Prices

June 11, 2020

Hot Rolled Futures: Mixed Messages in the Ferrous Complex

Written by Tim Stevenson

SMU contributor Tim Stevenson is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Tim’s previous role, he was a Director at Cargill Risk Management, and prior to that led the derivative trading efforts within the North American Cargill Metals business. You can learn more about Metal Edge at www.metaledgepartners.com. Tim can be reached at Tim@metaledgepartners.com for queries/comments/questions.

We’ve seen a small pullback in the forward HRC curve over the past week, with most of the weakness out in 2021. We’d regard this move as mostly “noise” and not indicative of any major change in opinions. While not reflected in the chart below, there was some renewed selling pressure today that pushed things lower. This may be a result of the hard selloff in the stock market today or traders being concerned with renewed steel price weakness developing.

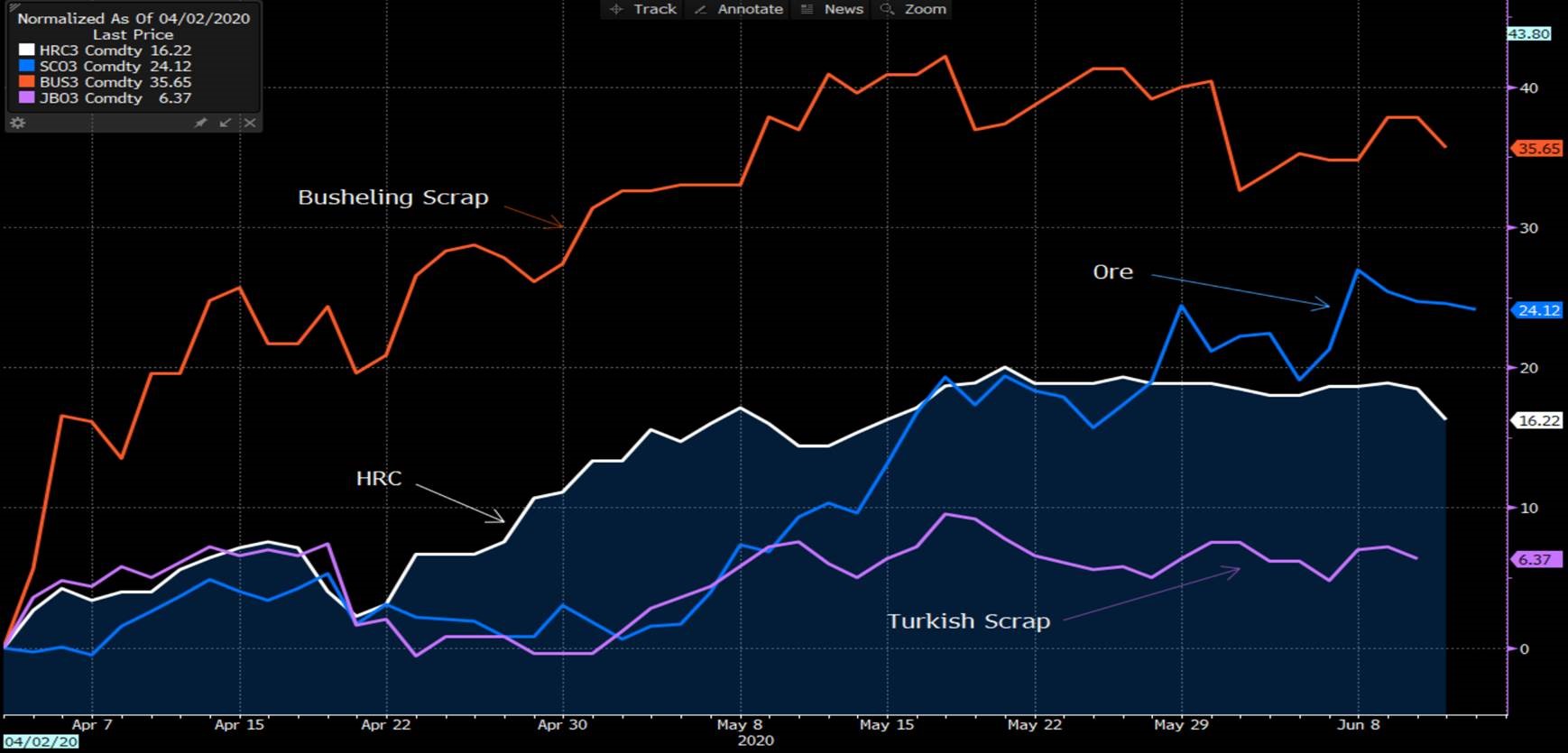

Busheling has had a more interesting week, with that curve moving up $5-15 across the curve. Some of the weakness prior to the last week was driven by fears of auto restarts and more supply of high grade scrap, but apparently fears of more busheling supply have abated, along with some developments in iron ore that were supportive of that raw material. Note the nice move up in the below chart:

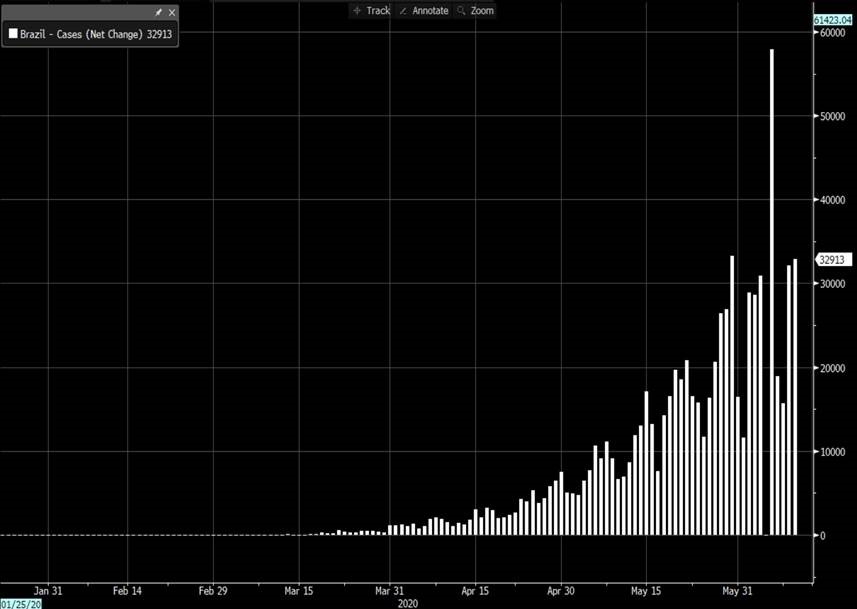

On iron ore, demand continues to be strong in China, and virus cases in Brazil are spiking, causing the temporary closure of one of Vale’s iron ore mines. There were concerns today (Thursday) that additional mines could be forced to close as well, causing a ramp up in ore. New virus cases in Brazil are on the second chart below.

Indeed – not only did spot ore prices rise over the past week, but the entire curve shifted up, signaling that at least some players in the marketplace expect persistent supply issues and strong demand. One investment bank today noted that spot ore could rise to $120/ton before the current tightness subsides.

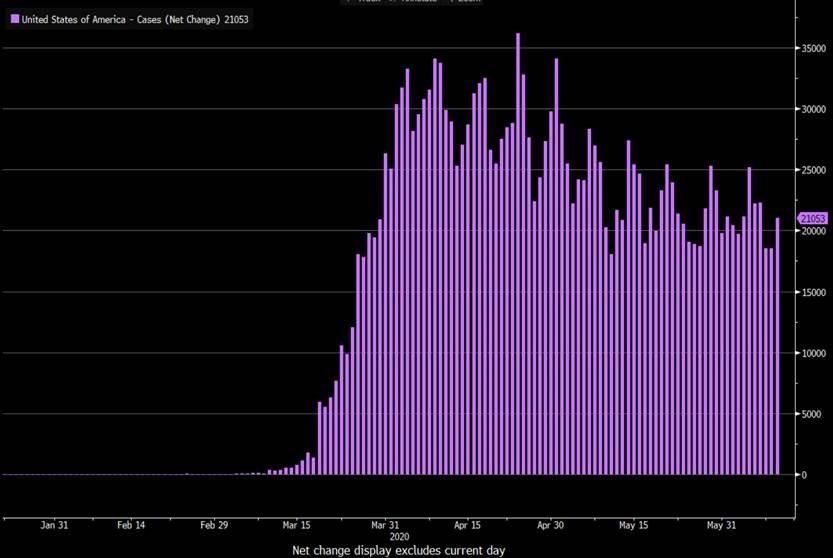

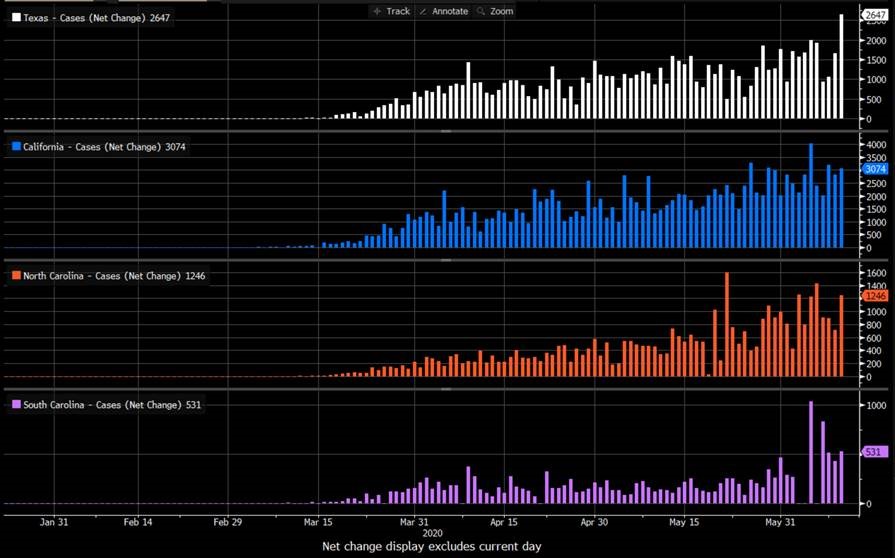

While the U.S. equity market sold off hard today, in part on fears of a “second wave” of virus infections, the actual data has been a bit mixed. Overall, the U.S. has not shown a big spike (first chart below), while Texas, North and South Carolina, and California have seen some recent increases (second chart below). There have also been some articles written about an emerging second wave due to recent civil unrest that has unfortunately gripped some parts of the U.S., resulting in less social distancing. Time will tell.

In an attempt to compare all these trends, we’ve put together a chart of several ferrous commodities. You can see that from early April, busheling scrap has been the clear stand out, followed by ore. We think the reasons for the move in busheling was threefold. First, it overshot to the downside on initial virus fears, with futures diving to the low $200s. Second, the auto shutdowns clearly eliminated a massive amount of supply. Third, ore has been supportive. After all, scrap is really just ore + energy, and with China’s demand for steel and ore being strong, it has pushed ore higher. This should, all else equal, be good for busheling prices. What remains to be seen is whether busheling scrap can remain strong with the auto restarts and purchases of some substitute products easing some of the supply constraints.

As far as volumes go, May HRC futures traded roughly 350,000 tons on the exchange. So far in 2020, volumes have averaged 361,000 tons/month, versus 2019 average volumes of 290,000/month, a rise of 25 percent. It is important to note that in addition to these volumes on the futures exchange, one must add “over the counter” or OTC volumes, which some industry players say are at least as large as what trades on the exchanges. In addition, we believe the launch of the new CME Midwest Domestic Steel Premium contract is an important development. The contract is basically designed to help companies with hot-dipped galvanized (HDG) coil exposure hedge this risk. Basically, someone who wants to “lock in” their HDG price can buy an underlying HRC contract, and then buy the HDG contract to make sure that they can plan for steady costs of the material. Service centers with significant HDG physical exposure can sell both contracts together to hedge their inventory. This week, a large investment bank started making markets in this contract, which is a critical step in getting the contract off the ground. No doubt, volumes will start small, but we felt it was worth highlighting this new tool. We hope everyone remains healthy and safe!

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information