Prices

July 16, 2020

Hot Rolled Futures: Hot Lazy Summer

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

Declining HR spot steepens the HR futures curve even as it shifts lower, but the light is just around the corner.

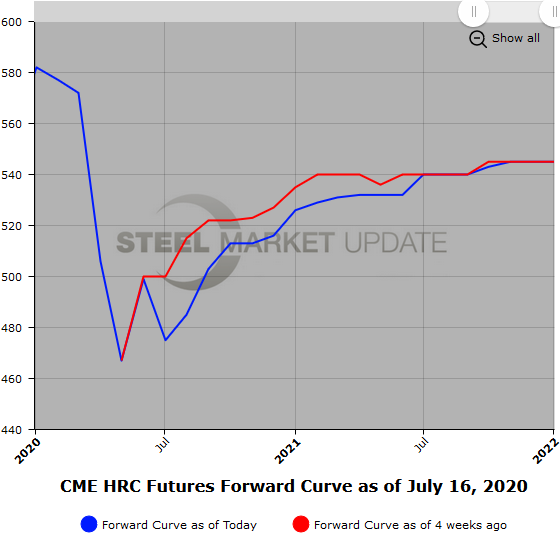

HR futures markets have seen a drop-off in activity while participants take a wait-and-see approach to putting on new HR futures hedges due to the HR spot price trending lower over the last month after peaking at $510/ST in mid June. The current HR spot hovers around $471/ST. The softer than expected demand and concern this will continue has shifted sentiment and left the HR futures curve lower and a bit steeper than just two weeks back. The declining prices in the nearby futures months have led to some profit-taking by market shorts and a thinning of potential selling interests. Both of which have also led to lower trading volumes. The end of July should bring some more clarity for manufacturing businesses as the Fed unemployment subsidy will sunset, which could lead to more consistent business operation as employment returns to more normal conditions. Futures pricing in 1H’21 reflects improving price expectations with the latest values near $530/ST.

The current HR futures curve out 12 months is about a $54/ST contango (Jul’20 $476/ST, Jun’21 $530/ST), with the nearby month prices having declined the most. Q3’20 and Q4’20 HR futures have dropped about $19/ST from the end of June versus Q1’21 and Q2’21 having dropped about $7/ST each since the end of June. Some of this price weakness can be attributed to the steep monthly decline in the BUS futures settlement for July, which was down by over $40/GT ($278/GT).

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

The early chatter around BUS suggests continued weakness as folks look for an additional $20/GT decline. Last month’s BUS price decline left a few folks surprised. Continued uncertainty surrounding business demand due to Covid-19 and the still low 56 percent capacity utilization rates being quoted for HR production could support the view. However, robust export prices for 80/20 partly due to a weak U.S. dollar could help buoy SHR and BUS prices in the coming month. We have seen a pickup in market inquiries for the BUS. Nearby BUS futures are trading just shy of $280/GT with about a $20-30 contango out to January 2021.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. To use its interactive features, view the graph on our website by clicking here.