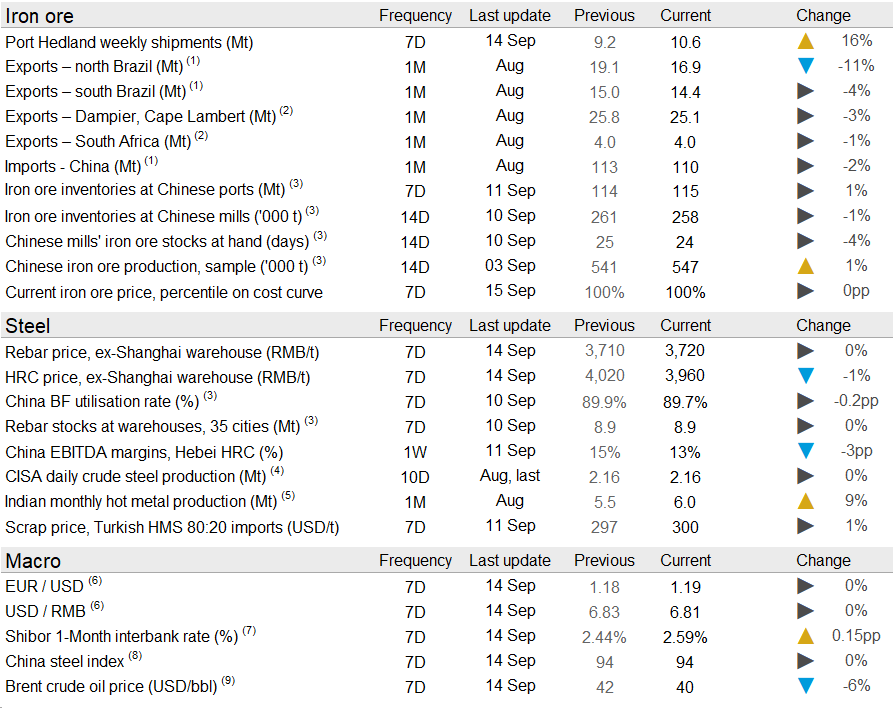

Iron ore prices have stayed elevated in the past week and even exceeded $130 /dmt, before falling back on Tuesday to just below that level. Weakening margins in the Chinese steel industry held prices from rising further and seaborne supply improved in the past week. On Tuesday, Sept. 15, CRU has assessed the 62% Fe fines price at $129.0 /dmt, an increase of $1.0 /dmt w/w.

Chinese HRC prices have dropped by RMB60 /t w/w, as heavy price falls in tandem with lower crude oil and stock prices contributed to a negative market sentiment. The rebar price has not been as volatile, but inched up slowly by RMB10 /t. These price changes prevented steelmakers from passing cost increases onto steel end-users, resulting in lower margins. In combination with stricter operating restrictions in Tangshan city, surveyed BF capacity utilization dropped marginally last week.

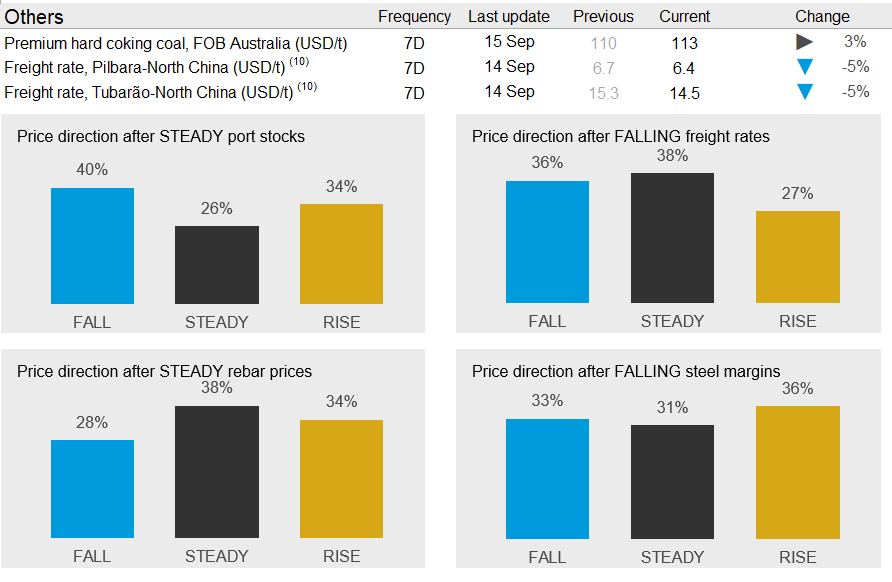

Given lower hot metal production, iron ore port outflow dropped slightly, facilitating further build-up of iron ore inventories at ports. In addition, our sources have mentioned that port congestion associated with import restrictions on Australian iron ore were not applied at all ports throughout the country. For instance, offloading activities at ports around Tangshan were not severely impacted by the licensing issue. In terms of mill operations, we heard steelmakers would continue to blend high-grade and low-grade iron ore fines in their sinter mix. However, in order to reduce costs, they had been increasingly charging more Indian fines that were sold at lower prices.

Seaborne supply has improved after a weak start to September. Port Hedland shipments jumped by 1.4 Mt w/w on stronger supply from BHP. Rio Tinto had a strong week while FMG has struggled to keep shipments at a high level through the month of September. Brazilian exports have been reported at a very high level in the first half of September, but our observations of vessels leaving Brazilian ports indicate that exports are at levels similar to the past month. Indian iron ore exports have dropped somewhat in recent months and our sources are suggesting that domestic supply issues will result in Indian pellet exports seeing a sharp drop in the coming month.

Lower steel margins, stronger supply and an easing of port congestion in China will improve the flow of iron ore into the Chinese market. We therefore expect prices to come under pressure in the coming week.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com