Overseas

August 12, 2020

CRU: Five Features of the Pandemic Recovery

Written by Jumana Saleheen

By CRU Chief Economist Jumana Saleheen and Economist Ippolito Tarabini, from CRU’s Steel Sheet Products Monitor

The economy is in the midst of a recession triggered by a health crisis. That makes this recession unusual and different. Here we examine how this recession compares to previous recessions. From that we infer key features of the pandemic recovery. We conclude that demand in most commodity end-use sectors – construction and manufacturing – is likely to be more resilient than normal, because the Covid-19 recession is primarily a service sector recession. The automotive sector is an exception, however, and experiences a slower recovery in light of the structural challenges it faces with respect to climate policy.

Forecasting is as Much of an Art as a Science

Forecasting relies on historical relationships and judgements about the future. In 2020 the global economy was hit by a once in a 100 year pandemic. In these unusual times we expect the pandemic recovery to be different to the past and display five key features (Figure 1).

Table 1 sets out what one would normally expect during a global recession, key observations about the current recession, and our inferences about the nature of the recovery from the pandemic. We highlight five features, with emphasis on the end use-sectors that matter most to the commodity industry. These features correspond to those shown in Figure 1.

Consumer Services Sectors Bear the Brunt of Covid-19

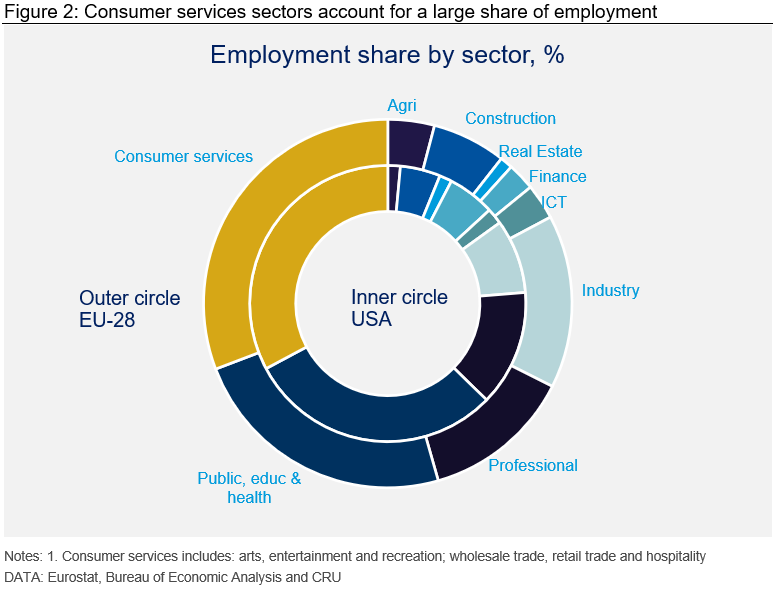

It is well known that Covid-19 has hurt economic activity in the consumer service sectors by more than it has hurt manufacturing and construction. The main reason is that social distancing is hard to achieve in these sectors. Take for example, travel, eating out, cinemas and shopping – these activities tend to occur with large groups of people, risking virus spread. Figure 2 shows that the consumer service sectors – wholesale, retail and entertainment and arts and entertainment – accounts for about a third of total employment in the EU and the USA. The jobs and income of these workers remain at risk until a vaccine is found, which would allow businesses in these sectors to return to normal.

GDP Growth: Sharp Initial Recovery, Then Slower Momentum

Covid-19 has given rise to a larger downturn than the Global Financial Crisis (GFC) – indeed it is the largest downturn seen since the Great Depression of the 1930s. Figure 3 shows that GDP growth in China in 2020 is forecast to fall sharply, but remains positive at 2 percent y/y. In contrast GDP growth in World ex China is forecast to contract by more than 5 percent in 2020. In our base case forecast, we assume the virus can be contained with social distancing, and that a vaccine will be available for public use in the middle of 2021. These assumptions allow the economy to rebound in 2021, but downside risks remain from a second Covid-19 wave.

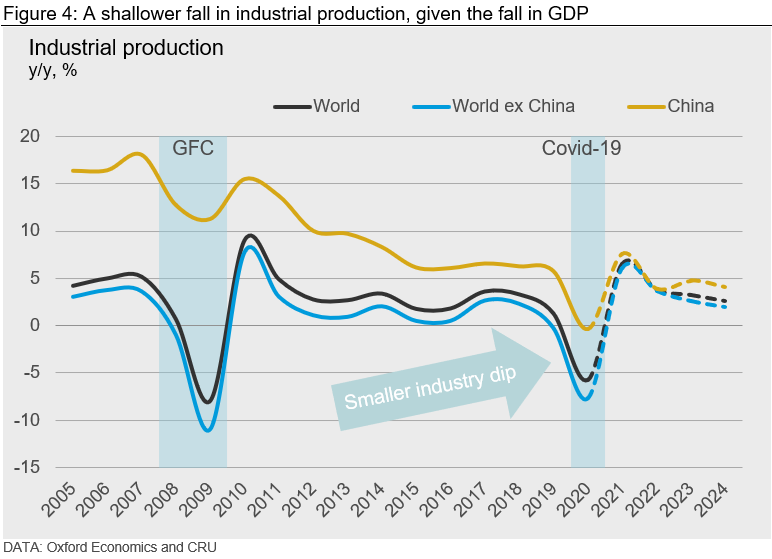

A Proportionately Smaller Fall in Industrial Production

Over the past 50 years industrial production (IP) has been twice as volatile as GDP: a 1 percent fall in GDP tends to be accompanied by a 2 percent fall in IP, and vice versa. In a normal downturn, households and firms become concerned about their future income prospects. In response households tend to lower spending on consumer durables – houses, cars and home appliances – but maintain spending on essential items such as food. Companies tend to lower investment, reducing spending on capital goods (e.g. machinery). These cuts disproportionately hurt the industrial sector (i.e. mining, manufacturing and utilities).

Covid is different. Our view is that the Covid-19 downturn will give rise to a fall in world IP that is roughly equal to the fall in world GDP, ~5 percent in 2020 (Figure 4). The smaller than usual fall in IP arises because the pandemic hurts services by more than it hurts industry.

Many economies kept mining in operation through lockdown as an essential activity. Demand for manufacturing goods has not fallen by as much as in a normal downturn. As people “stay at home” they have not cut back on manufactured goods (e.g. electronics and home appliances) as much as they would have done in a normal downturn. That is because they see the purchase of these goods as somewhat of a substitute for not being able to venture out for leisure and entertainment. Anecdotal evidence suggests that social distancing has led some households in India to purchase dishwashers as a substitute for their housemaid.

China is leading the charge with a strong rebound in IP that follows from (a) the earlier outbreak in China and therefore an earlier recovery; (b) the structure of the Chinese economy–40 percent of valued added is from secondary industry; and (c) our assessment that the government’s 2020 fiscal stimulus has had a larger impact on industry than on services.

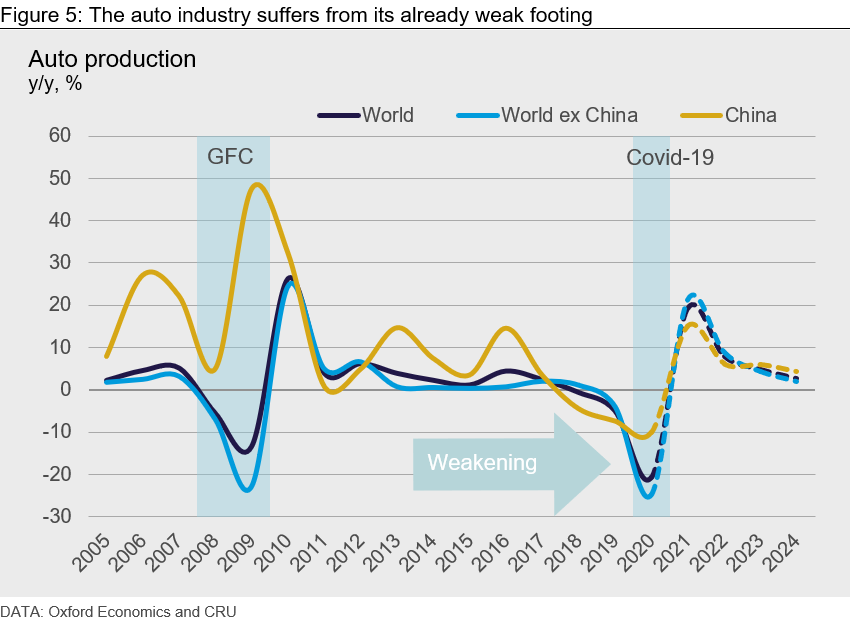

Slow Recovery in the Auto Sector

The outlook for the auto industry in 2020 was bleak prior to Covid-19. 2019 was a challenging year, as climate concerns brought industry sustainability to the forefront. 2019 was the year of new emissions standards in Europe, China and India. This led to a fall in auto demand with uncertainty around how much was due to temporary factors (e.g. confusion about the rules) and how much was permanent (e.g. changing preferences towards ride sharing).

Covid-19 made things worse. Like previous recessions, concerns about future job security, make consumers less likely to buy a big-ticket item like a car. We forecast double-digit falls in global auto production in 2020 followed by a recovery 2021. The level of production will return to its pre-Covid level by 2022.

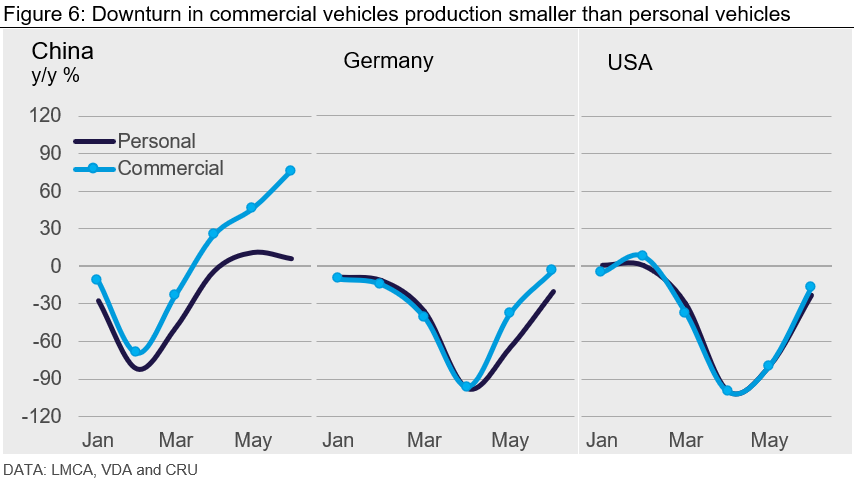

Commercial vehicle production has fallen by less than personal vehicles. This makes sense given the greater demand for home delivery while staying at home. This strength is particularly stark in China (Figure 6). In Germany and the USA commercial vehicles have also fared better. In the EU, commercial vehicle registrations reached their highest level in 2020 in July; and in the U.S. production has almost returned to pre-Covid-19 levels. However, commercial vehicle production is only one-fifth the size of the personal car market, so it could not make up for the shortfall in demand for personal vehicles. The overall outlook is bleak.

Construction Sector More Resilient and Synchronized

A striking feature of Figure 7 is the similarity in the construction sector outlook in China and the rest of the world post Covid-19 compared to the GFC. This highlights two important points. First that China is loathed to deliver the mega-stimulus akin to the GFC as that is now thought to have led to a misallocation of resources and overheating of key sectors (e.g. property). Second, the gradual downward trend in Chinese construction growth reflects the development and urbanization in China over the past 20 years. China is now focused on rebalancing the economy away from investment and towards consumption (dual circulation).

The size of the recent downturn in the Chinese construction sector is larger than the GFC. The expected rebound is also larger. In recent months CRU has become more optimistic about the construction sector in China. There is evidence that a larger than expected share of the Covid bonds are being used for infrastructure projects. Real estate appears to be more optimistic, too, supported by easier access to credit. In the U.S. and EU there is tentative evidence that the commercial real estate sector may see a more protracted downturn than previous recessions, given the rise in remote working.

In our June Global Economic Outlook, we show that the construction sector in major economies recovers to their pre-Covid level earlier than the corresponding recovery in auto production. The main reason for the resilience of the construction sector is workers’ ability to return to work in a socially distanced way. The main constraint behind auto recovery is demand, which is hindered by uncertainty about the future and the transition of the industry.

Unbalanced Recovery Until a Vaccine is Available

We are living in unusual times. The 2020 recession is different to the past in that it has been triggered by a health crisis rather than the overheating of one sector of the economy. As a result the trends from this recession have been different and so too will the recovery.

Recovery in some commodity end-use sectors (construction and manufacturing) is likely to be more favorable than previous global recessions. The explanation for this is simply that social distancing creates less of a drag (on both the supply and demand) in these sectors. The outlook is not so good for the auto industry, partly because the industry was on a weak footing even prior to Covid-19, and partly due to the usual weakness in the demand for large durable goods in downturn. We do not expect a full recovery in the service sector, and the broader economy, until a vaccine is available to the public.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com