Prices

May 14, 2020

CRU: Scrap Prices Rise as Supply Evaporates

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Metallics Monitor

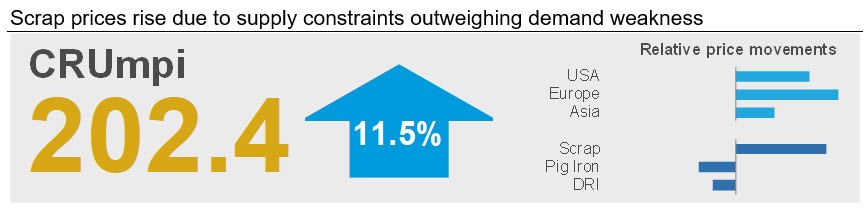

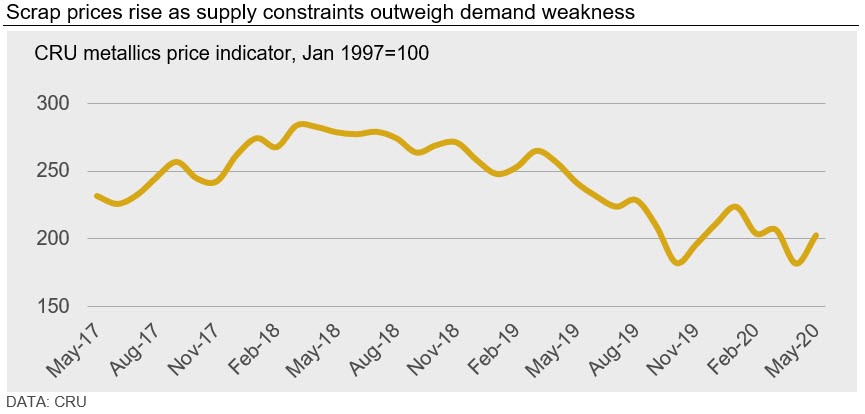

The CRU metallics price indicator (CRUmpi) moved higher by 11.5 percent m/m to 202.4 in May. Supply constraints caused by the Covid-19 pandemic combined with either sustained or recovering scrap demand to lift prices across most of the globe, although pig iron demand was more stagnant. Still, further price increases will be dictated by how much and how quickly steel end-use demand recovers.

Scrap prices rose across the globe in May as Covid-19 countermeasures strangled supply in nearly every market. Rapidly dwindling supply in the U.S. outpaced a collapse in steel demand, while the restart of EAF operations in Europe and Asia caused demand to rise. A brief quarantine in Russia also hindered scrap collection. With supply constricted in their traditional source markets, Turkish buyers were forced to keep prices range-bound even though margins for finished steel products tightened.

In the U.S., obsolete scrap availability was severely restricted as lockdown measures throughout the country hindered peddler traffic, demolition activity and shredding operations. Meanwhile, the shutdown of automotive and manufacturing operations nearly eliminated prime grade flows. As such, the mills that were still producing were forced to broaden their search and increase prices even as total U.S. capacity utilization fell to its lowest level in over a decade. Price trends varied greatly by region and grade, but generally prime grades rose by $30-50 /l.ton and obsoletes rose by $20-50 /l.ton.

While scrap supply was limited in Europe, the restart of EAF operations meant that scrap demand was the primary driver of price increases. Mills in Germany have operated more normally compared to Italian producers, which has resulted in German producers buying scrap out of northern Italy. As such, the return of Italian producers has created the potential for scrap price differentials between the northern and southern regions of Italy. With supply already scarce in the north, producers there may have to pay more to secure their scrap needs next month. Meanwhile, the relative abundance of supply in southern Italy could lead to lower prices in June.

Mills in Russia were forced to increase purchase prices after a countrywide lockdown between April 16 and May 12 limited scrap flows and transportation. With export prices holding relative to April, domestic mills in the south were also forced to compete with scrap buyers at the ports.

Constrained supply in the markets that Turkey traditionally sources scrap from has meant mills there were unable to drop buying prices at a time when their margins are getting squeezed. In the week ending May 9, Turkish rebar export prices fell by $5 /t to $400 /t FOB, while HR coil export prices fell by $15 /t w/w to $390 /t. Meanwhile, HMS 1/2 80:20 prices traded in the $245-255 /t CFR range.

In China, steel inventory liquidation in April occurred at near-record speed and resulted in much higher demand for scrap in May. With much of their inventories already liquidated from an early-April selloff, scrap sellers held on to material in anticipation of yet higher prices and this caused the scrap market to tighten. Meanwhile, EAF and BOF capacity utilization rates surged, as demand from both the construction and automotive sectors rapidly recovered, reaching roughly 60 percent and 85 percent, respectively.

In some other regions of Asia, an easing of quarantine measures has revived steel demand and boosted market sentiment. In Vietnam, construction projects that had been delayed for weeks were allowed to resume activity, raising steel demand. Conversely, tightening quarantine measures in Japan resulted in EAFs reducing output, with capacity utilization rates now estimated to be around 20 percent, although scrap prices only fell by about 1 percent as supply was also impacted.

For ore-based metallics, China again took its place as the primary demand driver in 2020 after scrap prices there increased m/m. Chinese buyers are no longer paying a premium for pig iron produced in southern Brazil relative to material from the north, and they have also sought and secured HBI supply from other countries. Even so, a lack of buying activity from more traditional markets caused some downward pressure on prices for ore-based metallics.

Outlook: Further Increases Hinge on Demand-Side Recovery

International steel demand will need to keep rising if scrap prices are going to continue on their upward trajectory. For markets like the U.S., easing lockdown restrictions will increase supply availability, and end-use steel demand will need to rise for recent scrap price increases to hold. With sentiment in Europe becoming more bearish, Turkish buyers will likely be able to secure material at lower price levels as June approaches, meaning that U.S. sellers are unlikely to find support from the international market.

The near-term outlook for scrap prices in China is more bullish as mills ramp up production. This means that buyers there will likely stay interested in the international metallics market barring any unexpected downturn.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com