Prices

September 1, 2020

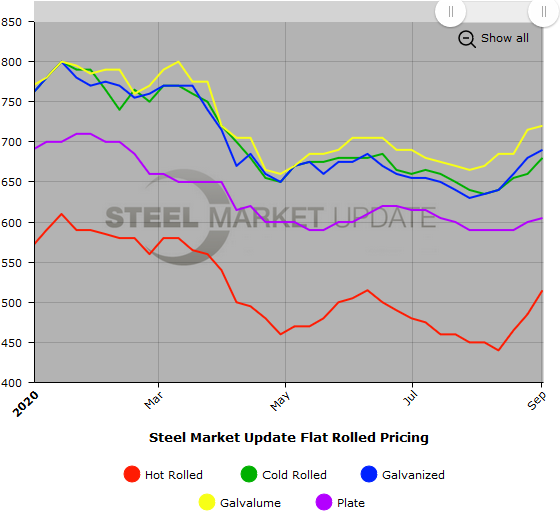

SMU Price Ranges & Indices: Still Trending Upward

Written by Brett Linton

Mills have hiked prices on flat rolled and plate steels in the past 10 days and it appears they will collect at least a portion of the increases. Steel Market Update’s check of the market this week shows prices up as much as $30 per ton, depending on the product, on top of a $10 to $20 increase last week. Two out of three service centers responding to SMU’s poll said they are actively raising prices to their customers. Roughly half describe domestic mill lead times as “normal,” while nearly all the others consider them slightly or even highly extended, which indicates improving steel demand from the lows of the pandemic. SMU’s Price Momentum is Higher on sheet products, but remains Neutral on Plate.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $490-$540 per net ton ($24.50-$27.00/cwt) with an average of $515 per ton ($25.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end increased $40 per ton. Our overall average is up $30 per ton over last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 4-8 weeks

Cold Rolled Coil: SMU price range is $660-$700 per net ton ($33.00-$35.00/cwt) with an average of $680 per ton ($34.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $20 per ton compared to last week. Our overall average is up $20 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 5-8 weeks

Galvanized Coil: SMU price range is $660-$720 per net ton ($33.00-$36.00/cwt) with an average of $690 per ton ($34.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $20 per ton. Our overall average is up $10 per ton over last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $729-$789 per ton with an average of $759 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-8 weeks

Galvalume Coil: SMU price range is $700-$740 per net ton ($35.00-$37.00/cwt) with an average of $720 per ton ($36.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end increased $10 per ton. Our overall average is up $5 per ton over one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $991-$1,031 per ton with an average of $1,011 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $590-$620 per net ton ($29.50-$31.00/cwt) with an average of $605 per ton ($30.25/cwt) FOB delivered to the customer’s facility. The lower end of our range increased $30 per ton compared to one week ago, while the upper end decreased $20 per ton. Our overall average is up $5 per ton over last week. Our price momentum on plate steel is Neutral until the market establishes a clear direction.

Plate Lead Times: 4-6 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.