Prices

May 12, 2020

CRU: Iron Ore Prices Rising on Robust Chinese Demand, Weak Supply

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from the CRU Steelmaking Raw Materials Monitor

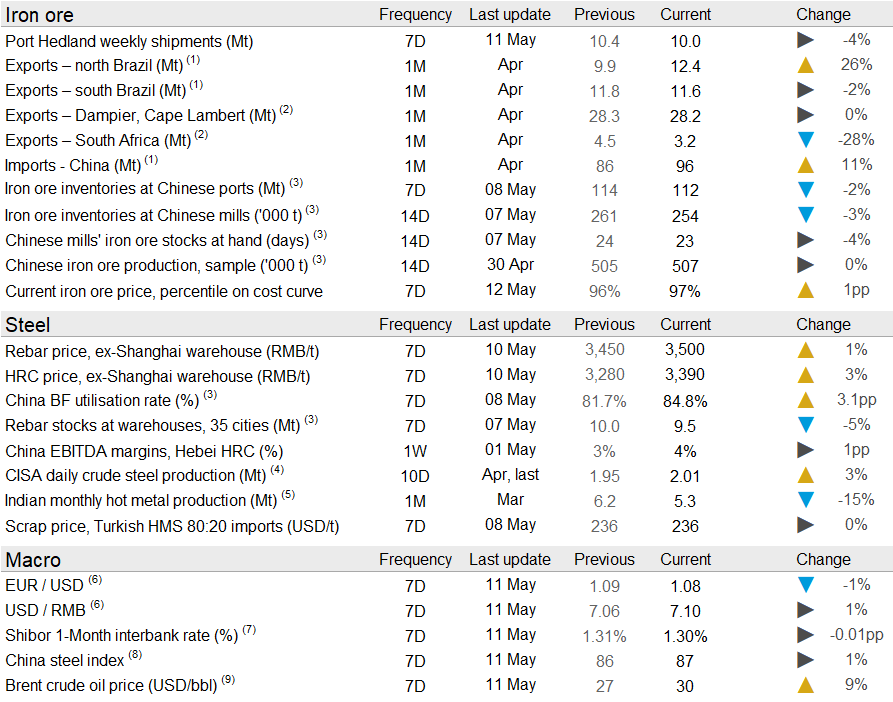

In the past week, the iron ore price has risen to $88.8 /dmt as seaborne supply displayed some temporary weakness while China’s steel production remained at a high level. The current iron ore price, $5.3 /dmt higher than last week, sits at the 97th percentile on CRU’s Business Costs curve.

China has recently come out of its Labor Day holiday (May 1–5) and focus has now shifted to the “Two Sessions,” which will start on May 21 after having been postponed from early-March. The “Two Sessions” is China’s most important political event of the year and includes:

• National People’s Congress (NPC), a meeting of China’s top legislative body, which approves the government’s work, passes new laws and outlines the country’s economic targets.

• Chinese People’s Political Consultative Conference (CPPCC) is a representation of China’s civil society and advises the NPC on issues important to the people.

CRU’s sources in China mention that expectations of new stimulus measures are boosting sentiment, with rising prices of steel and raw materials as a result. Chinese BFs keep increasing their output, and we have seen iron ore inventories at ports and mills decline further in the past week.

Seaborne supply has disappointed in the past week. Although Port Hedland shipments have been steady at 10 Mt, shipments from Rio Tinto and both parts of Brazil have fallen w/w. In Brazil, there are growing concerns after a sharply rising number of infections and fatalities following the Covid-19 outbreak in the northern parts of the country. Several cities in the state where Vale’s mines are located have gone against the federal government and introduced lockdown measures. The same have been taken in the port city of São Luís where Vale’s Ponta de Madeira port is located. In South Africa, mining restrictions have been lifted but the rail network is still operating at reduced rates, meaning the country will keep exporting at reduced levels for some time.

In the next week, we expect prices to hold high on low inventory levels. However, there is room for a slight correction as we expect seaborne supply to bounce back after a relatively poor week.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com