Market Data

August 4, 2020

Consumer Confidence Declined in July Following June's Gain

Written by Brett Linton

The Conference Board Consumer Confidence Index decreased in July, a decline from June but an improvement over recent months. The composite index now stands at 92.6, down from 98.3 in June, and down from 135.8 percent one year prior. “Consumer Confidence declined in July following a large gain in June,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The Present Situation Index improved, but the Expectations Index retreated. Large declines were experienced in Michigan, Florida, Texas and California, no doubt a result of the resurgence of COVID-19. Looking ahead, consumers have grown less optimistic about the short-term outlook for the economy and labor market and remain subdued about their financial prospects. Such uncertainty about the short-term future does not bode well for the recovery, nor for consumer spending.”

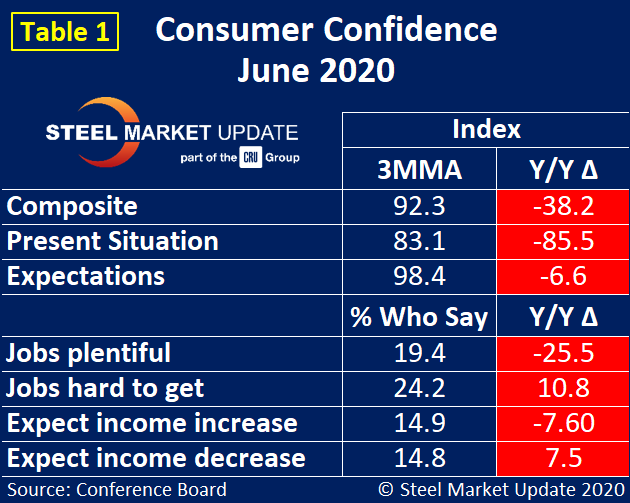

Steel Market Update takes data from The Conference Board and presents it as a three-month moving average to smooth the trend. It’s been four months since the coronavirus shut down the U.S. economy, and the trend is clear. The composite index is made up of two sub-indexes: the consumer’s view of the present situation and his or her expectations for the future. On a 3MMA basis comparing July 2020 with the same period in 2019, the present situation was down by 85.5 points and expectations were down by 6.6 points (Table 1). The color codes show improvement or deterioration of the individual components in Table 1; the red indicates that consumer confidence is negative in all aspects.

In July, the consumers’ view of the present situation registered 83.1 as a 3MMA, down sharply from 170.0 in March just prior to the start of the pandemic. Consumer expectations declined from June to July, moving from a 3MMA of 99.3 in June to 98.4 in July. The composite index now stands at a 3MMA of 92.3, up from 90.0 in June, but down from the 2020 peak of 130.4 in February. Consumers’ expectations for the future are more positive than their current sentiment (Figure 1).

The consumer confidence report includes employment data that shows some positive labor trends. Figure 2 shows the 3MMA differential between the positive and negative statistics for employment and wages. In March, pre-pandemic, the differential between consumers who said jobs were plentiful and those who said jobs were hard to get was +29.5. After dipping into negative territory in April through June, the 3MMA is now positive in July at +1.3. Expectations for wage increases, which were negative in April and May but positive in June, remained slightly positive in July at +0.1. Consumer attitudes improved somewhat in June and July as businesses reopened and more people got back to work.

Steel demand is dependent on the growth of GDP, which in turn is strongly influenced by consumer confidence, disposable income and a willingness to spend. The July data shows early signs of improvements in present consumer attitudes, but those gains could easily reverse if a resurgence of COVID-19 shuts down parts of the economy once again.

About The Conference Board: The Conference Board is a global, independent business membership and research association working in the public interest. The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months.