Prices

September 10, 2020

U.S. Steel Exports Recover in July

Written by Brett Linton

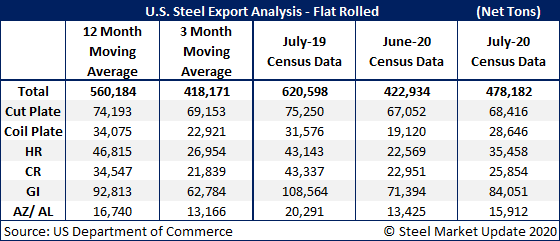

U.S. steel exports continued to recover in July, up 13 percent from June to 478,182 net tons, according to recent U.S. Department of Commerce data. This is up 35 percent from two months prior when exports were at the lowest levels seen in SMU’s 24-year data history. Although up, July exports remain low historically, down 23 percent from levels one year ago.

The 2020 monthly average for exports has now declined to 516,000 tons, whereas the first seven months of 2019 averaged 611,000 tons. The 2019 monthly average was 616,000 tons.

Total July exports were above the three-month moving average (average of May through July 2020), but below the 12-month moving average (average of August 2019 through July 2020). Here is a detailed breakdown by product:

Cut plate exports increased 2 percent from June to 68,416 tons, but were down 9 percent compared to one year ago.

Exports of coiled plate were 28,646 tons in July, up 50 percent over last month, but down 9 percent year over year.

Hot rolled steel exports rose 57 percent over June to 35,458 tons, down 18 percent from July 2019.

Exports of cold rolled products were 25,854 tons in July, up 13 percent from June, but down 40 percent over the same month last year.

Galvanized exports increased 18 percent month over month to 84,051 tons. Compared to levels one year ago, July was down 23 percent.

Exports of all other metallic coated products were 15,912 tons, up 19 percent from June, but down 22 percent compared to one year ago.

Below are two graphs showing the history of U.S. steel exports through July data, in total and by product. To use their interactive features and see a longer history, view the graphs on our website by clicking here. If you need assistance logging into or navigating the website, contact us at info@SteelMarketUpdate.com.