Plate

July 13, 2020

Regional Flat Rolled and Plate Imports Through May 2020

Written by Peter Wright

Steel Market Update presents a comprehensive series of import reports ranging from the first look at Commerce license data to a detailed look at volume by district of entry and source nation. This report is designed to plug the gap between the two.

![]()

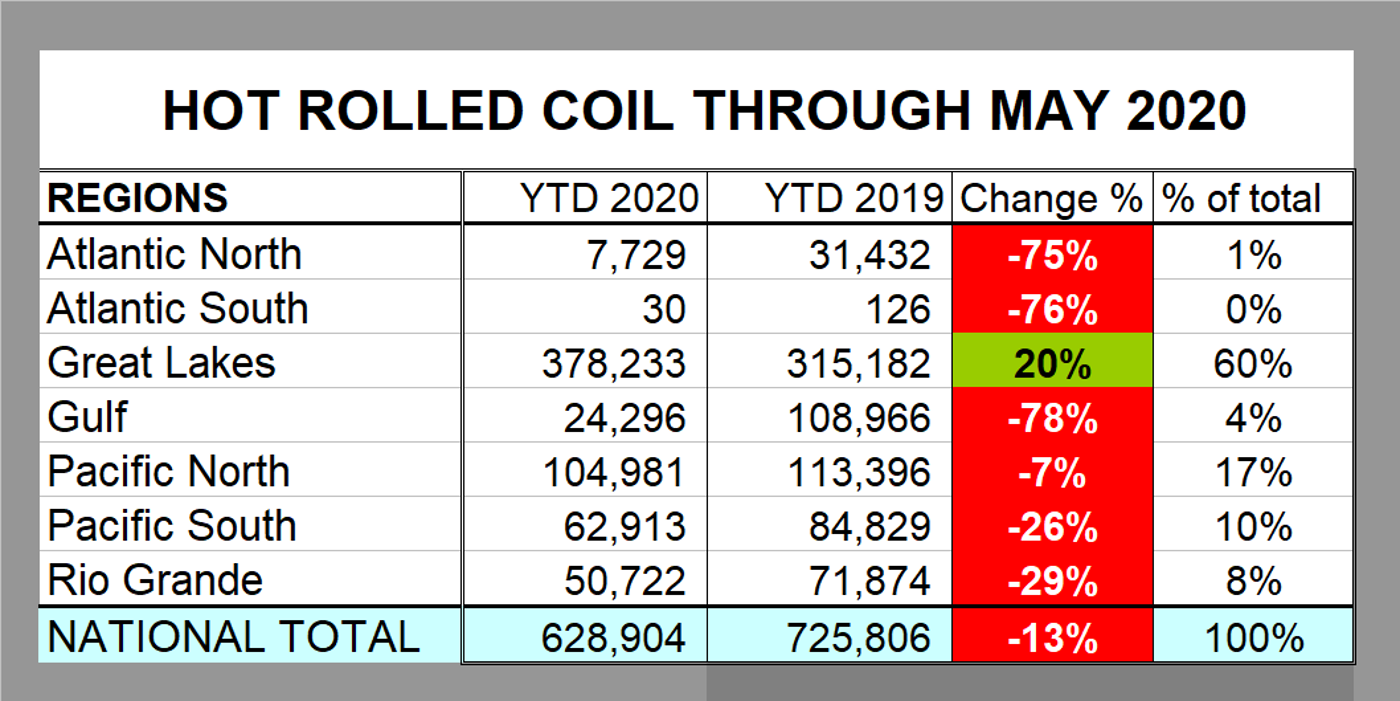

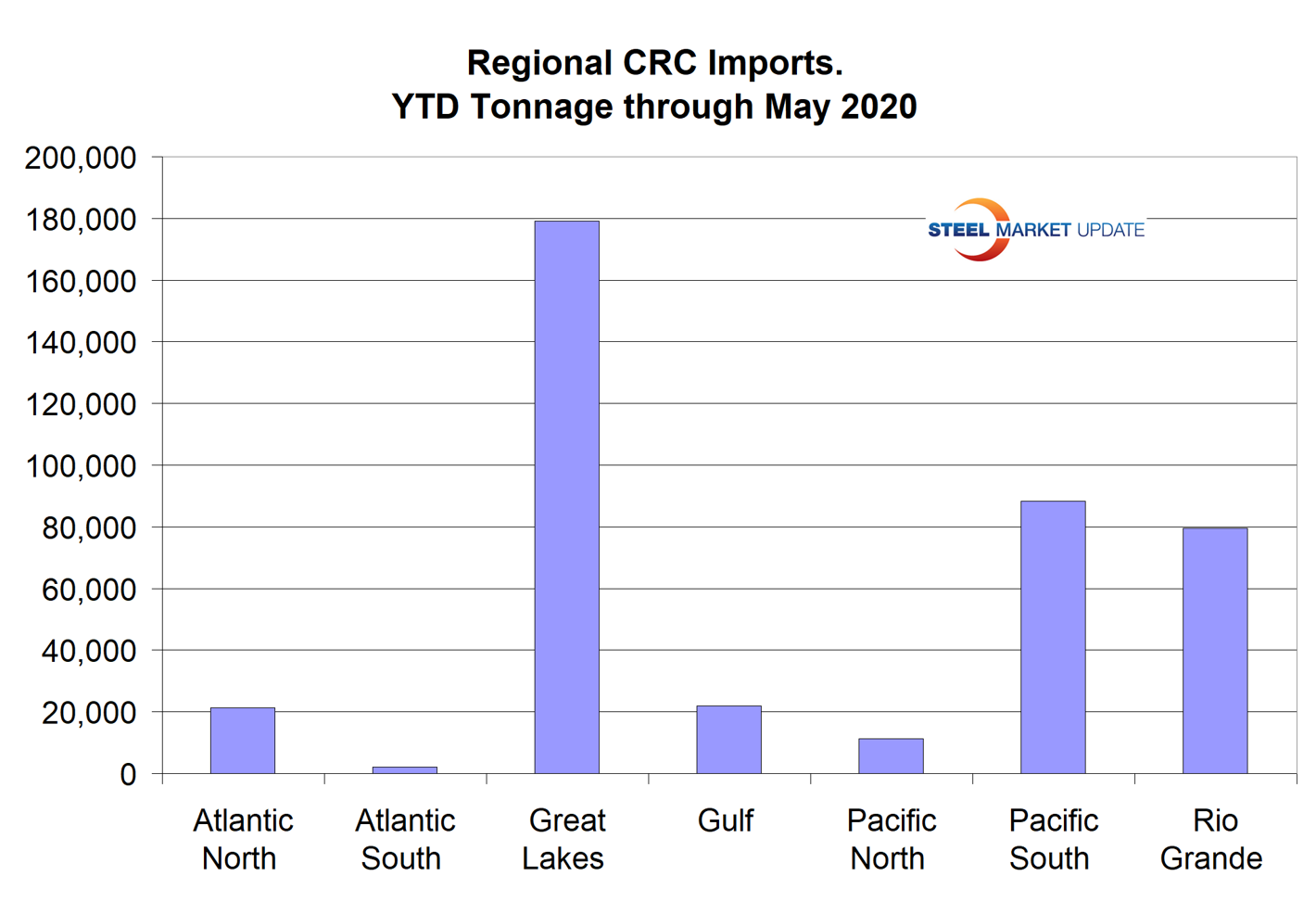

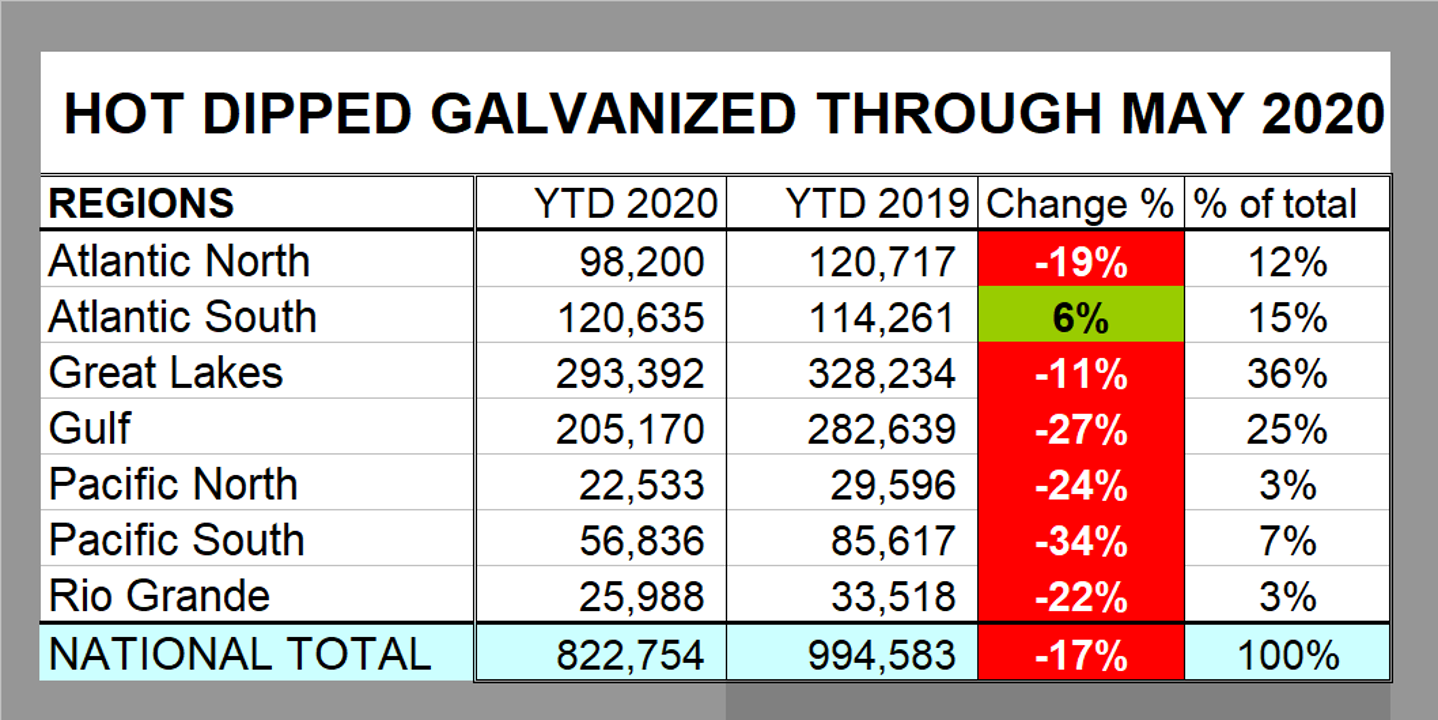

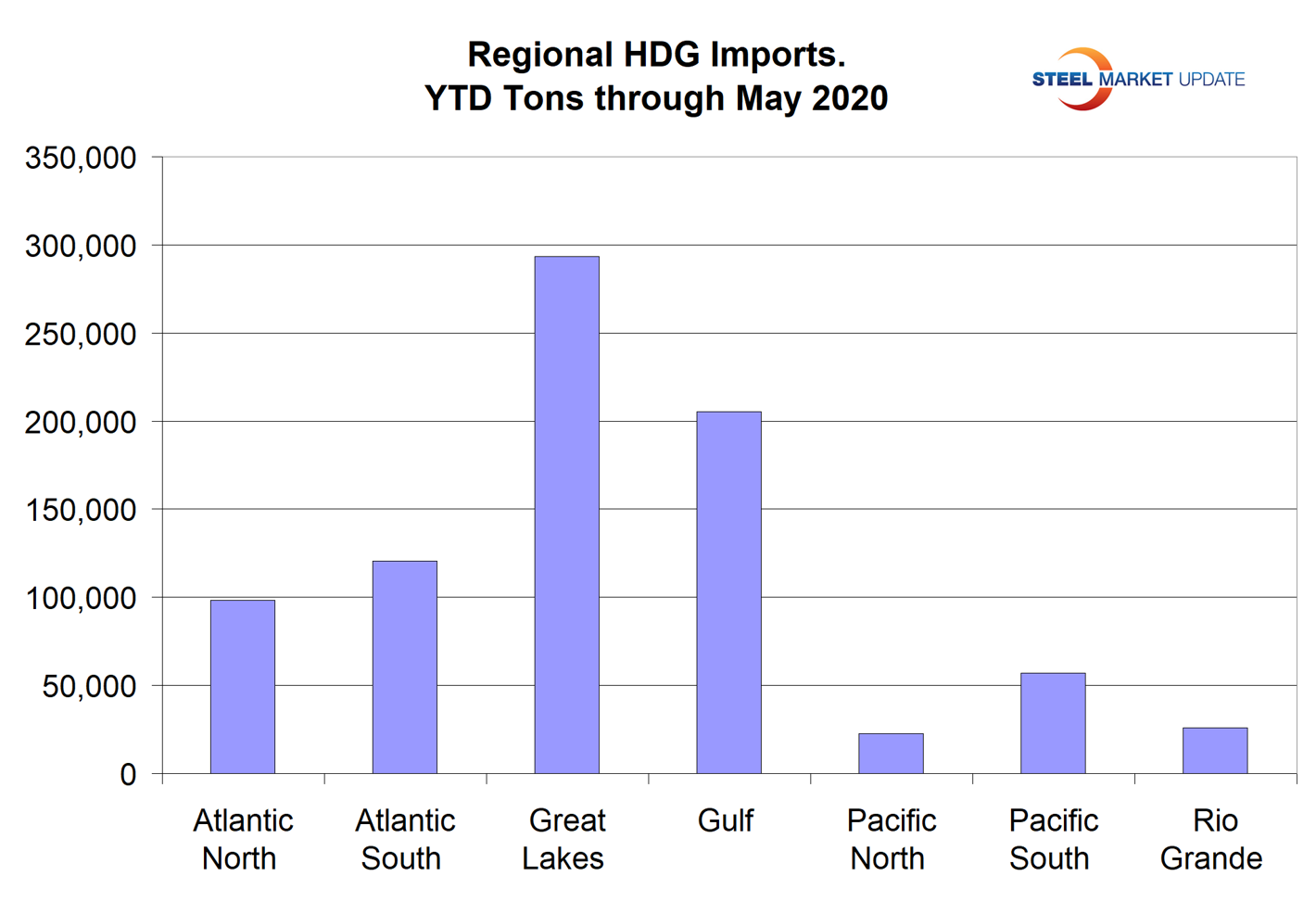

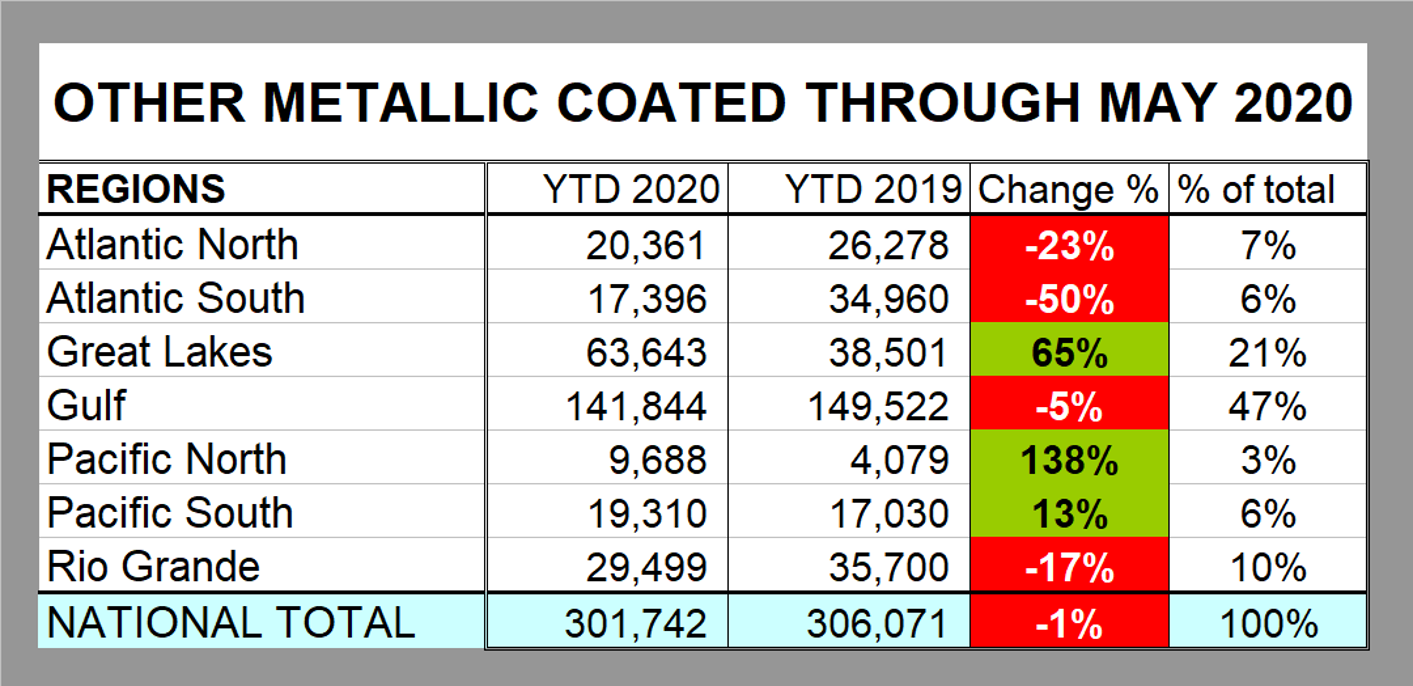

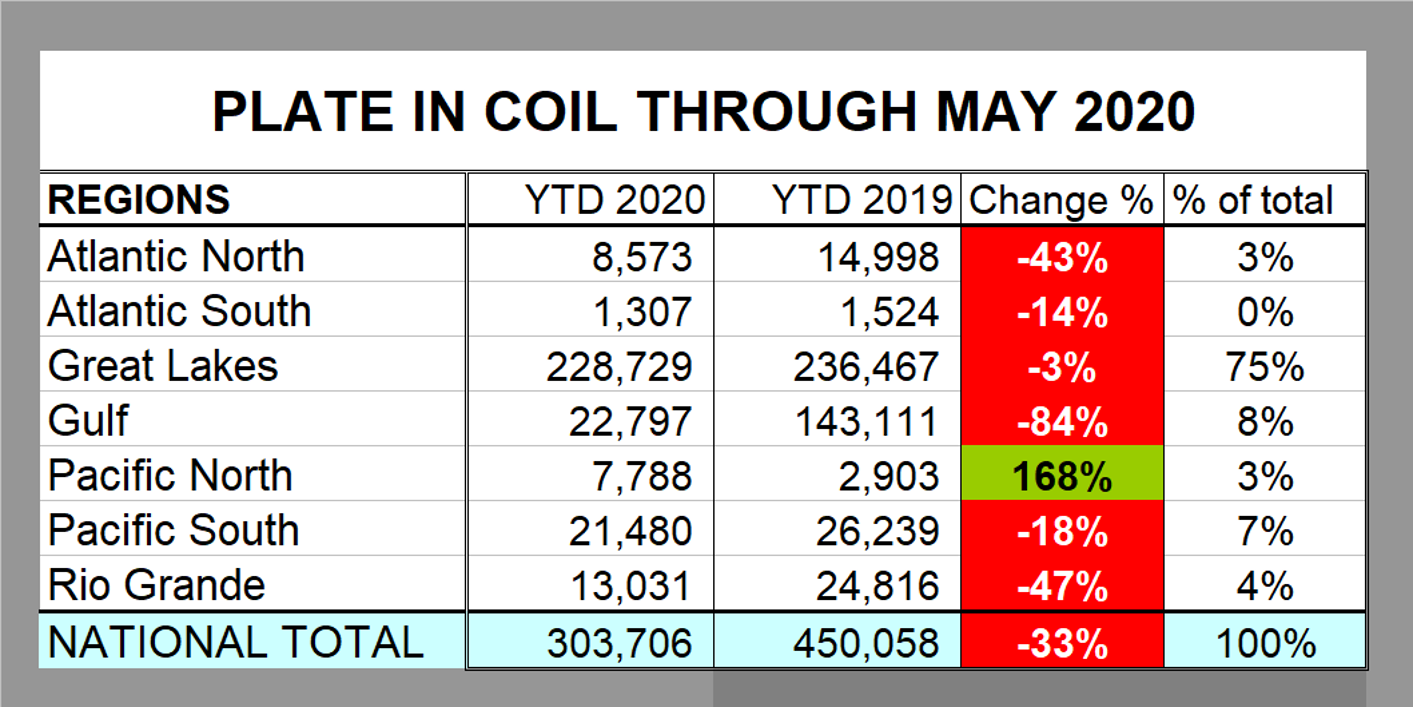

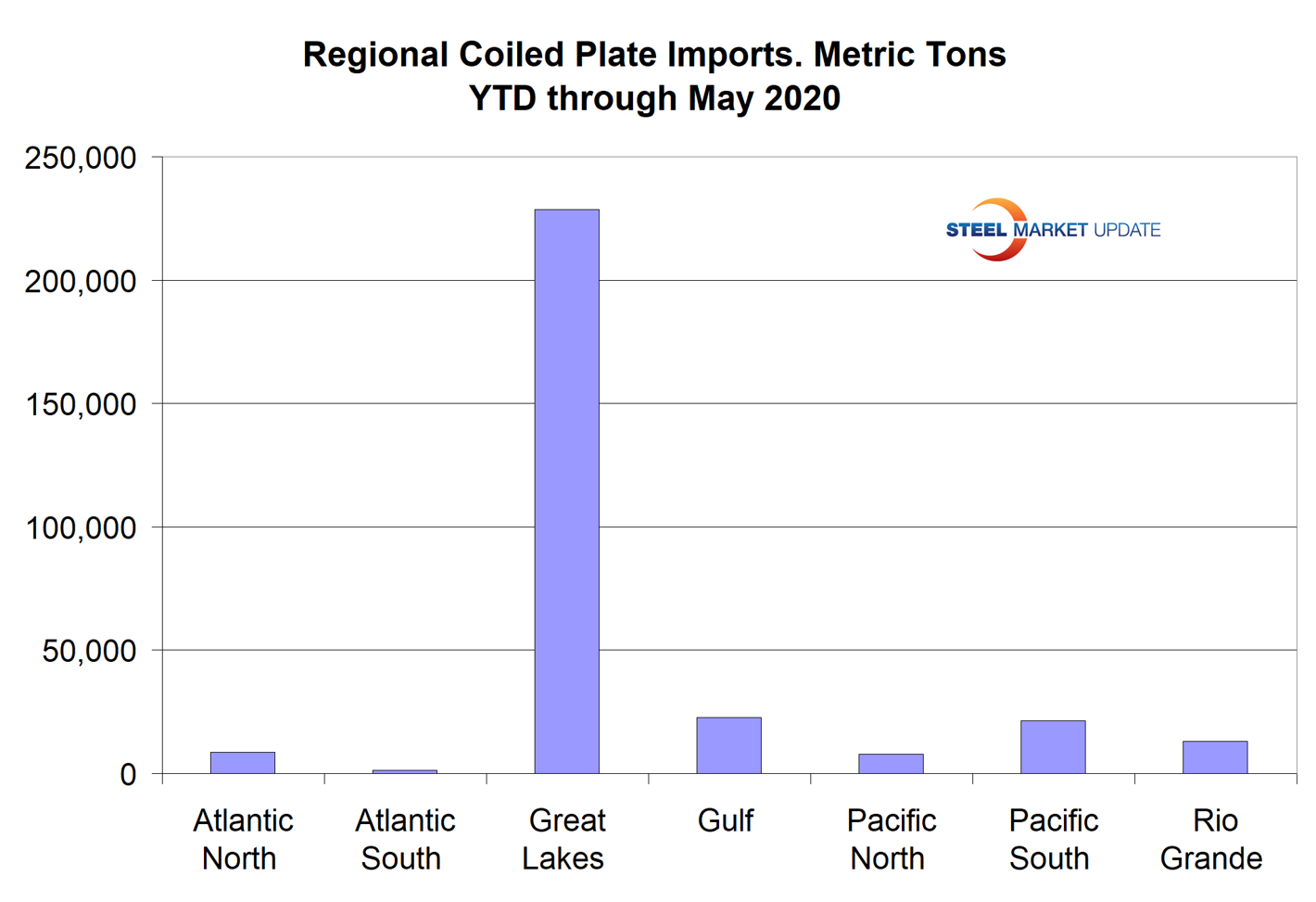

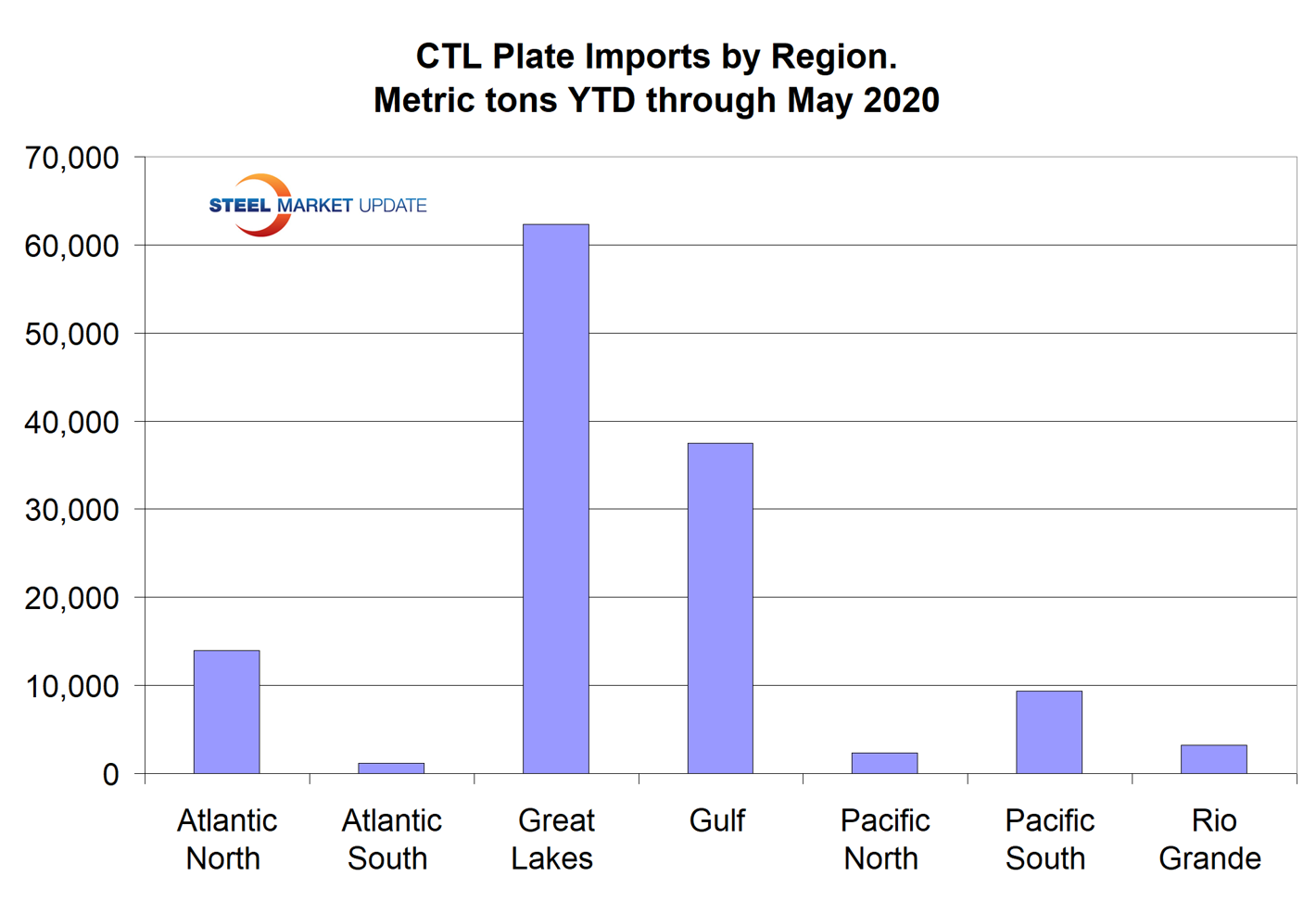

National level import reports do a good job of measuring the overall market pressure caused by imports of individual products. The downside is that there are large regional differences. This report breaks the total year-to-date import tonnage of six flat rolled products into seven regions and shows the growth or contraction for each product and region. There is a summary table for each product group and a bar chart showing volume by region for the first five months of 2020. These are reference documents with no specific comments.

The charts tell the story, but to cite an example, the national tonnage of cold rolled coil was down by 23 percent in May, but the Great Lakes, which has the highest regional volume of imports, was up by 33 percent. These charts have been developed as a guide for buyers and sellers to give them a broader understanding of what’s going on in their own back yard. This report will be produced every other month and alternate with the imports by district and source report. This month, we are reporting regional imports through May.

Regions are compiled from the following districts:

Atlantic North: Baltimore, Boston, New York, Ogdensburg, Philadelphia, Portland ME, St. Albans and Washington, DC.

Atlantic South: Charleston, Charlotte, Miami, Norfolk and Savannah.

Great Lakes: Buffalo, Chicago, Cleveland, Detroit, Duluth, Great Falls, Milwaukee, Minneapolis and Pembina.

Gulf: Houston, New Orleans, Mobile, San Juan, St. Louis and Tampa.

Pacific North: Anchorage, Columbia Snake, San Francisco and Seattle.

Pacific South: Los Angeles and San Diego.

Rio Grande Valley: Laredo and El Paso.