Prices

August 4, 2020

CRU: Iron Ore Surging Towards $120/dmt

Written by Eduardo Tinti

By CRU Research Analyst Eduardo Tinti, from CRU’s Steelmaking Raw Materials Monitor

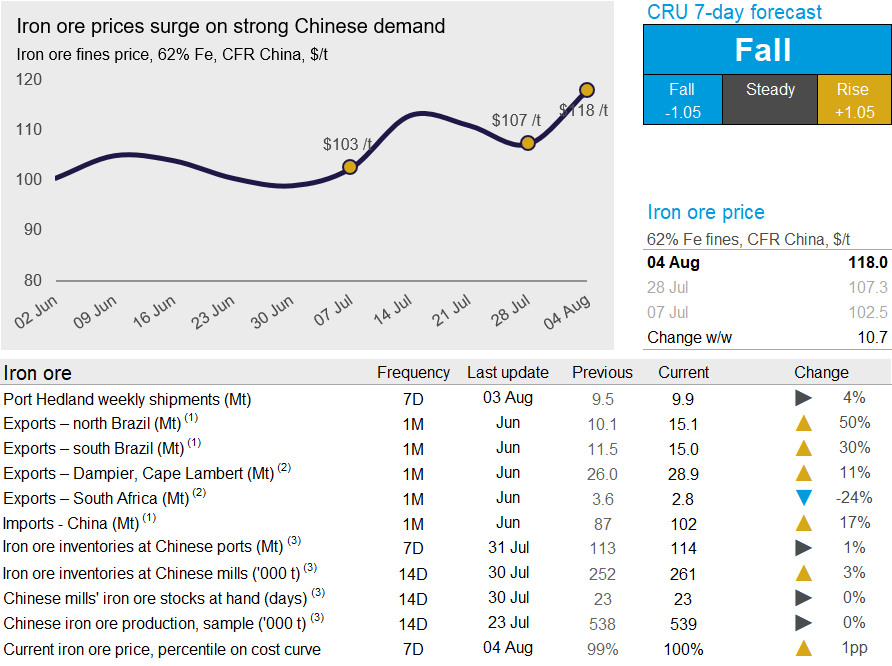

Last week, iron ore prices rallied, rising by $10.7 /dmt w/w. This was mainly due to very strong Chinese demand driven by high steelmaking margins, BFs operating at historic high capacity utilization rates and bullish market sentiment. Albeit rising iron ore inventories at ports, steel mills continue to operate with low levels of stock at hand and have no room to delay purchases to wait for lower prices. On Tuesday, Aug. 4, CRU assessed the 62% Fe fines price at $118.0 /dmt.

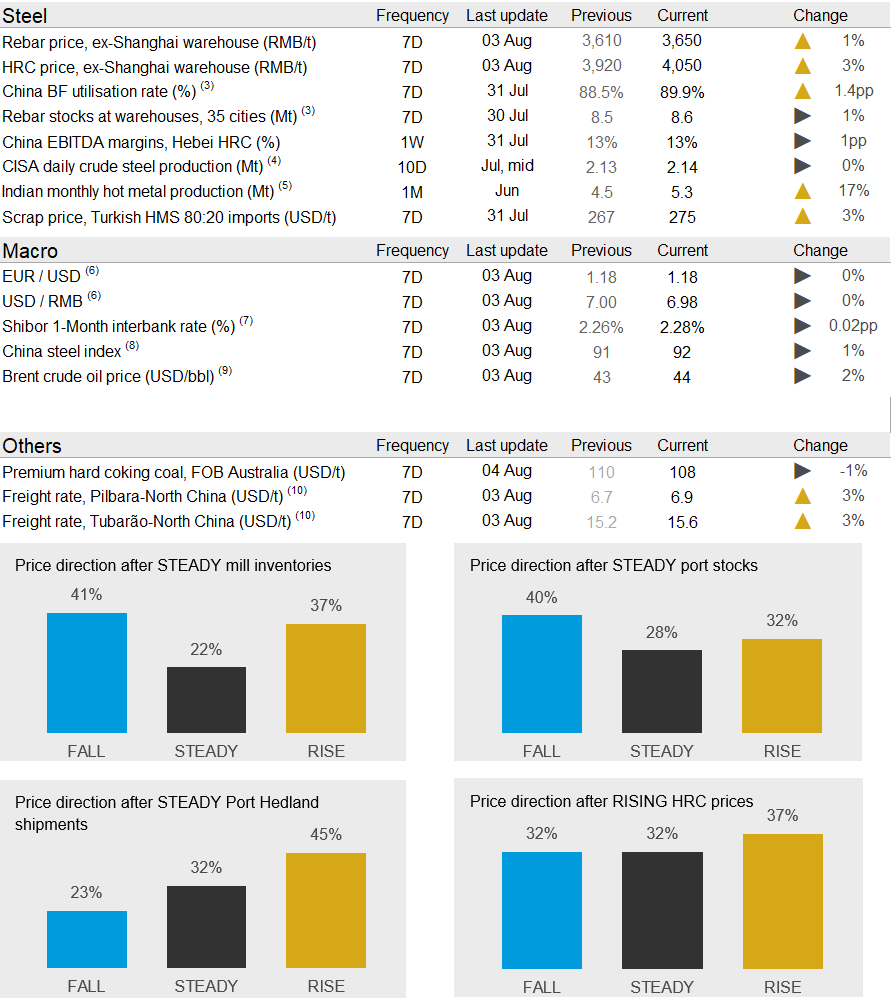

Chinese finished steel prices rose again last week. Many construction sites resumed operations after the rainy season ended. As a result, rebar demand lifted, pushing up prices by RMB40 /t w/w. Meanwhile, HRC prices rose more sharply, by RMB130 /t w/w. Robust sheet demand was fueled by positive market sentiment as the Caixin Manufacturing PMI came in at 52.8, the highest level since February 2011, indicating that the Chinese manufacturing sector is performing extremely well. Rising finished steel prices are boosting steelmakers’ margins and incentivizing mills to maximize production. As a result, and with BFs restarting in Tangshan, BF capacity utilization in the country reached the historic high level of 90 percent, providing ample support for iron ore demand.

Meanwhile, seaborne supply remained healthy and broadly steady w/w. In Australia, port Hedland shipments rose slightly w/w to 9.9 Mt as Roy Hill resumed exports after concluding its scheduled shiploader maintenance. Lower exports from Rio Tinto were partially offset by improving shipments from southern and northern Brazil.

Chinese ports continue to face offloading delays as Covid-19 checks in ships’ crews remain in place. Consequently, vessel congestion is still observed at Chinese shores; 159 vessels are currently waiting to offload their cargo compared to 165 last week. This reduction in vessels waiting to offload contributed to rising iron ore stock at ports, now at 114 Mt from 113 Mt last week and 108 Mt a month ago. However, steel mills’ iron ore stocks at hand remain low and mills rely on new purchases to keep their operations running, which contributes to stubbornly high prices.

Chinese steel mills have been charging higher rates of lump recently. This is due to low lump premium and to sintering restrictions in the Hebei province. Such restrictions are expected to end soon, which will push lump rates down.

In the coming week, we expect iron ore prices to lose momentum and decline as seaborne supply remains healthy and, despite the vessel congestion at ports, iron ore availability increases in China. As an upside risk, extremely optimistic sentiment in the Chinese market may continue to boost prices, but we believe market fundamentals will prevail and prices will fall from current heights.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com