Prices

September 8, 2020

CRU: Iron Ore Prices Steady Prior to Chinese National Holiday

Written by Eduardo Tinti

By CRU Research Analyst Eduardo Tinti, from CRU’s Steelmaking Raw Materials Monitor

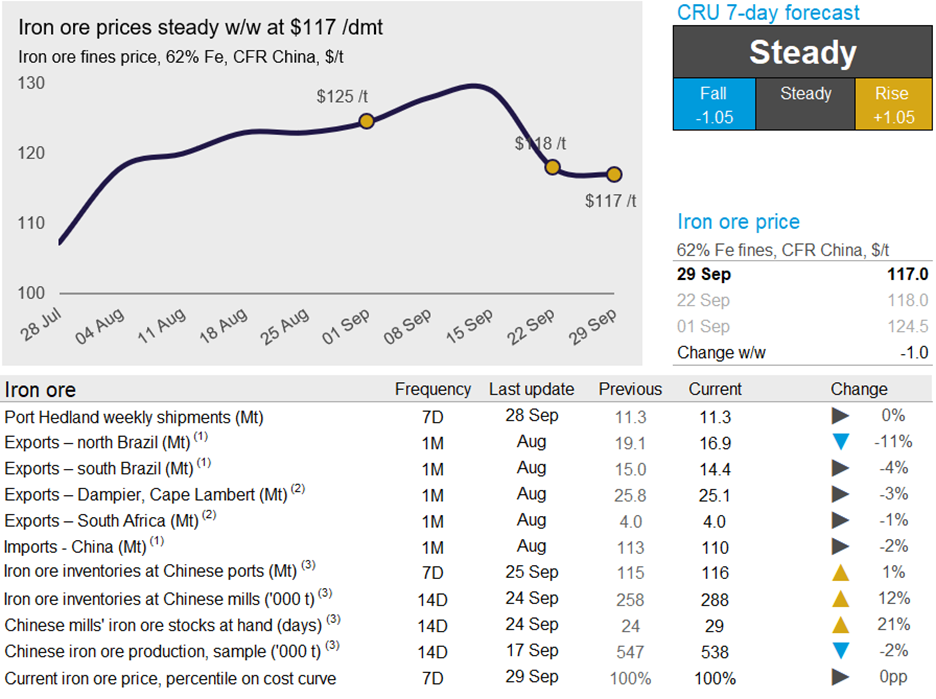

In the past week, iron ore prices remained steady. Despite somewhat lower demand from hot metal production, pre-holiday restocking activity kept iron ore port outflows at a high level while the seaborne supply registered one of the best weeks in the year so far. Iron ore inventories lifted both at steel mills and ports. On Tuesday, Sept. 29, CRU has assessed the 62% Fe fines price at $117.0 /dmt, a $1.0 /dmt decrease w/w.

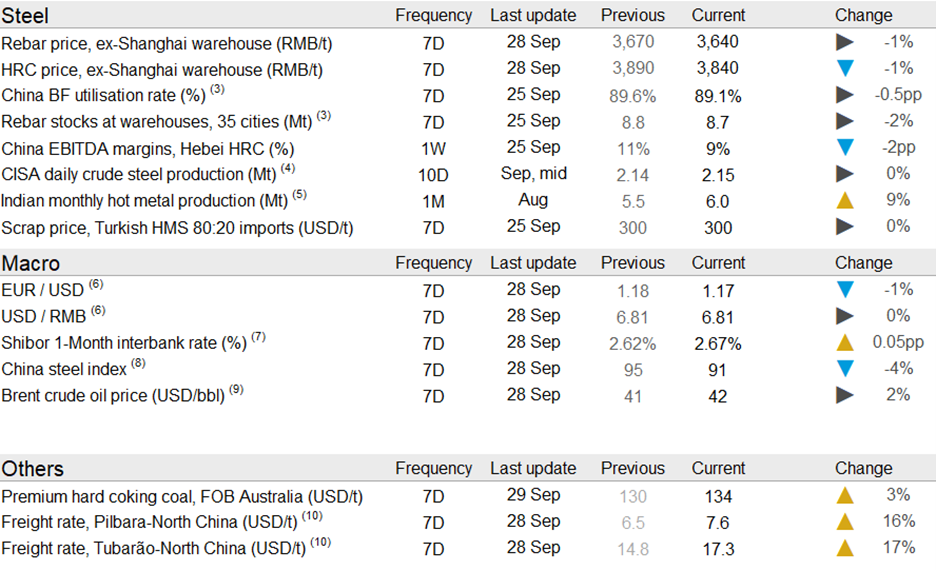

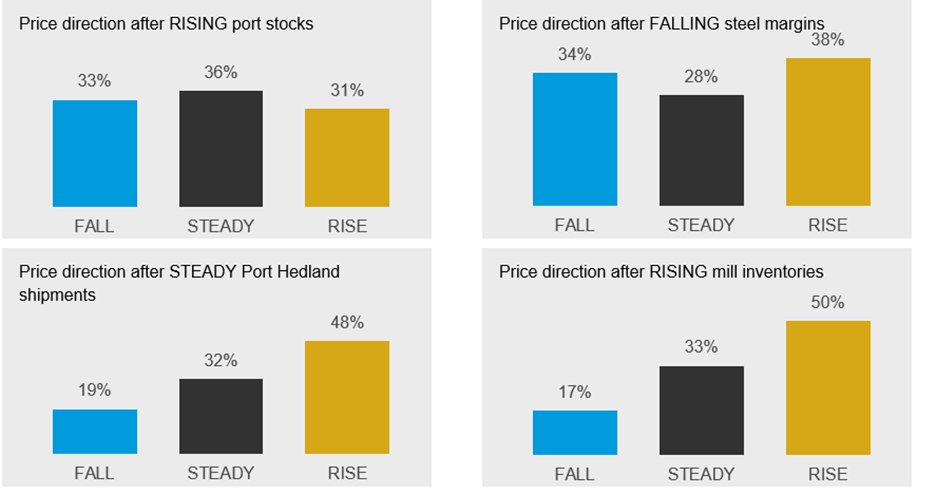

The Chinese domestic HRC price fell by RMB30 /t w/w while rebar prices remained relatively stable. Price volatility has decreased over the past week as the futures market became quieter and business activity gradually slowed down prior to the coming Oct. 1-8 holidays. Despite continuous steel price decreases over the last few weeks, steel margins remain generally above cash neutral levels, keeping steel output elevated. However, the reinforced environment-led restrictions in Tangshan city has lowered BF utilization for six consecutive weeks, compressing Tangshan average BF capacity utilization rates to ~67 percent. This contributed to reduce the national average capacity utilization from the above-90 percent peak reached in mid‑August to 89 percent. The decline in iron ore demand due to lower BF activity and hot metal production was offset by pre-holiday restocking, which kept iron ore port outflows above 3 Mt per week. Consequently, iron ore inventories at steel mills lifted significantly from 24 to 29 days of production at sample mills. Chinese port iron ore inventories also increased by 1.2 Mt w/w. The vessel queue at Chinese ports increased w/w from 142 to 157, but remain significantly lower than in end-August when it reached 188 vessels.

On the supply side, the main producing regions registered an outstanding week as producers pushed for higher volumes to try to boost quarterly results. Consequently, weekly shipments reached the second highest level in the year, just below the last week of June. In Australia, Port Hedland shipments remained steady at 11.3 Mt, a very strong performance, while Rio Tinto exported 7.2 Mt, one of the highest weekly volumes in the year. Over the past week, a Covid‑19 outbreak was spotted in a vessel crew arriving at Port Hedland. Australian authorities have successfully isolated the crew and we believe supply disruption risks linked to the incident are low. In Brazil, weekly exports from the north were at a very high level and shipments from the southeast also improved, though some producers there continue to struggle. On Sept. 24, Vale suspended the disposal of tailings at its B7 dam following a local court decision. As a result, the company halted activities at the Viga concentration plant and, though mining at Viga will remain unaffected, this will have an annualized impact of ~4 Mt/y in production. B7 is considered a low-risk dam and Vale will appeal the court’s decision.

In the coming week, we expect iron ore prices to remain steady as China enters its national holiday period and spot buying activity stops. Further ahead, lower steel margins and higher iron ore port inventories linked to the strong seaborne supply and the expected reduction in the vessel queue at Chinese ports will likely continue to pressure iron ore prices downwards.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com