Market Data

August 3, 2020

SMU Energy Analysis for July

Written by Brett Linton

U.S. production of crude oil decreased in May by 1.99 million barrels per day (b/d), the largest monthly decrease since at least January 1980, according to the latest data from the U.S. Energy Information Administration. May marks the sixth consecutive monthly decrease in crude oil production and is the third month since March when the government declared a national emergency over the COVID-19 outbreak.

May crude oil production decreased by 16.6 percent as the economic impact of COVID-19 mitigation efforts led to a drop in demand. Reduced economic activity has caused changes in energy supply and demand patterns. Crude oil producers curtailed production and reduced drilling activity, lowering the output for the major U.S. oil-producing regions. The benchmark West Texas Intermediate (WTI) crude oil average spot price dropped from $58 dollars per barrel (b) in January 2020 to $17/b in April. However, WTI increased to $29/b in May as production decreased and demand increased.

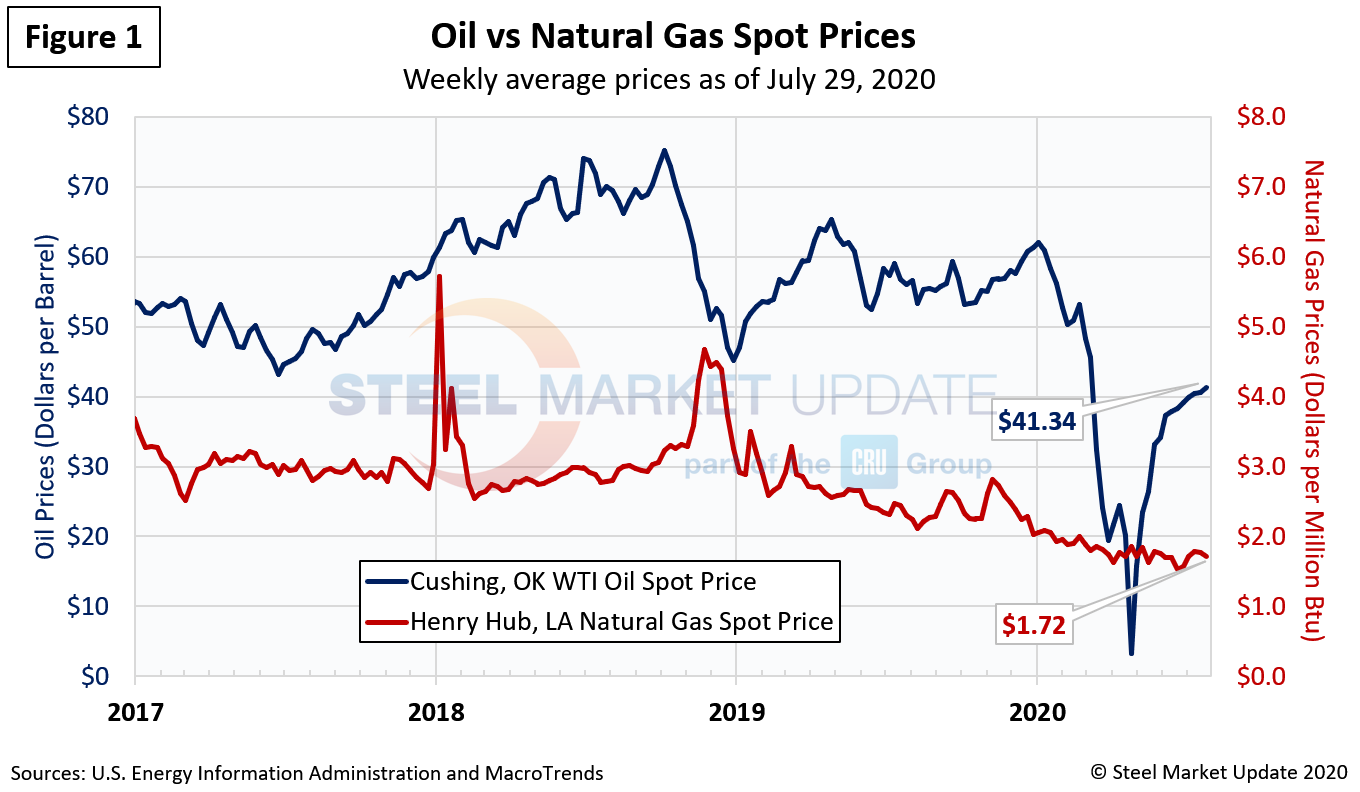

Spot Prices

The spot market price for West Texas Intermediate (WTI) has rebounded somewhat from the plunge after the cornonavirus shutdowns, increasing to $41.34 per barrel as of July 29. Natural gas at the Henry Hub in Oklahoma was priced at $1.72 per MMBTU (million British Thermal Units) as of July 29, down from just over $2.00 at the beginning of the year. Analysts say the supply overhang, and weakened demand due to the pandemic, are likely to keep downward pressure on oil and gas prices for some time.

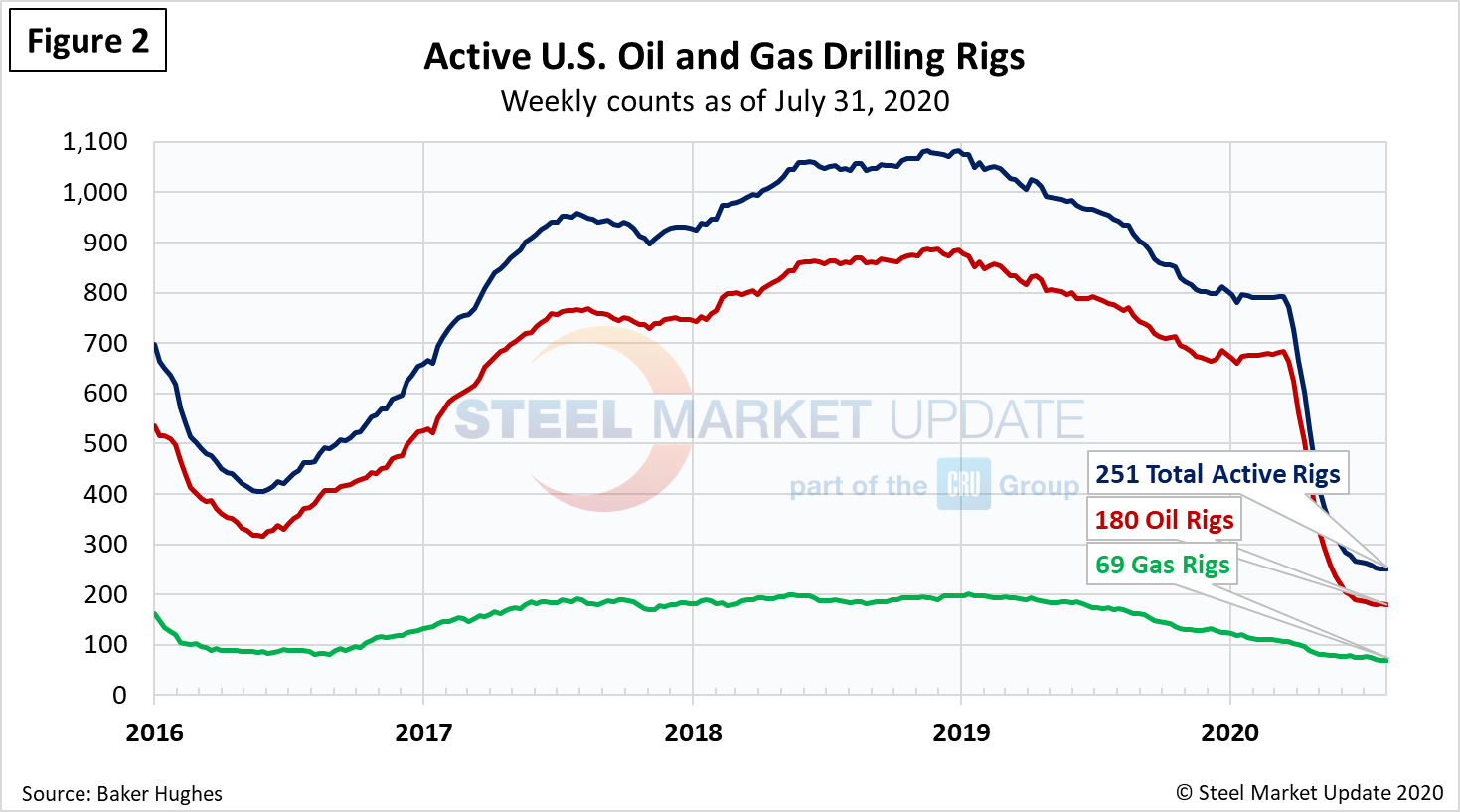

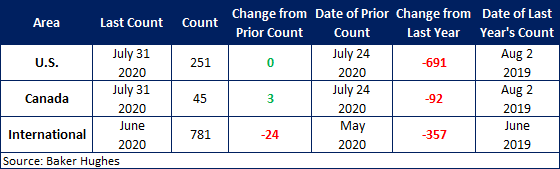

Rig Counts

The decline in active U.S. rigs drilling for oil and gas has flattened as of last week to 251 rigs, including 180 oil rigs, 69 gas rigs and 2 miscellaneous, according to the latest data from Baker Hughes (Figure 2). That’s a decline of 68 percent from the 793 rigs in production in March prior to the coronavirus shutdowns. The table below compares the current U.S., Canada and International rig counts to historical levels.

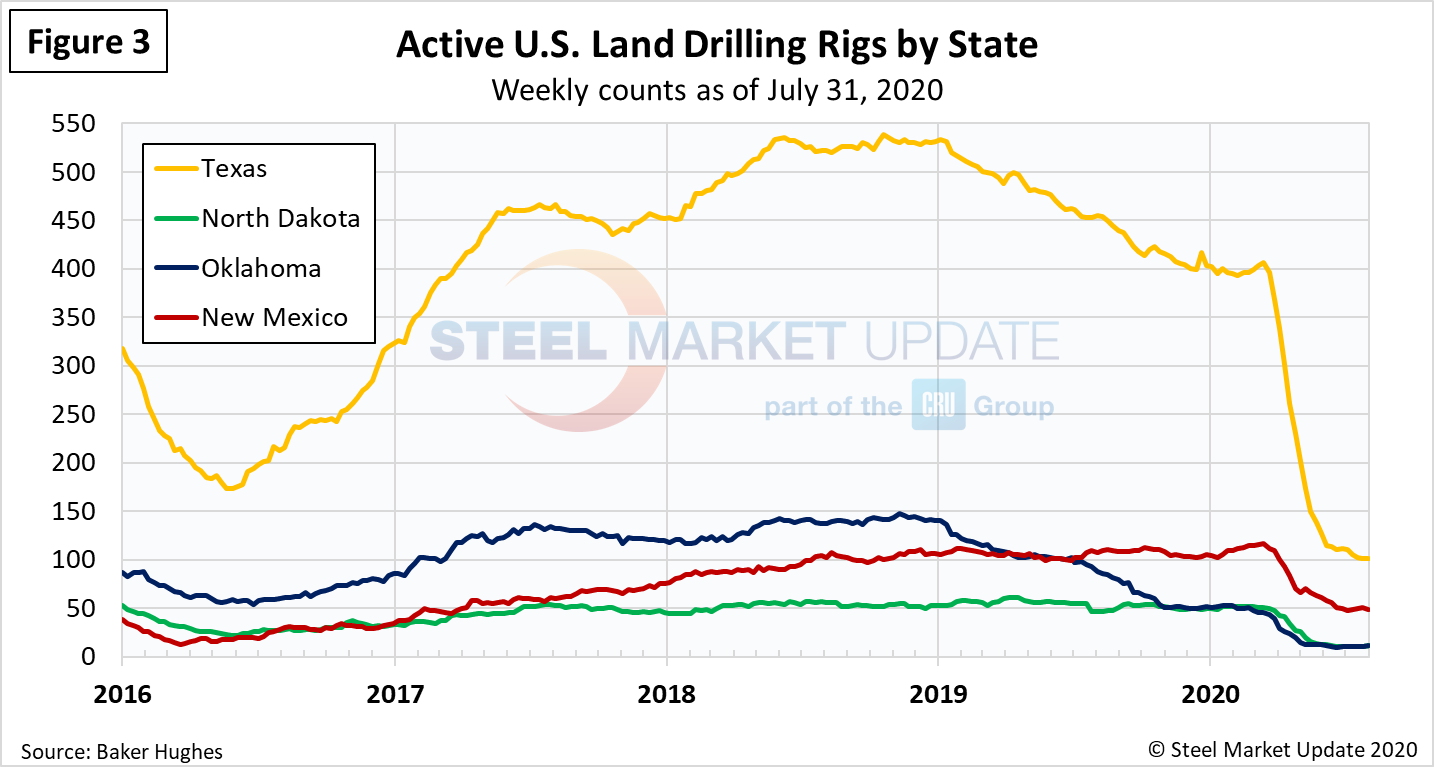

U.S. oil and gas production are heavily concentrated in Texas, Oklahoma, North Dakota and New Mexico, which have all seen declines of more than 70 percent in active drill rigs since mid-March. The rig count in Texas plummeted from 407 in mid-March to 101 as of last week (Figure 3).

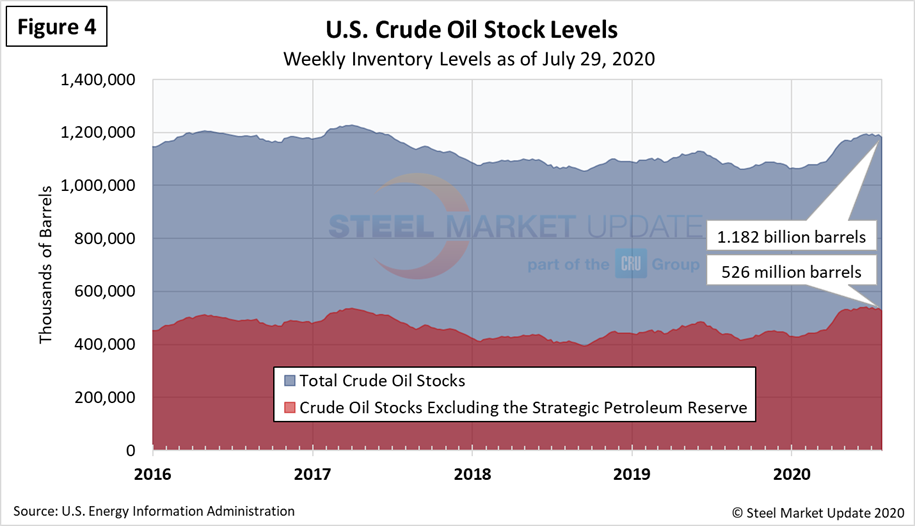

Stock Levels

Total crude oil stocks in the U.S. have been on the rise since the beginning of the year, even before the coronavirus crisis, hitting 1.182 billion barrels as of July 29, up from just over 1 billion barrels at the beginning of the year (Figure 4).

EIA expects U.S. crude oil production to rise in July data as demand and prices increase. In its July Short-Term Energy Outlook (STEO), EIA forecasts that U.S. crude oil production will average 11.6 million barrels per day in 2020. Before the COVID-19 pandemic and the economic downturn, U.S. crude oil production averaged 12.8 million b/d in the first two months of 2020.