Market Data

July 13, 2020

CRU: FX in 2020—RMB Stable, Real and Rouble to Strengthen

Written by Jumana Saleheen

By CRU Chief Economist Jumana Saleheen, from the Steel Sheet Products Market Outlook

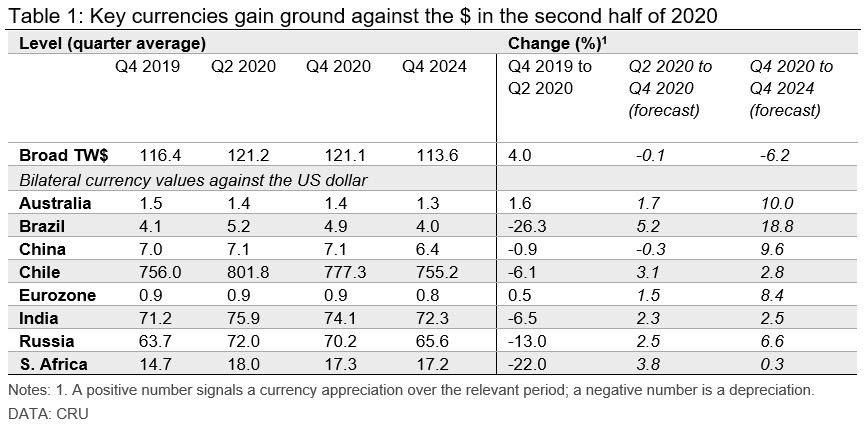

There is widespread agreement that the dollar is overvalued by around 10 percent. CRU expects the trade weighted dollar (TW$) to remain overvalued and broadly stable for the rest of 2020, as pandemic uncertainty continues to support the dollar as a “safe-haven” currency. The stability of the TW$, however, hides important changes in bilateral currencies: the RMB is forecast to remain stable for the rest of the year while the Russian rouble and Brazilian real gain 3 percent and 5 percent, respectively, against the dollar. We expect the TW$ to fall materially between 2021 and 2024, returning it to fair value as pandemic uncertainty fades and fundamental forces reassert themselves.

TW$ Surges to New Highs Spurred by a Rush to Safe Assets

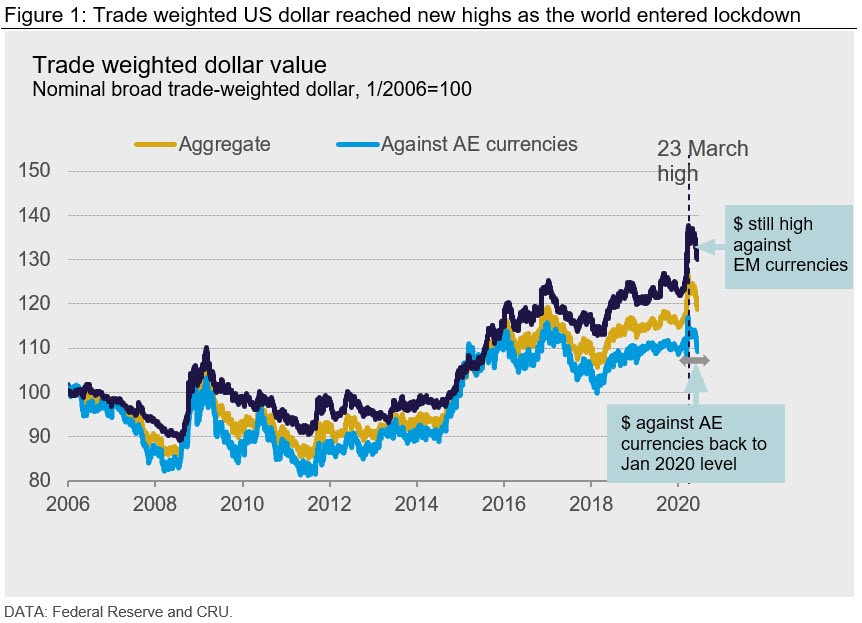

Prior to Covid-19, there was widespread agreement that the TW$ was overvalued relative to fundamentals by about ~10 percent. Since then the dollar has strengthened further, such that TW$ reached new highs on March 23 (Figure 1). Some of that strength has unwound. Commodity market participants may be considering where next for the dollar, given its strong link to commodity prices. This insight sets out CRU’s view on three major commodity currencies—the RMB, the real and the rouble.

This strength in the dollar can be explained by heightened pandemic uncertainty that led investors to rush to hold safe assets, including cash and dollar assets. Fundamental factors (interest rate and growth rate differentials) have played a relatively smaller role, as Covid-19 has led growth and interest rates to be revised down everywhere with a large margin of uncertainty. As governments responded with guarantees of support, and lockdowns eased, investors felt more confident to move funds back into other currencies. This has allowed the TW$ to come off its late March highs. The dollar is now back to the same level it was trading at against advanced economy currencies before the pandemic. Against EM currencies some adjustment has been made, but it has not unwound fully.

One Story Does Not Fit All Currencies

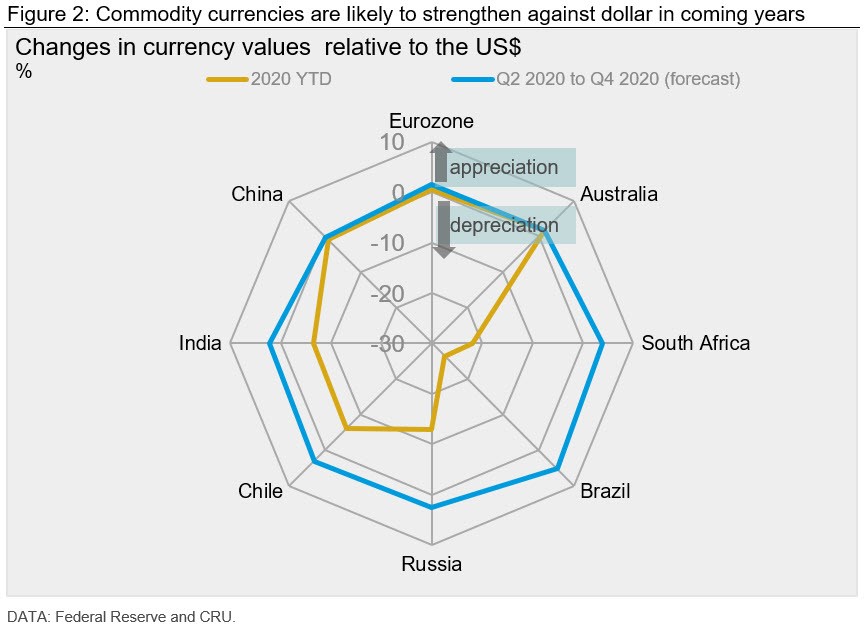

For the rest of 2020, we expect the TW$ to remain broadly stable around its current values. But that stability hides expected moves against other currencies. These are highlighted in Figure 2 and Table 1.

The yellow line in Figure 2 shows how major commodity currencies have moved against the dollar so far this year. Most currencies have depreciated against the dollar (negative numbers in column 6 of Table 1). Brazil, South Africa, and Mexico have seen their currencies fall by double digits against the dollar. In contrast, the RMB, euro and the Australian dollar have appreciated slightly.

Looking forward to the remainder of 2020, we expect most currencies shown to gain in value against the dollar, partially reversing some of the falls earlier in the year (positive numbers in column 7 of Table 1). The exception is the RMB where the fall is small enough to be classified as stable.

Between 2021 and 2024, we expect further appreciation of most currencies against the dollar, over that period. The largest long-run adjustment of the dollar is expected against Brazil, China, Europe and Australia. This follows as pandemic uncertainty recedes and fundamental forces (interest and growth rate differentials) reassert themselves (Table 1).

Brazil Suffers a Bad Case of Covid-19

Brazil currently has the second largest death toll from Covid-19. With cases still rising, markets are questioning whether the Bolsonaro-led government can bring the virus under control. Covid-19 is one reason why investors have pulled funds out of Brazil, leading the real to fall by 26 percent so far this year (Table 1).

The latest macro data has led us to forecast a deep recession in Brazil in 2020, larger than in the USA. In response, we expect the Central Bank to drop interest rates and possibly use their newly granted QE powers. Markets are fearful of QE in Brazil given the lack of central bank independence and high levels of government debt (85 percent of GDP in 2018).

We forecast a modest recovery in the real (5 percent appreciation) in the second half of 2020. This would allow the real to return to just below 5 real per dollar, consistent with market expectations. That is our base case forecast, which assumes the virus is contained in 2020. In such a scenario, investor risk appetite will return in 2020, allowing funds to flow back to most EMs, including Brazil.

Between 2021 and 2024, with the virus behind us, we expect Brazil’s fundamentals (economic growth and higher interest rates) to entice investors back. That would allow the currency to strengthen to its pre-Covid-19 value of 4 real per dollar.

Russian Roulette Hurts the Rouble

Russia has been playing at the high stakes table. On March 8, the world’s third largest oil producer decided to go to war with Saudi Arabia: it refused to abide by OPEC recommended production cuts. In this war the market was flooded with additional supply, at a time when demand was plummeting as the world started to enter lockdown. The Brent crude price nosedived to below $20bbl in April, lowering Russian exports and industrial output.

In May and June, Russia hit headlines again. It had ended the oil price war, which was good. Russia also recorded the third highest number of Covid-19 cases, behind the USA and Brazil. These developments have led us to forecast a 5 percent contraction in the Russian economy in 2020. Despite this, the ending of lockdowns will allow oil demand to increase further. This will support a modest appreciation of the rouble (2.5 percent) in the second half of the year.

Beyond 2021, Russia will return to modest rates of growth, which will support the rouble to appreciate further by 6 percent, but it will not return to its level in Q4 2019. More significant appreciation of the rouble is constrained by the same factors that impede Russia from achieving higher growth rates: low private investment, stagnant productivity growth and insufficient diversification away from extractive industries.

RMB Shows Remarkable Stability in 2020

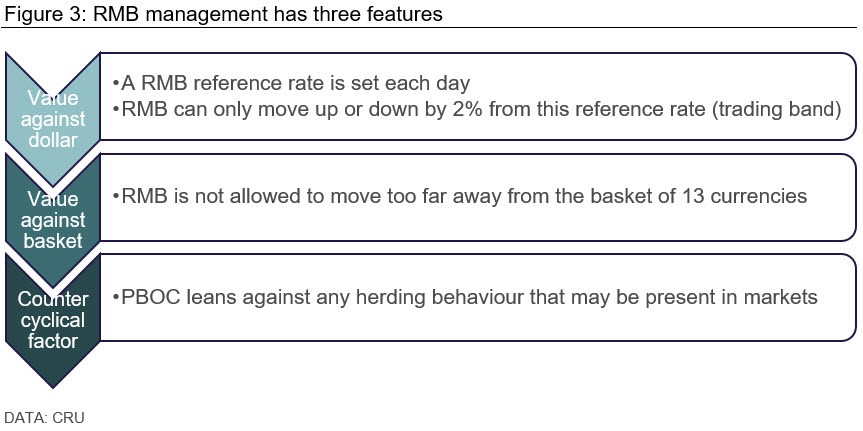

The RMB has been among one of the most stable currencies in the world since mid-2016. It has fallen by less than 1 percent against the dollar this year. The RMB’s stability is partly by design since it is a managed currency rather than a free-floating currency. It is also partly a result of how the basket of currencies has moved recently. This regime operates under three constraints described in Figure 3.

For the rest of 2020 we expect RMB stability to ensue. The RMB is expected to fall by just 0.3 percent by the end of this year (Table 1). Beyond that, we expect to see some mild appreciation of the RMB. Monetary policy in China is likely to remain tighter than the USA. We also judge that China’s competitiveness (productivity growth minus wage growth) relative to the USA will increase somewhat. These two fundamental factors will support the RMB at least over the next five years.

Sentiment is a Powerful Driver of Currencies

The greenback is an important influence in commodity markets. Looking ahead CRU expects the TW$ to remain overvalued and broadly stable through 2020. Within that, the RMB is expected to remain stable against the dollar, while the real and rouble will reclaim some of the lost ground earlier this year. Between 2021 and 2024, we expect the TW$ to fall gradually by around 6 percent.

The potential for the dollar to weaken between 2021 and 2024 suggests that it is likely to be positive news for commodity prices beyond 2020. However, changes in the dollar relate to changes in commodity markets in different ways, and it is only one of many variables that affect prices.

Of course, there is always the risk that the adjustment comes sooner and with a jolt, precipitated by a significant economic or political event. There are also material risks that the dollar stays stronger for longer—for example if there is a second Covid-19 wave or if the economic recovery in the U.S. outpaces the recovery in other parts of the world.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com