Market Data

September 8, 2020

CRU: Global Recovery Loses Momentum

Written by Jumana Saleheen

By CRU Chief Economist Jumana Saleheen, from CRU’s Global Economic Outlook

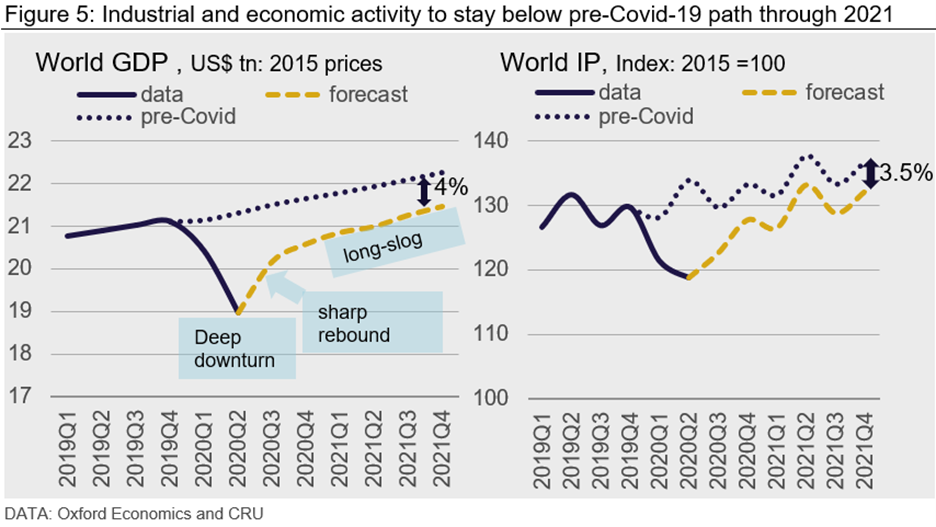

Since lockdown restrictions eased in May the global recovery has been strong, but with marked differences across countries and sectors. The strong recovery in China is partly due to its better virus trajectory over the summer, which has allowed confidence to return. This has helped commodity prices to strengthen. The USA has also witnessed rapid recovery, setting it apart from Europe and India. From this point onwards, and into 2021, we expect the global recovery to lose momentum as the easy successes are over and the “long slog’” begins.

Widespread Recovery is Underway

A recovery is underway in the global economy following the easing of strict confinement measures. The virus continues to challenge our daily lives; schools remain shut in many U.S. states and rising Covid-19 cases in Europe have led to new measures being launched to restrict social interactions. Uncertainty about the future remains high and confidence is still fragile.

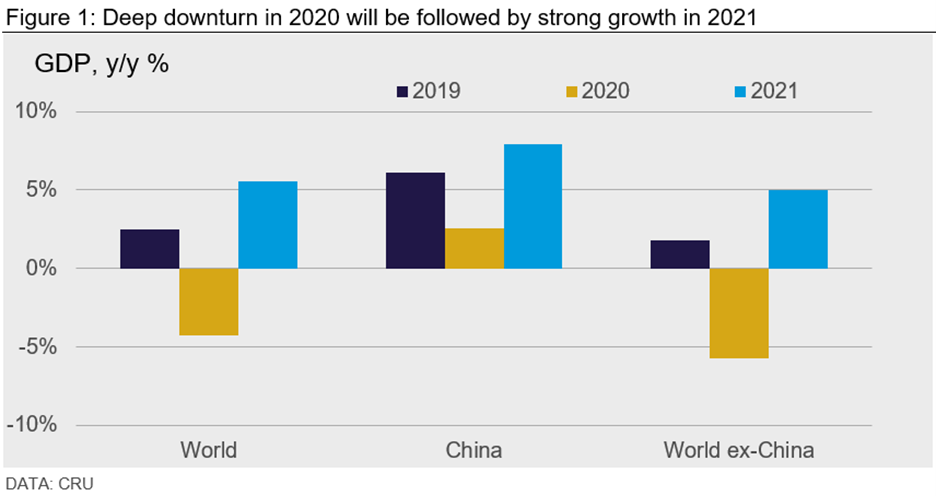

World GDP is forecast to fall by 4.3 percent in 2020, compared with 4.6 percent forecast last month. Most of the upgrade comes from the USA, where data outturns have proved better than expected (e.g. lower unemployment). In response, the dollar has appreciated against the euro. The OECD and Federal Reserve have also upgraded their U.S. outlook. Our view is that Congress will not agree on a stimulus package before the election; additional stimulus is expected in 2021. Our China and Eurozone forecasts are little changed from last month. We forecast world GDP to rise by 6 percent y/y in 2021. The high annual growth rate reflects a return to pre-Covid-19 activity levels from the very low levels of activity reached in April 2020. It should not be mistaken for a particularly favorable growth environment in 2021. It will not be.

Phases of Recovery from Covid-19

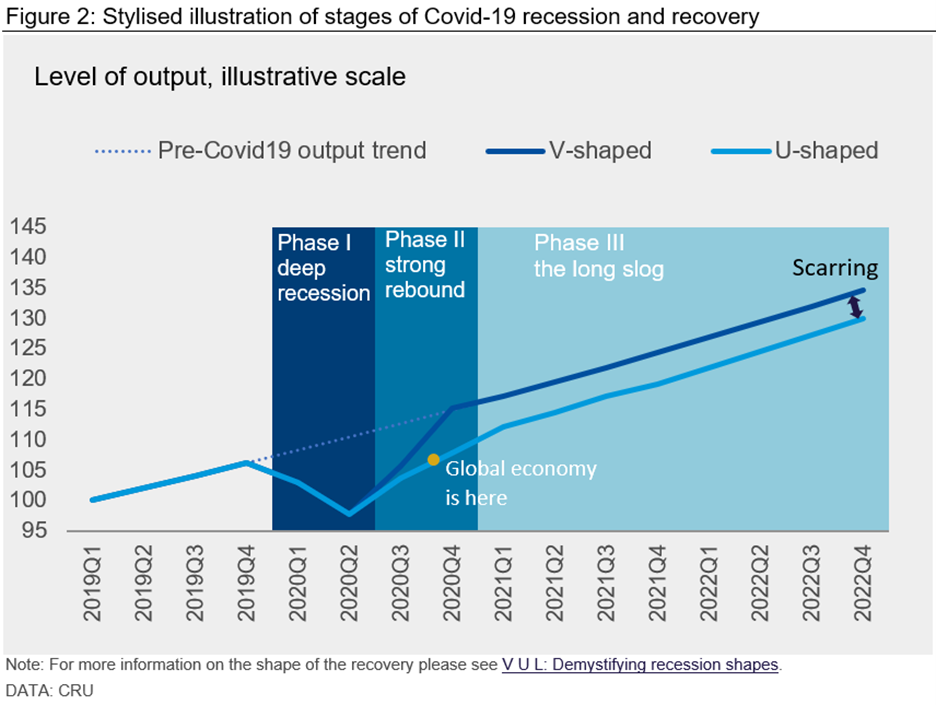

At the start of the pandemic we set out our expectation of the shape of recession and recovery following Covid-19 (Figure 2). This trajectory has been largely borne out by events. April saw the first phase of this shock—a sudden and deep downturn hit the global economy as lockdowns across the world outside China brought activity to a standstill. Phase II reflects the strong rebound in activity that followed once lockdowns were eased. Phase III reflects a loss of momentum in the recovery—we refer to this as the “long slog.” It reflects a period when the quick improvements from re-opening the economy end, but a full recovery is held back by a virus that lingers on. At some point in the future, we expect the world to reach a post-Covid-19 new norm (Phase IV). There is uncertainty about when phase IV will begin, which is why it is not shown on the chart below. It is worth a reminder that in our base case forecast, we assume a vaccine will be available to the public at around mid-2021; again, there are large uncertainties around that too.

China passes through each phase earlier than the rest of the world, as the virus outbreak occurred earlier there. China is the world’s largest consumer of commodities, and its longer period of recovery has helped commodity prices to strengthen. In turn, that has benefited commodity producing countries, such as Chile and Brazil. We have revised up the outlook for these countries this month.

The Damage from Covid-19 in Q2 – the Bad and the Ugly

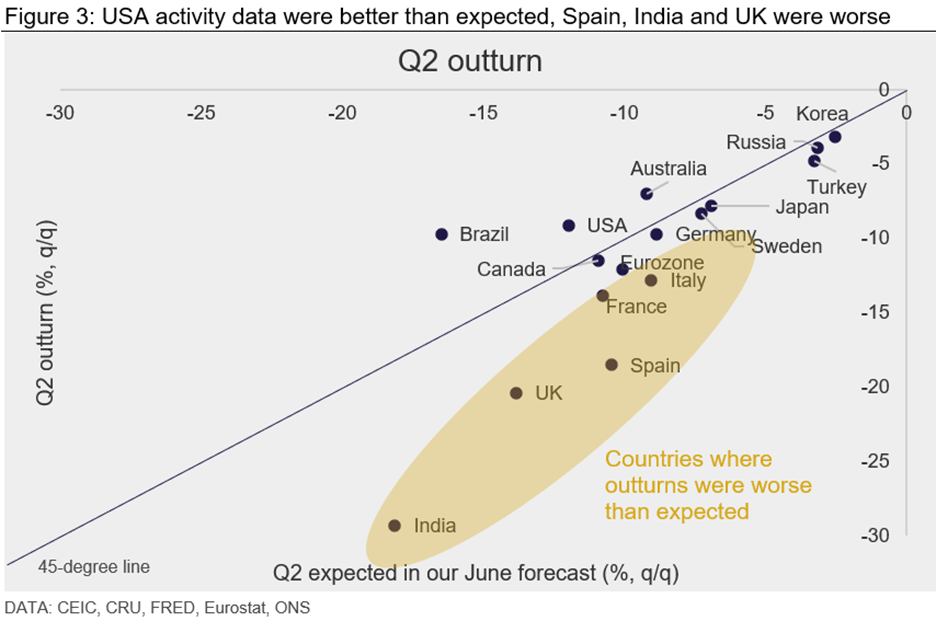

The damage from stringent lockdowns in April is captured in the Q2 data. This month we received Q2 data for several EM economies including India, Brazil, Russia and Turkey. These data have been incorporated into our latest forecasts for 2020. Figure 2 sets out the lessons learned from these data. There are two key lessons.

First, the loss in output from lockdown has been extremely large. The U.S. economy contracted by ~10 percent in Q2, India by ~30 percent and the Eurozone by ~12 percent. There is heterogeneity across European countries, but the industrial sector has remained resilient.

Second, the downturn in Q2 for the USA, Australia and Brazil was smaller than expected, but larger than expected for India, the UK and Spain. In the USA, the actual data outturns show a recovery that is much faster than suggested by leading indicators and past recoveries. In Brazil, we had underestimated the transmission from a stronger Chinese economy and higher commodity prices. In contrast, the adverse outturns in India appear to be linked to an aggressive virus path as the number of cases continues to rise exponentially.

Strong Rebound in Q3, But Momentum has Slowed

GDP data for Q3 is not yet available, but the monthly data for July-August points to a strong rebound. The rebound in quarterly data also reflects the very low levels of activity endured in Q2. We forecast world GDP to grow by 6 percent in Q3. This rebound is as expected. It can be explained by the relaxation of lockdown measures that allowed spending on goods and services to resume. In advanced economies this spending has been supported by temporary fiscal support (e.g. furlough schemes, short-time payments and extended unemployment insurance). In EMs, such as China, there has been less stimulus through welfare payments and more through direct government investment on healthcare and infrastructure.

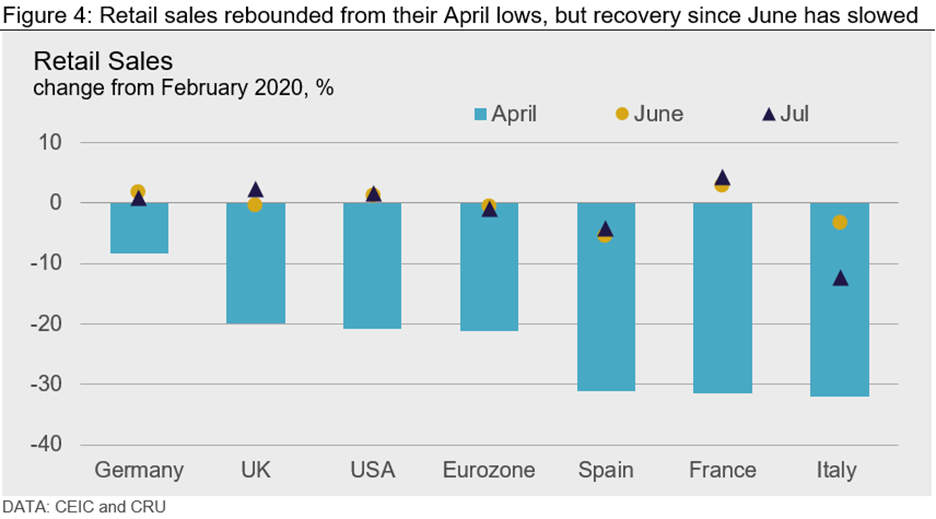

Monthly data allow us to examine the rebound in greater detail. Figure 4 illustrates this with retail sales. At the height of lockdown, in April, retail sales fell by ~20 percent in Europe and the USA. However, by June retail sales in these economies returned to pre-Covid-19 levels (proxied by February). The pace of recovery between April and June was strong.

Between June and July, the improvement in retail sales slowed; this is captured by the small distance between the two markers for the two months. It means that recovery lost momentum from June. Italy is an exception, taking a step backward as retail sales fell in July. We expect this period of slow growth or what we call the “long slog” to continue until a vaccine is found. Without a vaccine, a cloud of uncertainty looms over job security for individuals and over business prospects. This suppresses consumer and corporate spending and hinders full recovery.

Into Q4 and Beyond

The global economy will continue to recover from Covid-19 in Q4 and through 2021. We expect growth in Q4 to be around 2 percent, or much lower than the 6 percent in Q3. In 2021, world GDP is expected to grow at just above 1 percent in each quarter. Combining these forecasts, we expect the world economy to be 4 percent smaller than it otherwise would have been in the absence of Covid-19.

World industrial production (IP) tends to be more volatile than world GDP. The recovery in IP in the remainder of 2020 and 2021 is expected to be a little stronger than world GDP. That is partly because Covid-19 and the need to socially distance hurts the consumer sector (e.g. hospitality and restaurants) more than it hurts mining, utilities and manufacturing activity. As a result, by end 2021, we forecast IP to be ~3.5 percent below its pre-Covid-19 level.

Risk of a Darker Outlook as Summer Ends

Forecasting would always have been difficult at this juncture, facing uncertainty over the U.S. election and the post-Brexit trade deal. On top of this we now have Covid-19 as well. That is why Federal Reserve Chairman Jerome Powell regularly repeats that the path of the economy depends on the path of the virus. Epidemiologists are still learning about the virus. Policy makers are still learning about the effectiveness of social restrictions. They aim to keep individuals safe while minimizing damage to the economy. This is likely to get harder as we enter the autumn and winter when virus transmission is said to be worse. As these uncertainties unfold, they will drive sentiment and volatility in financial markets including the dollar exchange rate. In our base case forecast we do not embody a second Covid-19 lockdown. That remains a significant risk. Should it materialize, it would darken the economic outlook.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com