Product

June 4, 2020

HRC & Busheling Futures: Front Months Drifting Lower in Quiet Summer Trading

Written by David Feldstein

Editor’s note: SMU Contributor David Feldstein is president of Rock Trading Advisors. David has over 20 years of financial market trading experience and has been active in the ferrous futures space for eight years. David earned an MBA from the University of Chicago Booth School of Business with concentrations in economics, statistics and analytical finance.

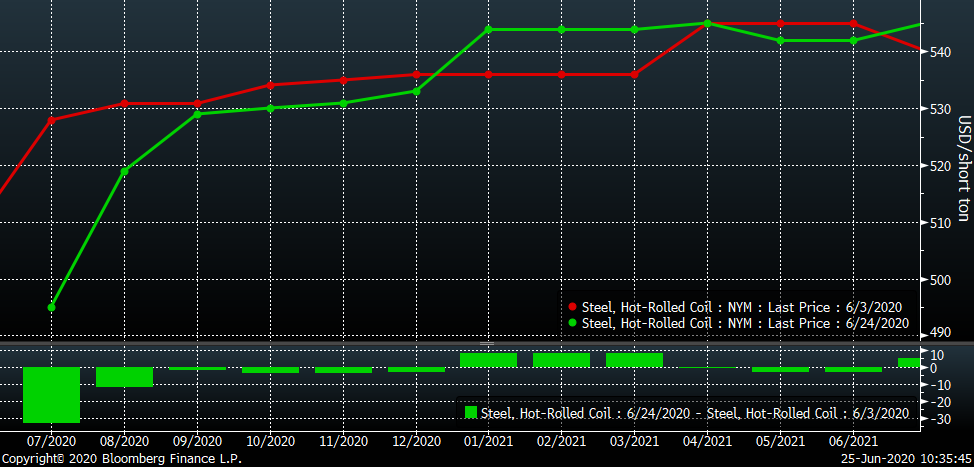

Since my last article on June 4, the July future dropped $30, now trading below $500, and August dropped $10-15, now trading around $515. The rest of the curve has been little changed and remains flat to upward sloping in the $530-545 range.

CME Midwest HRC Futures Curve

This chart shows the June 2020 future, which settled this week at $499. Over the last 14 months, the June future traded as high as $655 in April 2019 and as low as $440 in April 2020.

June 2020 CME Midwest HRC Future

With the expiration of the June contract, the rolling 2nd month shifts from July to August, which is why you see it pop up from $500 to $517. This down-trending chart continues to see lower highs and lower lows. Was a bottom established this past April or will we see a lower low in the months to come?

Rolling 2nd Month CME Hot Rolled Coil Future

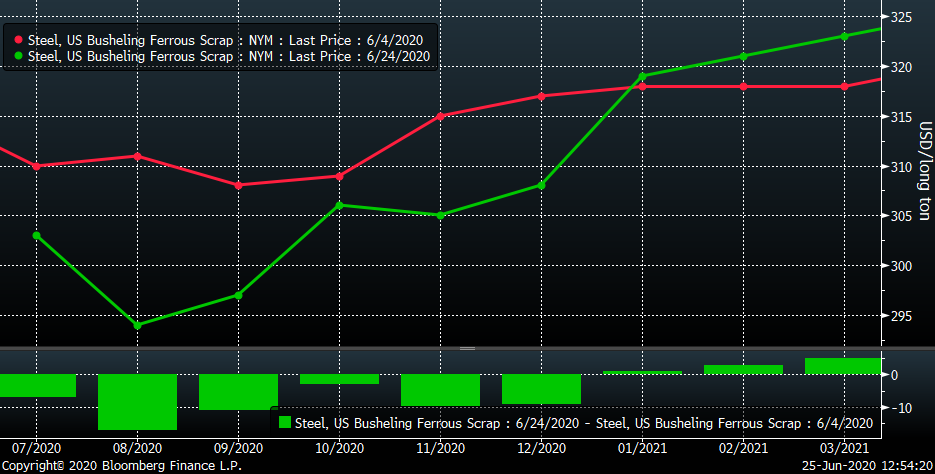

After a sharp and surprising shortage-induced rally due to manufacturing shutdowns, CME busheling continues to drift lower. July busheling is expected to be down $20-30 while August and September futures are trading in the mid-$290s.

CME Busheling Futures Curve

While CME busheling has been drifting lower, LME Turkish scrap has been in a tight range between $260 and $270 since May. The differential has compressed to $34 after peaking around $70/t.

Rolling 2nd Month CME Busheling Future (white) & LME Turkish Scrap Future (red)

After rallying $20 to $100/t in May, concerns that ore could scream higher due to COVID-related supply constraints in Brazil became front and center. However, Vale quickly brought back its Brazilian Itabira ore mine that accounts for 10 percent of Vale’s production, while China announced a number of new measures to fight a recent outbreak of COVID in Beijing. Ore has been tightly rangebound in the low $100s this week.

Rolling 2nd Month SGX Iron Ore Future $/mt

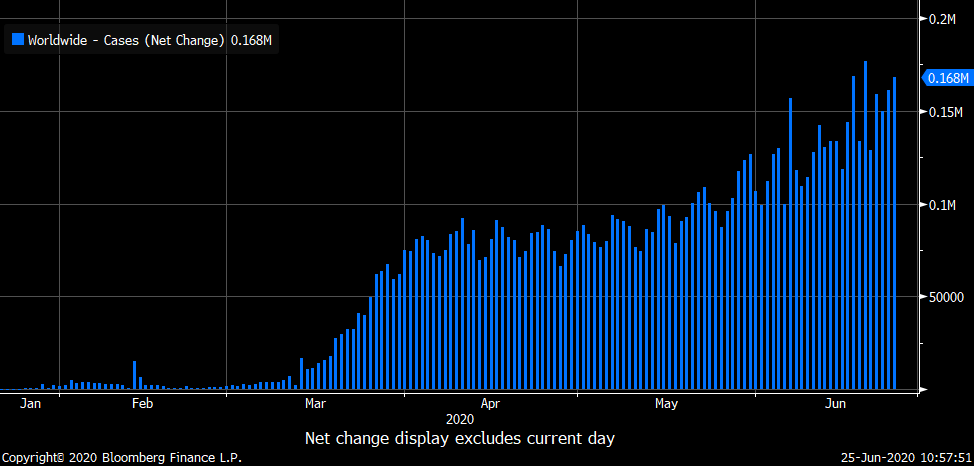

New daily cases for COVID continue to accelerate higher on a global basis.

New Daily COVID-19 Cases – Global

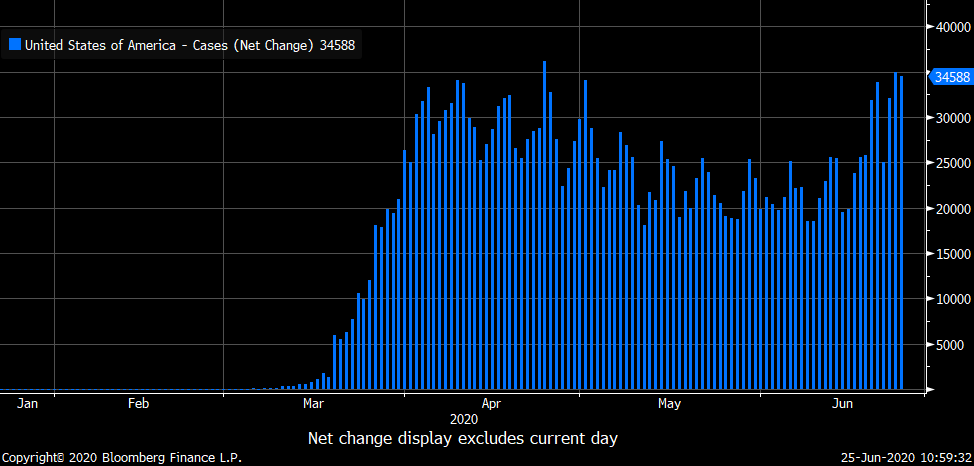

New cases in the United States have started to move higher with two of the three highest daily increases coming in the past few days.

New Daily COVID-19 Cases- USA

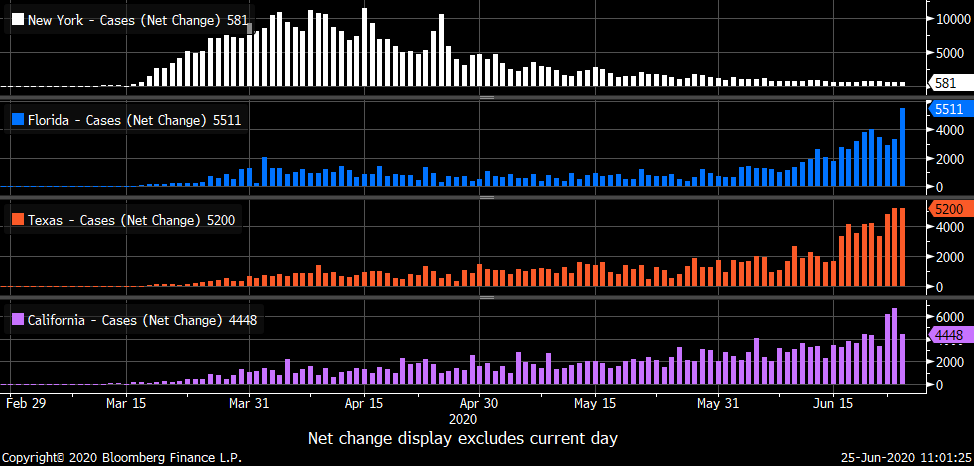

California (40m), Texas (29m), Florida (22m) and New York (19m) are the four largest states by population accounting for 110m Americans or 33 percent of the U.S. population. If you extrapolate the time it took New York to see exponential growth in COVID infections, flatten the curve and reopen (11 weeks) to the other three states, it can be argued these three states (as well as many others with similar circumstances) have many more weeks ahead of them. Following a similar timeline as in New York, it could be mid-August before they flatten their curve and see exponential decreases in new cases. However, taking into consideration the aggressive and restrictive measures taken by New York’s leaders and residents, it reasonable to expect that these three states, which were among the first to reopen and have mostly disregarded CDC safety measures, are likely to see their battle with COVID last relatively longer than New York’s. This will weigh heavily on economic production, GDP, etc.

New Daily COVID-19 Cases – NY, FL, TX & CA

The Associated General Contractors of America released a survey taken from June 9-17 where 57 percent of the 512 responses said the most helpful measure Congress could take would be to provide construction firms with protection from legal liability for failing to prevent COVID-19 infections among their workers. This potential liability for the construction industry applies to the entire economy.

Whether states seeing exponential growth in new cases “officially’ lockdown their economies or not, there will still be significant economic headwinds due to employment liability issues, consumers who fear exposure and self-impose stay-at-home measures, and state and local budgets hit with both a drop in revenue and increased spending related to COVID, which will decrease infrastructure spending in those states.

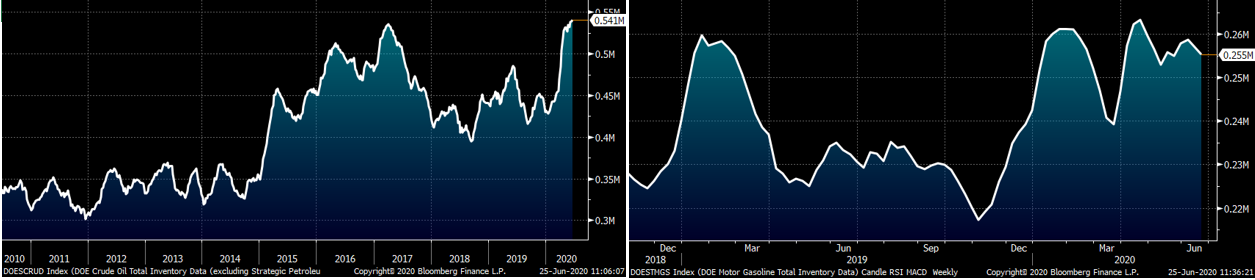

Another effect that was seen in states with problematic COVID spread is a sharp decrease in driving and gasoline demand. The Department of Energy crude oil and motor gasoline inventories are already at or near their highs.

DOE Crude Oil (left) & Motor Gasoline (right) Inventories

It has only been two-months since CME WTI oil futures traded negative as the country approached storage capacity limits. Since then, the WTI crude oil future rallied back above $40/bbl as the reopening of the economy brought back demand. The rally has faltered in recent days trading back below $40/bbl. Will we see a second sharp sell-off in oil? If so, will that drag steel prices down with it?

Rolling Front Month WTI Crude Oil Future $/bbl

The dollar index had fallen as much as 4.5 percent since trading above 100 on May 15. A cheaper dollar boosts commodity prices while a more expensive dollar weighs on commodity prices. Has the dollar bottomed? So far, there hasn’t been any major indication it has. However, we might experience another flight to safe-haven assets due to current COVID-related economic risks.

U.S. Dollar Index

The U.S. stock market regained most of what was lost during the March sell-off. However, many feel the market is frothy, even in a bubble. The 10-year Treasury bond market, which is greater than the stock market and considered to be comprised of a more sophisticated and intelligent group of investors, has not seen a return near its pre-COVID levels. It has been in a tight range, likely due to the Federal Reserve keeping rates low buying any dip in the bond futures (bond futures go down when rates go up). Taking a step back, the rally in the oil and the stock market look exhausted, while the dollar looks like it may be starting to reverse trend and the 10-Year Treasury is creeping higher. All of this is juxtaposed against the backdrop of a raging pandemic that is ravaging much of the country.

Rolling Front Month CME U.S. 10-Year Treasury Bond Future

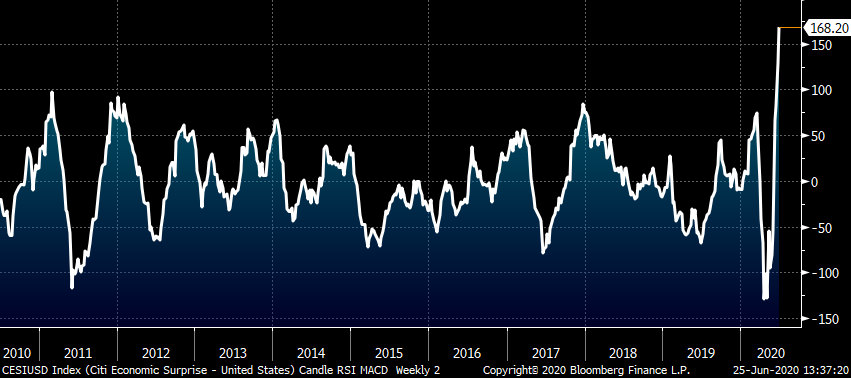

This last chart shows the Citi Economic Surprise Index at the highest level since its inception in 2003. The CESI tracks economic data surprises relative to expectations. This index is clearly mean-reverting, perhaps indicating economic disappointment ahead.

Citi Economic Surprise Index

It looks to be a challenging summer for the steel industry. In addition to the macro themes discussed above, steel will have to contend with a difficult news cycle that will include falling scrap prices, likely additional BOF supply returning and perhaps COVID manufacturing supply disruptions. Upside price events in the news cycle are harder to think of and seem more unlikely, but perhaps a COVID-induced shutdown of a mill in the South or further tariff action from Washington could surprise. Despite all of these economic issues, the Midwest HRC futures curve continues to express bullish expectations for the upcoming months trading $530 and above for September on out.

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Mr. Feldstein should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.