Market Segment

July 19, 2020

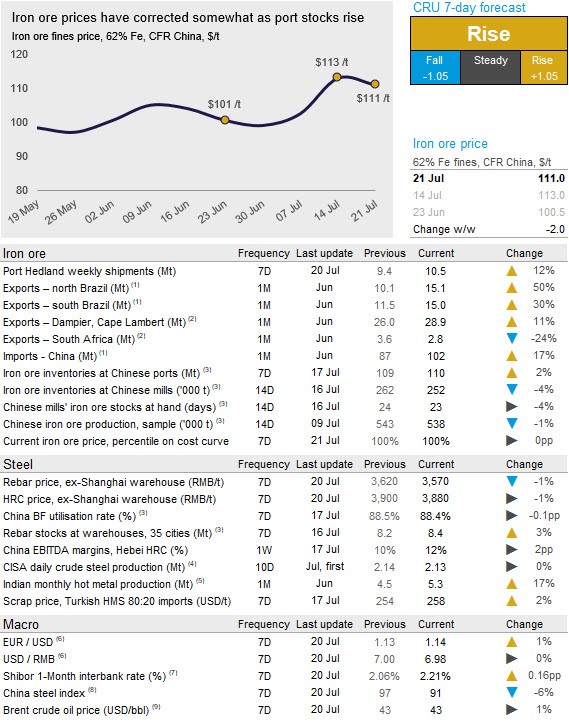

CRU: Iron Ore Prices Drop on Rising Port Stocks

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Iron Ore Market Outlook

Iron ore prices fell by $2 /dmt in the past week as port stocks continued to rise on high arrivals from Australia, while steel production in China declined slightly. On Tuesday, July 21, CRU has assessed the 62% Fe fines price at $111.0 /dmt.

Last week, Chinese steel output fell due to high-cost EAF mills cutting production and stricter BF operating restrictions in Tangshan, Hebei province. However, persistent demand weakness weighed on steel prices that fell by RMB20–50 /t w/w. In addition, market sentiment turned bearish after the stock market pulled back with expectations that the monetary ease would come to an end in H2 as good economic results in H1 indicated less necessity of government’s stimulus going forward. Meanwhile, the housing market is expected to cool down due to tightened home buying policies in cities including Shenzhen, Guangdong province to prevent housing bubbles bursting.

Although hot metal production dipped, evidenced by slightly lower BF capacity utilization w/w, steelmaking raw materials demand remained robust. Iron ore port outflow held above 3 Mt as steelmakers with low mill inventories kept taking iron ore to maintain operations. Having said that, port inventories continued to build up and stood above 110 Mt again for the first time since mid-May. Meanwhile, port congestions formed a long queue with 160 vessels waiting for offloading ore. This was in part due to a reported Covid-19 infection case of a ship crew at Lianyungang in Jiangsu province that slowed the unloading process. Also, poor weather conditions resulted in a slowdown in offloading ore and heavy floods in some central provinces including Hubei, Jiangxi and Anhui. Because of lower lump premia and some sinter operating restrictions in Tangshan, lump rate picked up slightly, but steelmakers have not considered to further lift lump rate. They said lump was still not economical compared with fines, in particular after screening.

On the seaborne market, Australian shipments have remained at a high level with Port Hedland registering 10.5 Mt of exports in the past week. However, shipments from southern Brazil have struggled in the past week and some market participants have mentioned a shortage of Capesize vessels impacting exports. With China’s enormous vessel queue at ports, it is expected that 5-10 percent of the global Capesize capacity is stuck at ports in China. Exports from northern Brazil, which primarily is carried out with VLOCs, remained at a high level in the past week.

In the coming week, we see further support to iron ore prices. Mill inventories have declined further while high steel margins will incentivize steelmakers to maintain production and keep buying high volumes of iron ore.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com