Prices

August 21, 2020

CRU: Import Restrictions on Australian Ore Keeping Iron Ore Above $120/dmt

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg from CRU’s Steelmaking Raw Materials Monitor

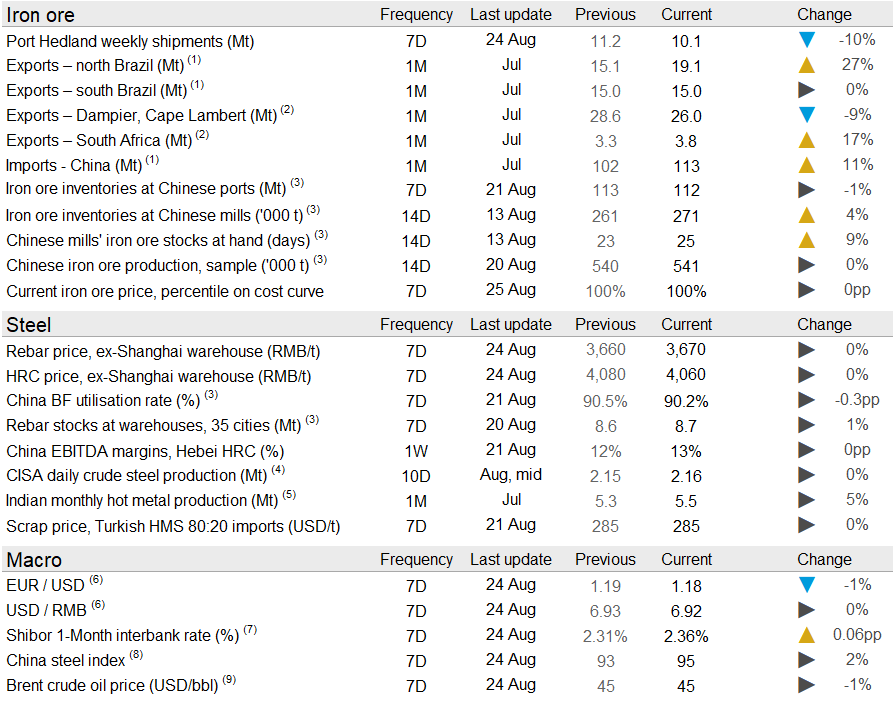

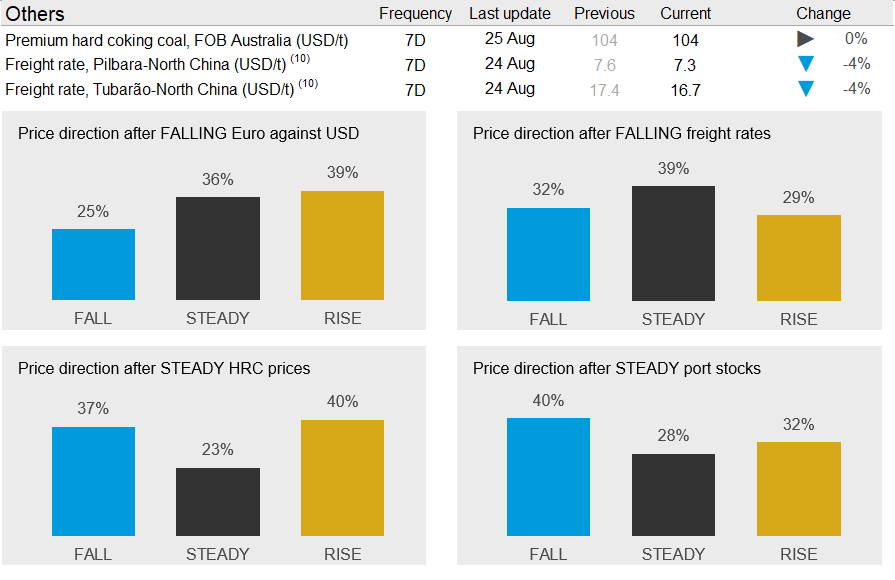

Iron ore prices have held steady in the past week as import restrictions on Australian ore have disrupted the supply chain and reduced the availability of Australian fines. As a result, port inventories of fines products remain at the lowest level in years. This has pushed up the prices of medium-grade fines and on Tuesday, Aug. 25, CRU has assessed the 62% Fe fines price at $123.0/dmt, unchanged w/w.

Chinese HRC and rebar prices have both edged down w/w due to weaker underlying demand. As BOF-based steelmakers slightly pulled back operations, steel flat products output dropped a little w/w. In contrast, EAF-based steelmakers lifted their capacity utilization, further building up inventories at mills and trader warehouses. As steel demand was in general behind market expectations, sentiment turned negative.

Because BF capacity utilization remained elevated, steelmakers were active in iron ore purchases early last week. Despite a slowdown of transactions late last week, weekly iron ore port outflow kept close to 3.3 Mt. In combination with ongoing port congestion, iron ore port inventories declined again last week. This is because of the continued import restriction of Australian goods, which includes iron ore. Our sources have mentioned delayed processing time for import licenses, which is disrupting the supply chain and makes it challenging to deliver ore from vessels to steel mills. It has also been reported that mills have started changing their preference for different ore grades since last week. Some mills in Shandong are now using more high-grade fines, and so are mills in Hebei. However, because of limited supply of low-grade materials including Super Special Fines, some mills are considering using more Indian pellet that is now underpriced relative to some fines.

On the supply side, Port Hedland shipments have pulled back to 10.1 Mt in the past week as Roy Hill has struggled with shipments and BHP has reported slightly weaker shipments in the past week. Rio Tinto and Vale’s Northern System have, however, shipped at a higher level. Arrivals to China from Australia remain at a low level while we are seeing a substantial increase of Brazilian arrivals, primarily from northern Brazil.

Iron ore prices have fallen off their peak and we expect the decline to continue as steel mills are decreasing production and we are seeing a shift in steelmakers’ preference for different ore types. Therefore, a shift away from medium-grade material will add some pressure to the spot price, and prices are expected to decline somewhat.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com