Market Segment

June 9, 2020

CRU: Iron Ore Surges on Vale’s Suspensions

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

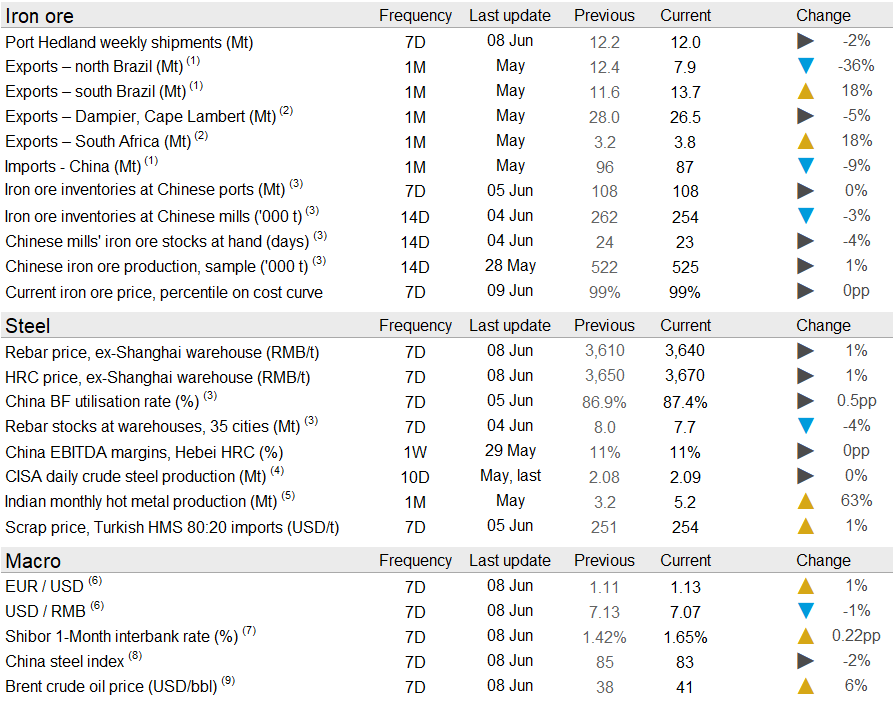

The suspension of iron ore production at Vale’s Itabira Complex resulted in prices surging after the weekend. On Tuesday, June 9, CRU has assessed the 62% Fe fines price at $105.0 /dmt, up $4.5 /dmt w/w.

In China, demand has remained robust as steel prices continue to climb and margins for HRC producers remain steady at just above 10 percent. The high profitability is keeping output elevated, and CRU expects strong steel production ahead of the wet season in southern China, which typically slows down demand from the construction sector. Steel mills in China continue to operate with exceptionally low inventories, and recent data shows mill inventories are declining further while port stocks remain steady at 108 Mt.

Seaborne supply has remained elevated in the past week. Port Hedland shipments are once again above 12 Mt and shipments from Rio Tinto have recovered to high levels following the weather-related issues at end-May. June is the last month of the Australian financial year and it is typically the time when Australian exports peak.

Brazilian trade data shows a recovery of shipments from Minas Gerais (south Brazil) while exports from the north fell below 8 Mt. Just as expected, shipments from S11D were particularly weak due to conveyor belt maintenance taking place at end-April and early-May. The big news in the past week has been the suspension of iron ore production at Vale’s Itabira Complex. CRU estimates that pellet feed makes up ~80 percent of the complex’s total production, which means production of pellets in Tubarão and Oman is likely to be affected. However, our sources in Brazil have stated that they expect production to resume fairly quickly.

In Sweden, LKAB’s Kiruna mine is still operating at a reduced rate after the earthquake at end-May. Production is kept at close to 50 percent capacity while seismic activities are delaying the inspections of the damage. Shipments are not expected to be impacted as the incident happened right before planned maintenance at the processing plants.

In other news, the bridge collapse in Russia is impacting Eurochem’s ability to ship concentrate to the Chinese market. India’s iron ore exports reached an extremely high level in May with ~6 Mt of exports, but CRU is expecting this level to decline in the coming months.

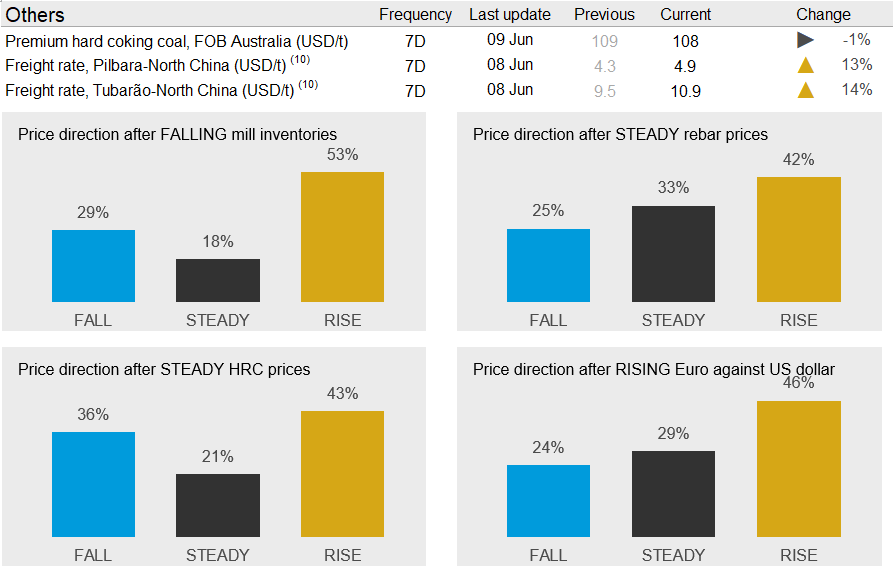

In the coming week, we expect prices to correct somewhat. Although the indicators below point towards a price increase, arrivals in China will rise while steel prices and iron ore futures have started falling, which indicates that we might be due for a price correction.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com