Prices

June 23, 2020

CRU: U.S. Zinc Demand on Road to Recovery as Auto Sector Ramps Up

Written by Helen O’Cleary

By CRU Senior Analyst Helen O’Cleary, from CRU’s Zinc Monitor

U.S. industrial production increased by only 1.4 percent in May, well short of expectations, but market sentiment is generally positive as the Fed has confirmed it will do “whatever it takes for as long as it takes” to help get the economy back on track and the Trump administration is again considering a $1 trillion infrastructure stimulus package.

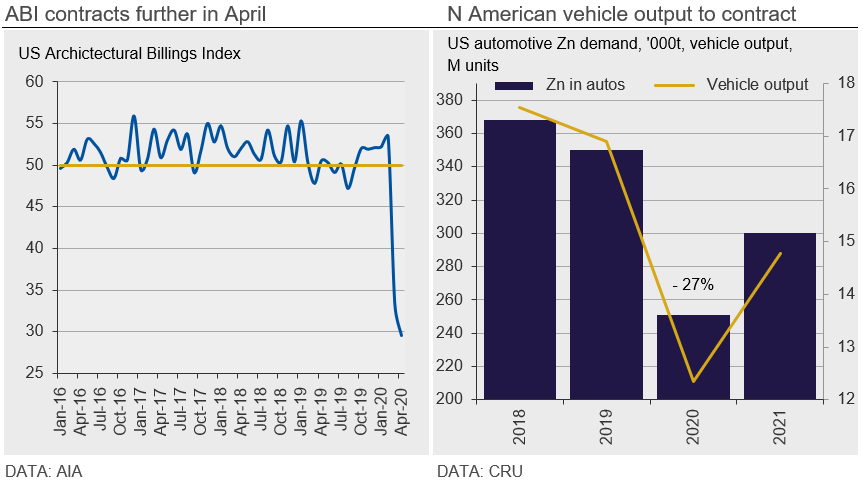

Crucially for zinc demand, the U.S. construction sector has remained relatively firm, particularly in states that have been less impacted by Covid-19 disruption and, although U.S. housing starts plummeted in April and came in under expectations in May, the home refurbishment market has been buoyant. However, as construction is a lagging indicator, the economic impact of Covid-19 will not be fully felt in the sector for some months, as signaled by the forward-looking Architectural Billings Index, which plunged further in April.

The North American auto sector is continuing to ramp up, with 95 percent of manufacturers now operating, according to LMC Automotive (LMCA), and y/y sales are up from -46 percent in April to -29 percent in May. But even though U.S. consumer sentiment readings for June surprised to the upside, we expect auto output to contract by 27 percent this year, with a return to normal levels not expected until 2022. Although there is a risk that supply may not be able to keep up with demand in the short-term, LMCA is concerned that a flood of rental cars into the second-hand market will act as a drag on new car sales. CRU estimates that a 27 percent contraction in North American vehicle output in 2020 would equate to the loss of almost 90 kt (~ 6.5 percent) of the region’s refined zinc demand.

North American steel sheet output is slowly beginning to recover, but high inventory levels throughout the supply chain mean that increases so far have been limited. Our Steel Sheet team reported a drop in U.S. HDG coil prices due to some mills lowering the zinc extra they charge from $68/s.ton to $60/s.ton. North American galvanized sheet output remained flat y/y in Q1, with an increase in U.S. output offsetting declines in Mexico and Canada, but Q2 output is forecast to contract by more than 40 percent y/y.

We have revised down slightly our 2020 refined zinc demand forecast for North America since last month’s Monitor and now expect it to contract by 6.7 percent y/y, with the U.S. limiting its losses to 6.5 percent and Mexico and Canada faring slightly worse. This is compared to our forecast of a marginal decline pre-Covid-19.

North American Refined Output Expected to Fall 8 Percent in H1

While we understand that primary smelters in Canada and the U.S. continue to operate normally, we hear that AZR’s Mooresboro smelter may be having some quality issues with its ramp up. As we mentioned last month, Mexico’s refined output fell by 8 percent y/y in Q1 and we are now expecting its H1 output to fall by 20 percent to 154 kt, down from 192 kt in 2019 H1. We estimate that smelter output in North America as a whole could fall by 8 percent y/y, to 537 kt in H1 (pre-disruption), a loss of 45 kt.

At the start of this year, we expected the North American market to register a modest refined surplus in 2020, with Peñoles’ Torreon operating at its full, expanded capacity and AZR’s Mooresboro ramping up, but the slump in demand on the back of Covid-19 disruption means that a larger surplus will emerge.

U.S. Premia Under Pressure as LME Stocks Increase

We are already seeing higher refined exports to the U.S., most notably from South Korea, which shipped 40 kt in January-April. This has yet to show up fully in U.S. import statistics, but U.S. ports data show that the majority of South Korean metal imports to date have arrived in Baltimore, with the balance arriving in Long Beach. U.S. customs data show that imports from Mexico, Peru and Brazil were also up y/y in January-April and we understand that some imported metal has been responsible for the recent increase in LME warehouse stocks. LME warehouse stocks have recently increased from just 4 kt in mid-April to 20.5 kt following inflows into NOLA (12.5 kt) and Baltimore (3.8 kt) so far this month. As U.S. refined metal premia have held up better than in other regions, we still expect to see more exports to the U.S. from other regions in the coming months.

Despite the gradual restarts across most sectors in the U.S., demand has yet to recover to the point where premia are being supported. Now that stock visibility has increased with inflows into NOLA and Baltimore, premia remain under pressure and we are reducing our assessment for this month to 7.00 ¢/lb.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com