Prices

June 18, 2020

Hot Rolled Futures: Uncertainty's Leading to Softer Prices

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

Uncertainty is leading to softer HR prices as optimistic forecasts are met by a slower than expected recovery process. A case of over promising and underdelivering.

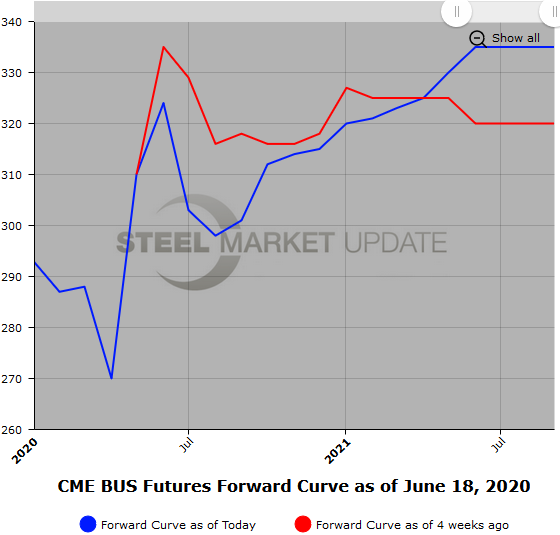

After a spot price pickup early in June, we have seen HR futures prices retrace in the near end of the curve as reality sets in. Jul’20 futures traded at $500/ST today. Progress appears to be lagging expectations as capacity utilization rates remain stubbornly anchored around 50 percent. Recent price declines for physical spot deals as reflected by the indexes and softer than expected lead times have led to broader selling pressure. In addition, a number of integrated mills are starting up select automotive furnaces, which will add to extra capacity concerns.

Since the beginning of the month, the Q3’20 HR futures have declined by about $17/ST and Q4’20 HR futures declined by roughly $6/ST. Calendar 2021 HR futures prices have been more resilient as the Q1’21 and Q2’21 quarters are both flat to slightly higher than at the beginning of the month. The stronger levels suggest the market is looking for a pickup after the turn of the year.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

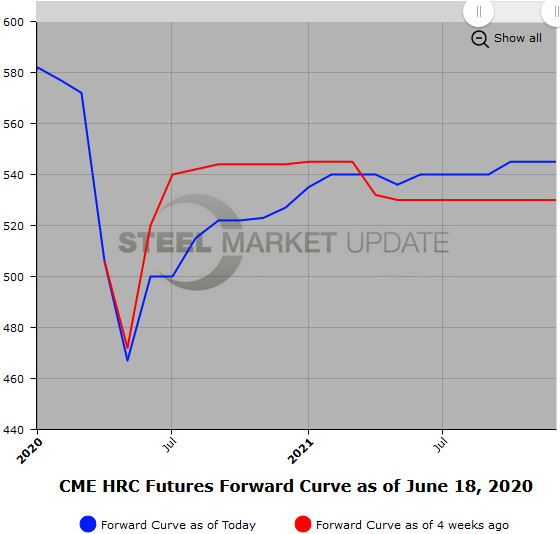

Scrap

Increased selling interest in the BUS futures for the balance of 2020 has led to a softening BUS futures curve after a strong move higher at the beginning of the month. Underwhelming demand for prime scrap, likely due to a slower paced recovery than the market was forecasting, has helped to dampen the supply shortage story. Also, reports of a number of seaborne scrap and pig iron cargoes due for June/July delivery could be leading to early chatter that BUS will likely retrace $10/$20 per GT next month.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. To use its interactive features, view the graph on our website by clicking here.