Market Data

August 4, 2020

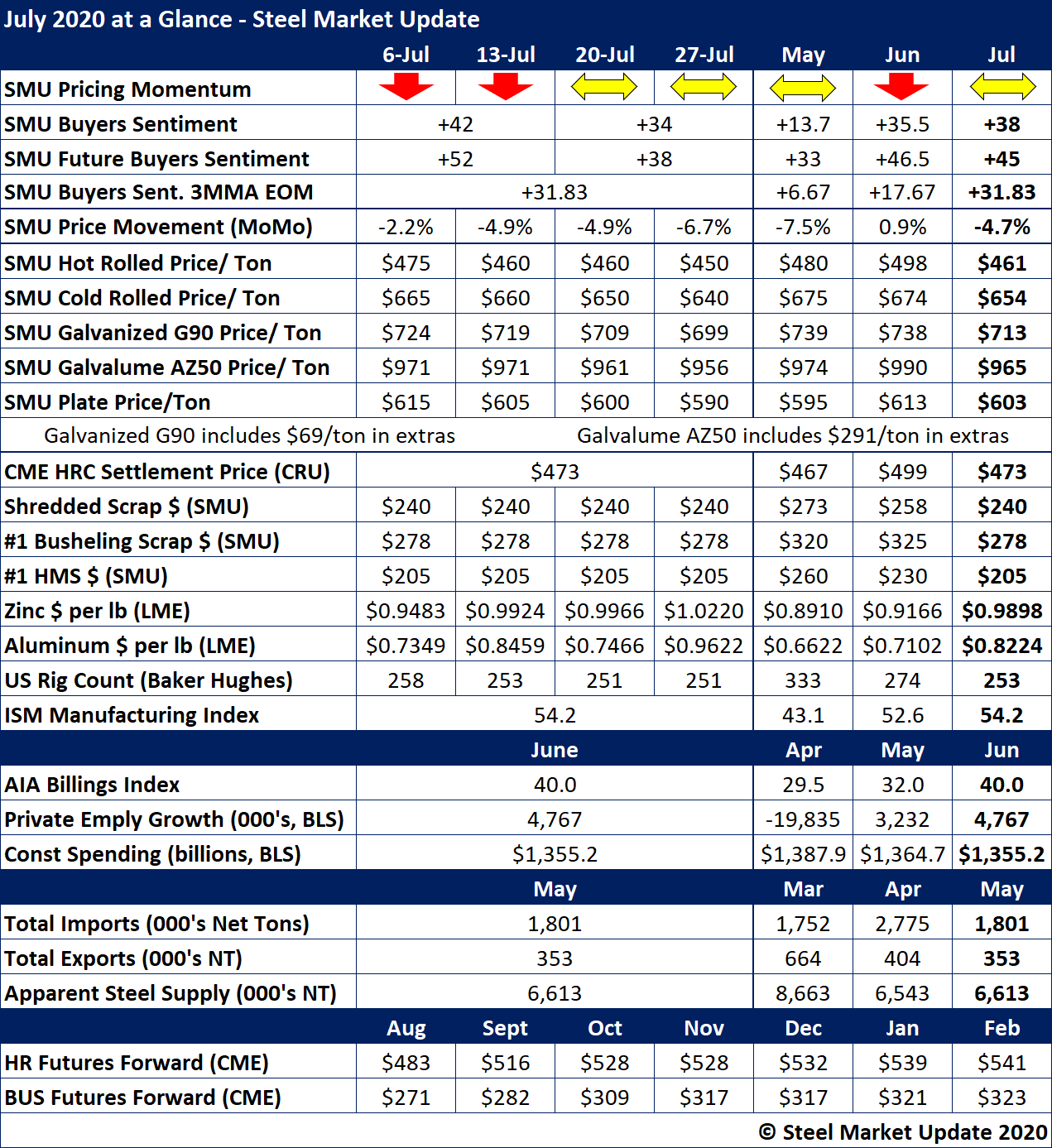

SMU's July At-a-Glance

Written by Brett Linton

Steel prices declined throughout the month of July, although mills announced price increases in the third week of the month. As of last week, Steel Market Update’s hot rolled price average had declined to $450 per ton. Scrap prices declined from June to July by $18-48 per ton. SMU adjusted its Price Momentum Indicator from Lower to Neutral in mid-July.

SMU Buyers Sentiment Index readings declined from July, with Current Sentiment remaining in positive territory but slipping to +34 at the end of the month. Future Sentiment ended the month at +38, while the three-month moving average reached +31.83 as of July 24, the highest 3MMA seen in 16 weeks. Note that monthly sentiment readings in the chart below are averages for each month.

Key indicators of steel demand were mostly up compared to the downturn seen in the prior months. The AIA Billings Index rose to 40.0, and private employment increased by nearly 4,800 jobs. Construction spending slightly decreased in July to $1,355 billion dollars (SAAR).

See the chart below for other key metrics in the month of July: