Market Data

July 30, 2020

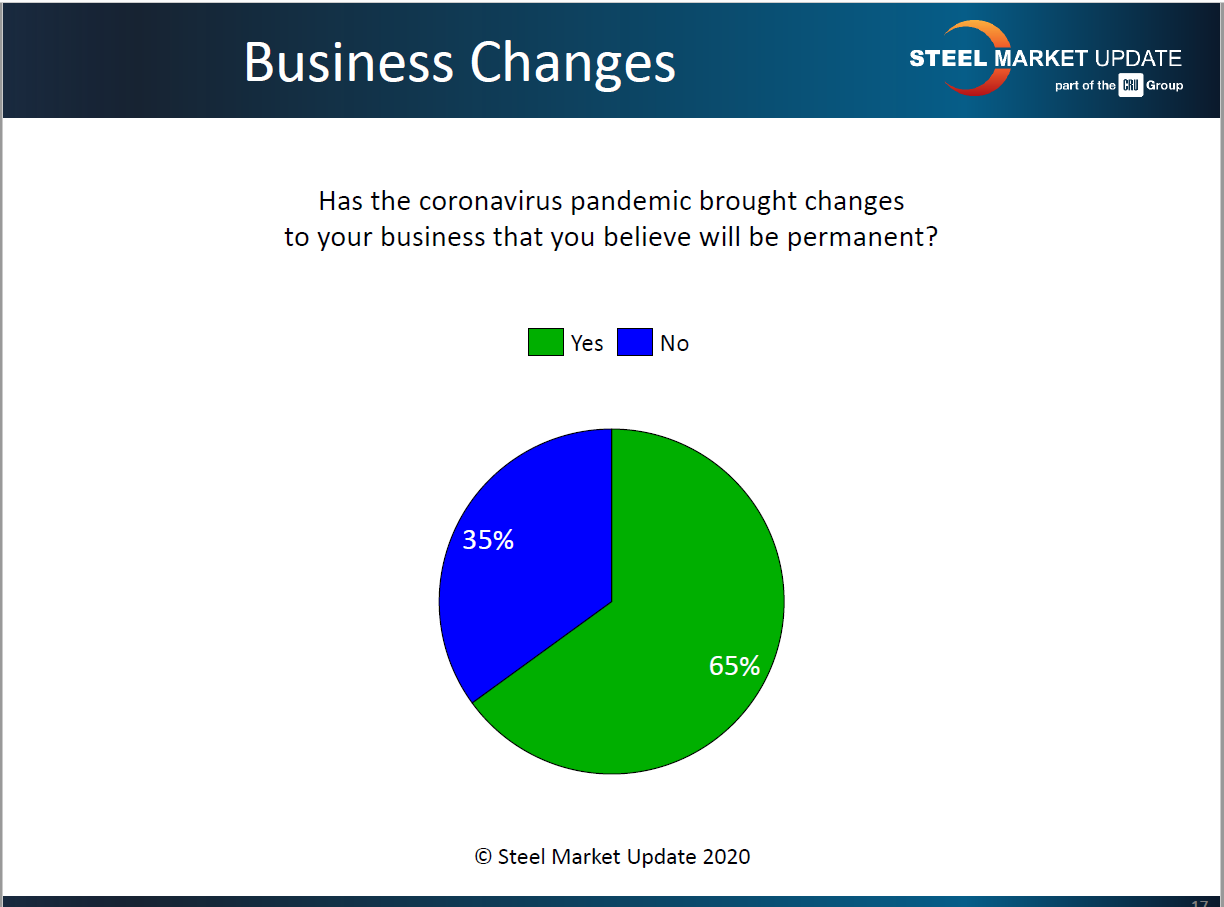

SMU Market Trends: Will Virus Change Business Permanently?

Written by Tim Triplett

Two out of three steel buyers polled by Steel Market Update believe the coronavirus has permanently changed the way they do business. Sixty-five percent of the respondents to SMU’s questionnaire last week expect less travel and more working from home to become common practice, among other changes.

Following are some of their comments:

“There will be more emphasis on social distancing, personal hygiene, staggering workforce and management’s acceptance of telecommuting when possible.”

“There will be more emphasis on social distancing, personal hygiene, staggering workforce and management’s acceptance of telecommuting when possible.”

“Awareness of this virus will continue to keep us all at a social distance.”

“We’ve learned that most folks and functions can work from home. Some cannot. We may not need as many permanent offices as before.”

“We will have some back office staff working from home and expect travel budgets to be curtailed.”

“There will be less import interest due to future risk. Trade cases like Section 232 are still restricting imports. We could see some permanent shift to more domestic supply.”

“Travel will remain restricted. Working from home will become more normal. Credit insurance companies will continue to be conservative, and there will be a stricter focus on cash.”

“Reduced travel and more stay-at-home office personnel. Fewer customers will be making larger, longer-term commitments.”

“I see a permanent reduction in workforce.”

“Remote working may become the norm.”