Market Data

June 14, 2020

SMU Steel Buyers Sentiment: Outlook Continues to Improve

Written by Tim Triplett

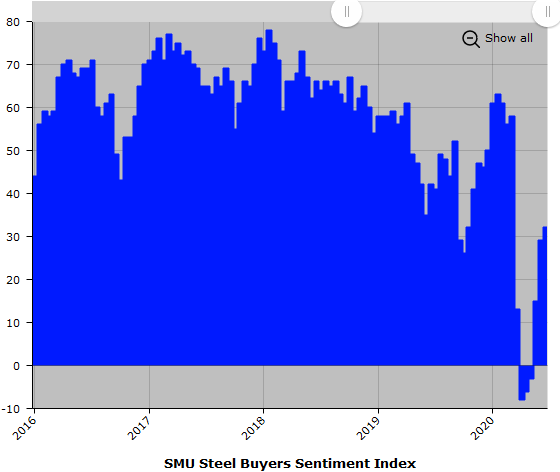

Steel buyers’ attitudes, as measured by Steel Market Update’s Sentiment Indexes, have improved steadily since their low point in the first week of April and are now approaching pre-coronavirus levels once again. Industry executives are clearly feeling more positive about their prospects as the economy begins to normalize.

Current Sentiment has improved by 40 points since April 2 when the index hit -8, the lowest reading since November 2010. The current reading of +32 compares to an average for the year prior to the pandemic of +48.

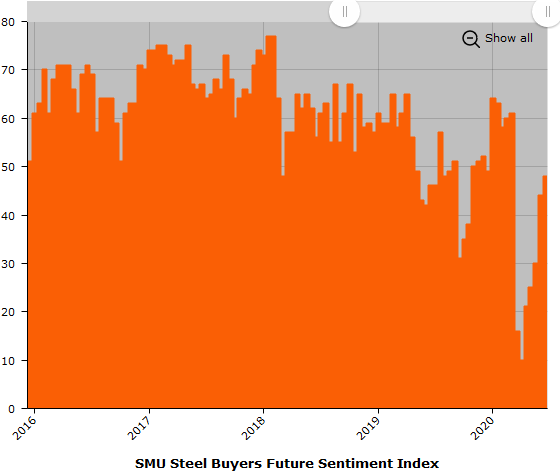

Future Sentiment

Steel Market Update asks steel buyers how they view their company’s chances for success three to six months in the future, as well as their current prospects for success. SMU’s Future Sentiment Index registered +48 this week, up 38 points since early April, and actually slightly above the reading in the same week of 2019.

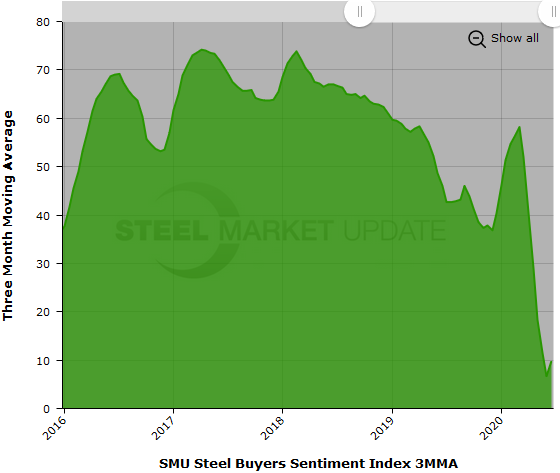

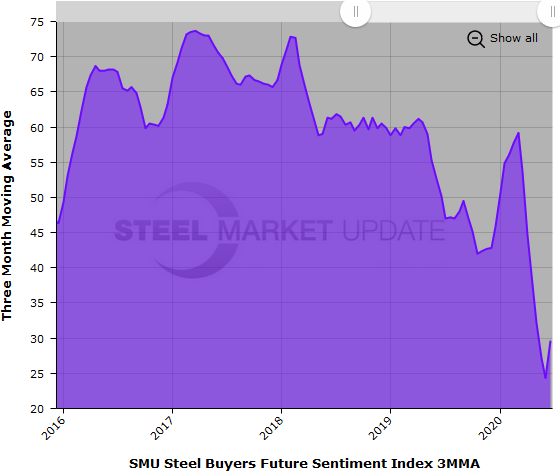

Three-Month Moving Averages

Results from SMU’s market trends questionnaire are posted as both single data points and as three-month moving averages (3MMAs) to smooth out the trend. Both Current and Future Sentiment measured as 3MMAs have begun trending upward. The Current Sentiment 3MMA increased to +9.83 from +6.67 in late May. The Future Sentiment 3MMA rose to +29.67 from +24.33 two weeks ago.

The chart below shows that the annual rate of change in the three-month moving averages for both Current and Future Sentiment is now trending upwards.

What Respondents Had to Say

“Nothing has really changed fundamentally. Unfair trade restrictions and flat to weak demand all make business very challenging.”

“Uncertain 60-90 days out on what demand will look like.”

“Depends on new order intake. Right now, we are at 20 percent of capacity, and at that rate we will only work three shifts per week.”

“Business needs to pick up.”

“The June forecast looks promising.”

“The demand for product in our industry is as high as it has ever been due to COVID-19.”

“Three weeks ago, I was not very optimistic. In the past three weeks orders have skyrocketed and we are way behind and running overtime.”

“We feel there is significant pent-up demand in construction, especially for medium-sized commercial jobs.”

“Hopefully, the demand will continue into next year.”

“Unless something fundamentally changes, we see more of the same. Free and fair trade is needed for U.S. manufacturing to flourish and survive. The U.S. cannot produce all the grades, sizes and specifications required and needs imports to keep mills competitive and in check.”

“Margins are very tight and demand fair. Lots of spot buying. No one is committing to any big tons right now.”

“It all depends on how the demand comes back after this summer.”

“We’re hearing that Q3 and Q4 will be much improved.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.