Market Segment

May 12, 2020

CRU: When Should Idled Steel Capacity Be Restarted?

Written by CRU Americas

By CRU Senior Consultants Amir Sabet and Josefa Carrere, from CRU’s Steelmaking Raw Materials Monitor

The Covid-19 pandemic has generated significant uncertainty in the commodities market. For the steel sector, this has resulted in a fall in demand and steelmakers have responded by taking a wide range of capacity-related actions. In this Insight we show how CRU Consulting’s Real Options capabilities can be applied to the steel industry’s strategic options around closures of mills in this time of uncertainty. This tool makes it possible to evaluate a range of decisions and get visibility on the value and risk profile of the available options.

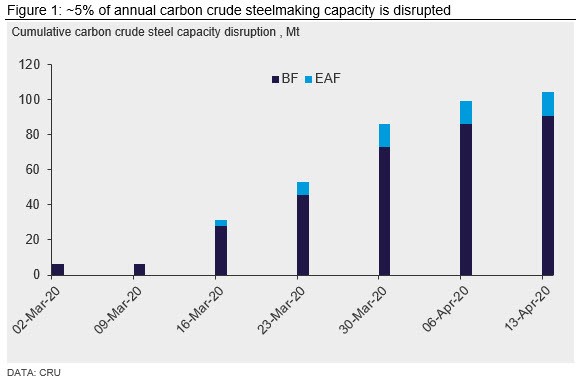

The spread of Covid-19 across the world has caused a wave of disruption in mining and metals, particularly at steel mills. Mill operators responded by taking different actions regarding their production capacity, all of which were closely monitored by CRU’s steel disruptions tracker (Steel Monitor subscribers only) as shown below for March to mid-April.

At this time of unprecedented levels of uncertainty, risk management techniques such as Real Options provide invaluable assistance with decision-making for both steel mill operators and market participants. In the steelmaking process, Real Options analysis is most suitable for decisions related to the Blast Furnace.

How Does Real Options Analysis Help Integrated Steelmakers?

Integrated steelmakers are facing a wide range of options regarding their production capacity as a result of the currently subdued demand levels, including:

• Reducing the operating rate,

• Temporary idling (“banking” or “hot idling”),

• Fully closing the mill (“blow down” or “cold idling”).

In all the above choices, steel mills will still have the option of restarting the operation or going back to full capacity (“blow-in”) in the future. However, the timing of this choice is significantly influenced by the type of actions the steel mills take at the time of closures (such as temporary idling or full shut down), as well as the outlook of steel margins at the time.

There are four key metrics which we have identified that steelmakers need to carefully consider when making operational decisions under a highly uncertain outlook:

1) The steel supply and demand outlook,

2) The cost of operating/closing/restarting the steel mills,

3) The volatility of steel margins (i.e. of prices and raw materials costs),

4) The timing of their decisions.

For example, the benefit of an early decision to reopen a steel mill gives the steelmaker early access to revenue. However, this could be largely offset by the upfront cost of restarting, or by still subdued (or even negative) steel margins should steel prices remain low for a longer period.

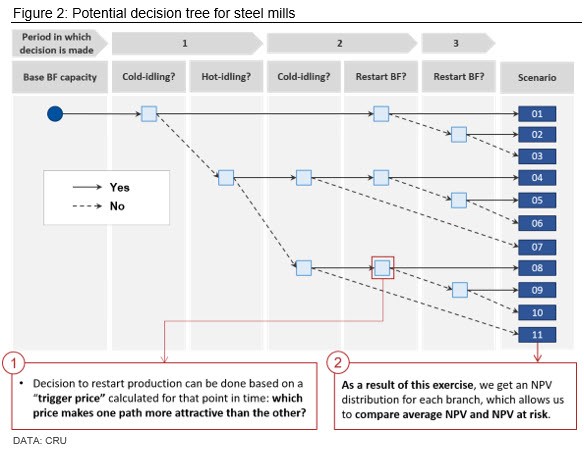

The binomial decisions that steel mills face and the way in which they can approach them can be illustrated as follows:

The Next Step: Consider the Different Choices

If we take the above example, we can see that, beginning at a starting point today, the first option available to steel makers would be to either close their mill, idle it, or continue operating as usual. If the mill is closed, there is an option in the future (period 2) to either restart production, or not. If the decision of restarting production is made, this would lead to Scenario 01 – the first of the many scenarios to be evaluated under Real Options Analysis. If, on the other hand, the decision to not restart production is made, this then opens up the opportunity in the future to evaluate a potential restart (period 3). If a decision is made to restart production in period 3, this will then lead to Scenario 02. If the decision at that point is to remain closed, this leads to Scenario 03 and so on.

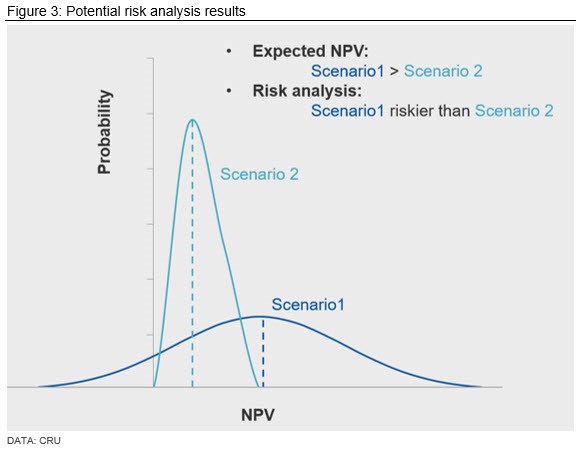

The result: quantified NPVs and risk profiles for each available option

The key advantage of CRU Consulting’s Real Options Analysis is that an NPV distribution can be calculated for each scenario, which allows decision makers to compare the expected NPV of each option they face, and for each scenario, as well as the likely range of their respective NPVs. This powerful combination enables operational decision making based both on quantified NPVs and the risk profiles of each option available, thereby enabling the full alignment of both the company’s and their stakeholders’ own risk preferences.

And This Can Be Applied to a Wide Range of Commodities

Using Real Options analysis allows our clients to make more robust decisions at times of uncertainty, enables decisions to be made to capture potential upsides more quickly and provides a common framework against which multiple assets across a region can be assessed.

CRU Consulting is currently tracking all supply disruptions in the mining and metals space including iron ore, steel, aluminum and copper. Post Covid-19, producers must make important operational decisions based on a range of variable factors and timing is critical. CRU Consulting has a depth and breadth of commodity expertise and so is well positioned to quantify the value of those options, helping all those involved in the commodity markets better navigate these uncertain times.

If you would like to discuss Real Options analysis further or better understand key opportunities and risks affecting your business, please get in touch using the contacts below.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com