Prices

August 14, 2020

CRU: Iron Ore Surges to $123/DMT

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

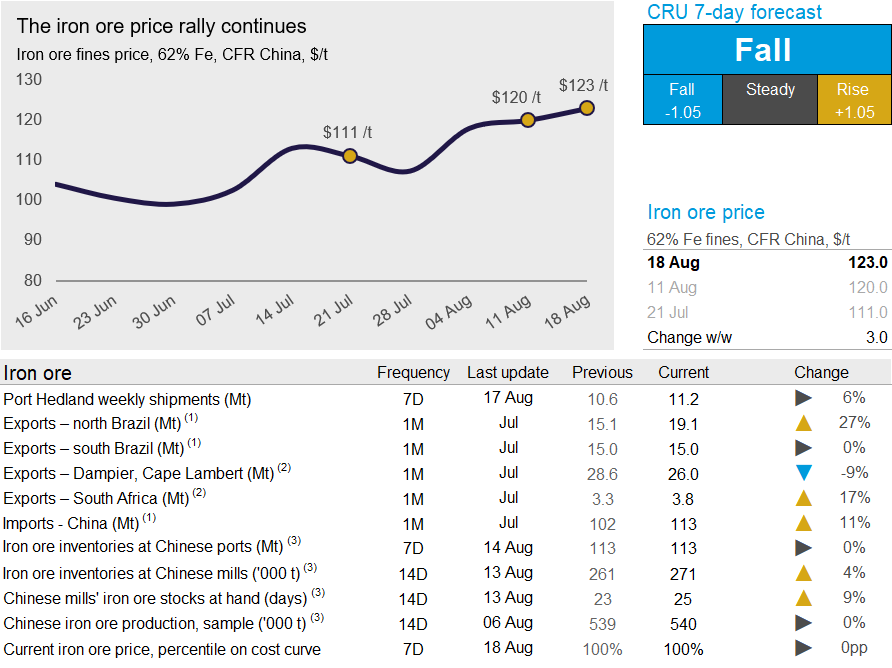

Iron ore prices continued their upward trajectory and traded at $123.0 /dmt on Tuesday, Aug. 18, a $3.0 /dmt increase w/w. Chinese demand remains strong and the challenges of delivering ore from vessels to steelmakers remain in place.

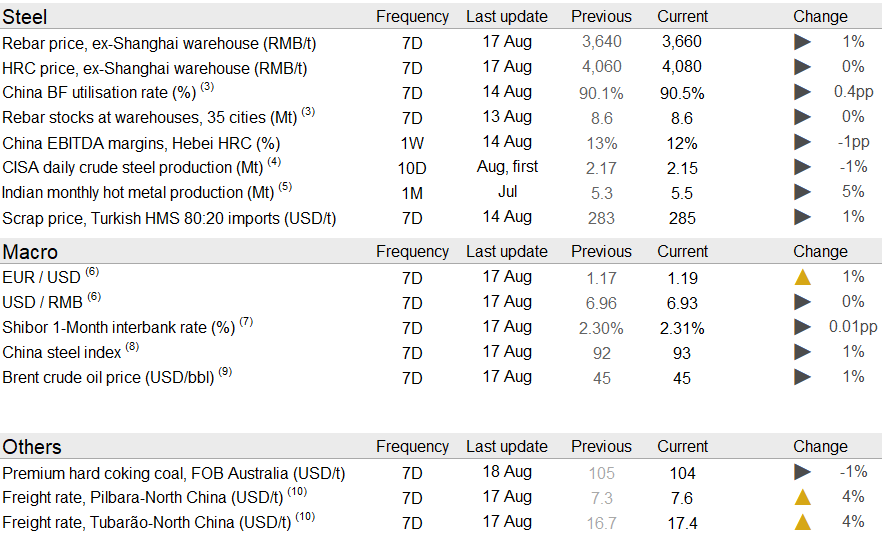

Chinese domestic steel prices have been generally stable over the past week with both HRC and rebar prices edging up by RMB20 /t w/w. As steel demand remained strong, both BOF and EAF steelmakers continued to ramp up production, although at a lower rate than in recent weeks. Surveyed BF capacity utilization has now achieved 90.5 percent, or 95.2 percent after excluding some idled capacity. This means super robust demand for iron ore.

Last week, higher hot metal production led to strong iron ore buying. Weekly iron ore port outflow hit a record high of 3.3 Mt and, in combination with ongoing port congestion, iron ore port inventories declined slightly w/w. Meanwhile, a slow offloading process further extended the vessel queue that is now containing 177 vessels. This was believed to be because of an increased number of days to obtain import license of Australian goods including iron ore. It was rumored early last week that the Chinese Ministry of Commerce tightened the examination of Australian goods, so it took 11 days longer than usual to get import license. Our contacts told us that it started taking effect last Thursday, but there have been no written documents to confirm this. In addition to the changing policy in the physical market, DCE expanded the list of iron ore that could be delivered in the futures market. This time, there were two new brands being introduced—Yandi (BHP) and Karara (Ansteel) that could be used for physical delivery since the September contract.

Seaborne supply has improved in the past week with Port Hedland reaching 11.2 Mt, while Rio Tinto as well as Brazilian exports remained at high levels. CRU has observed an increased availability in Brazilian spot cargoes as both Carajás material and BRBF volumes have been traded more frequently on the spot market. Despite this, fines availability in China is still low due to steelmakers’ strong preference for sinter in their BFs, while an absence of environmental restrictions is keeping demand for pellets and lump weak.

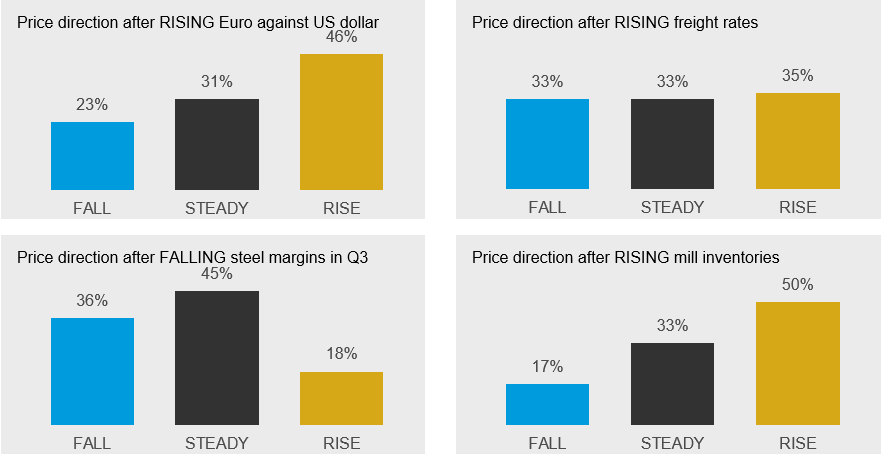

Prices have continued to rise despite rising supply and increased arrivals to the Chinese ports. The challenges to offload ore still persist and prices could very well continue to climb in the coming week. However, we still stick to our forecast of declining prices as mills have been able to increase their inventories somewhat and margins appear to have peaked for now. The high BF utilization levels also mean there is limited upside for Chinese steel production from current levels.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com