Market Data

August 23, 2020

SMU Steel Buyers Sentiment: Attitudes Improve

Written by Tim Triplett

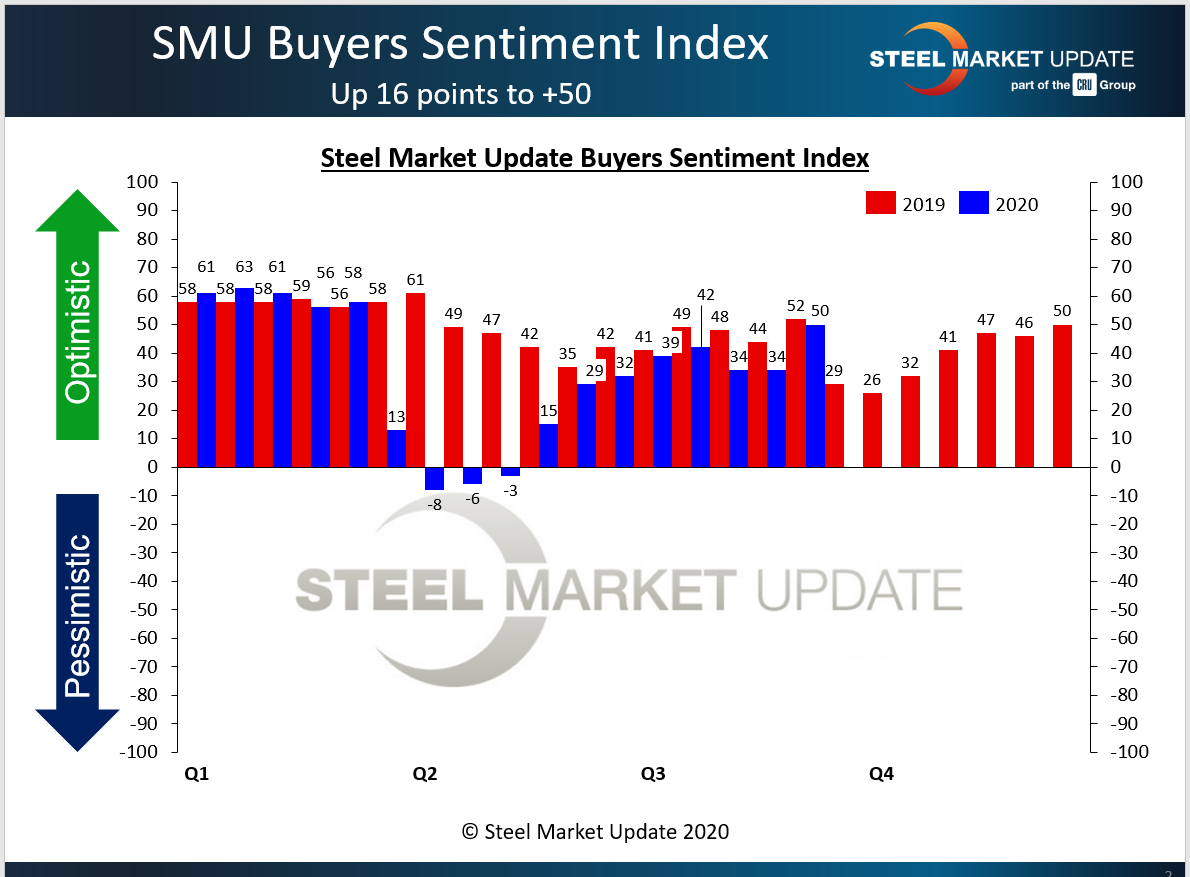

Industry sentiment has improved in the past two weeks, as measured by Steel Market Update. SMU’s Steel Buyers Sentiment Indexes took a dip in July but rebounded in the latest check of the market for reasons that are not entirely clear. Respondents bemoan the persistent uncertainty, but business is good in certain sectors.

SMU asks steel buyers how they view their company’s chances for success in the current environment. The Current Sentiment reading this week jumped 16 points to a reading of +50, which takes it near levels at this time last year. Current Sentiment has recovered from a low of -8 in the first week of April, its lowest reading since November 2010, as the coronavirus disrupted the market

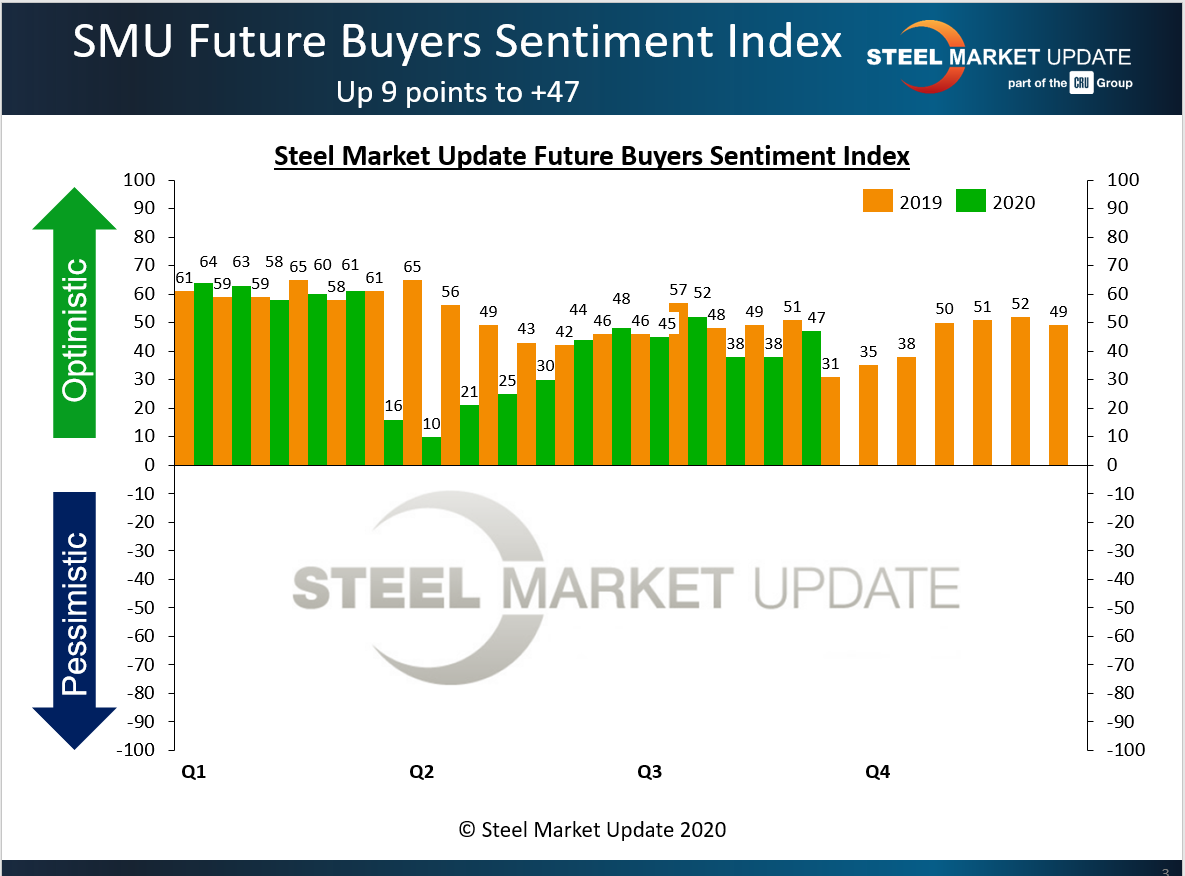

Future Sentiment

SMU also asks buyers how they view their company’s chances for success three to six months in the future. SMU’s Future Sentiment Index bumped up 9 points to a reading of +47. Future Sentiment hit a recent low of +10 in early April shortly after the pandemic took hold. At this time last year, Future Sentiment registered +51.

What Respondents Had to Say

“Visibility for November and beyond is very hazy. Concerns about the normal seasonal drop-off of construction activity and a possible second round of COVID makes the 4-6 month window difficult to predict.”

“Still not much improvement all year. Trade restrictions seem to be getting worse, and too much domestic supply versus demand is not going to change enough in the short run.”

“Long-term risks from imports are even larger now that the Commerce Department is considering changing some conditions on AD/CVD reviews and procedures. Too much domestic supply that is being started will make imports much less of a factor in the middle term.”

“Not sure the extent of the damage to the construction market.”

“I’m concerned with demand and that as mills come back online supply will get out of balance again.”

“Future’s too uncertain with the volatility that continues to exist. Wanted to say “excellent,” but with my under-promise, over-deliver philosophy, went with “good.”

“If a second wave of COVID forces a shutdown, then our ability to be successful goes to ‘awful.’”

“Current business is great, and would be ‘excellent,’ but there is still a lot of uncertainty.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.