Prices

May 12, 2020

CRU: Five Critical Uncertainties Facing the Steel Raw Materials Market Due to Covid-19

Written by CRU Americas

By CRU Principal Consultant Laura Brooks and Senior Consultant Amir Sabet, from CRU’s Crude Steel Market Outlook

The market impacts of Covid-19 are unknown in scale, varied and staggered in time across the world. The steel raw materials markets are being affected to a lesser or greater extent depending on the demand-side and supply-side regional focus, and exposure to oil prices and exchange rate fluctuations, both of which are impacting delivered costs. The current iron ore price is holding up well, whereas that for met coal has dropped. At a high level, this is the result of differing supply-side trends over recent months, and the reliance on Chinese seaborne demand for iron ore, which is now strengthening, and Indian demand for met coal, which is slowing and shrouded with uncertainty.

What Does It Mean?

There are widely varying scientific and economic views currently in circulation, as well as a broad range of commodity-specific influences, all leading to many potential outcomes over the next one to five years. Put simply, this now means that our base case, point forecasts come with increased risk. To better understand and quantify this risk, we are using scenario analyses as they provide a range of plausible outcomes for demand, supply and price. This approach enables you to stress-test your business by considering what might happen in a “mildly impacted” versus a “severely impacted” world and allows you to start preparing for different eventualities. CRU Consulting has developed three high-level scenarios (click here) which can be applied across the mining, metals and fertilizer industries. In the Insight below, the focus is on uncertainties in steel raw materials markets and our approach to running these industry-specific scenarios.

CRU Consulting’s Approach to Scenario Analysis: An Overview

CRU Consulting’s scenario analysis framework is well-established. Our models are both flexible and transparent, and they help you to better understand the impact of a global recession (to a greater or lesser extent) on steel demand through the full value chain, from end-use demand through to raw materials. We use revised GDP and IP forecasts to drive these macro scenarios through our demand-side model and adjust our supply-side expectations based on real-time conversations and research by our experts in local offices around the world. We ensure that our macro expectations—under each scenario—flow through to costs and, ultimately, to our price deck.

Five Critical Uncertainties: Key Factors to Consider

While the macro expectations are vital in establishing our scenarios, there are additional layers that must be considered. In this Insight, we would like to share with you some of our recent thinking around the uncertainties that the steel raw materials market faces at the moment.

- There may be an extension of the Indian lockdown as we soon enter the monsoon season and the huge population size makes the virus difficult to control. As of mid-April, a quarter of blast furnace capacity had already been idled. India is the largest seaborne consumer of met coal; how will a prolonged cut in demand impact the seaborne price?

- China’s increased pellet consumption could persist, as it absorbs weak demand elsewhere and sellers take advantage of the low freight rates. How will this impact the global pellet market and the premium?

- There are question marks around whether European blast furnaces that have been idled will be turned back on. May “greener” steelmaking technologies be pursued in the longer-run instead and will there be the investment available for this? What does this mean for demand for iron ore and met coal demand, and prices?

- Some Brazilian iron ore operations may be forced to close and face difficulties restarting, especially in Minas Gerais. This is the impact of both Covid-19 and pre-existing environmental concerns. Could this affect significant volumes of seaborne iron ore and can China “make up” the difference on supply? Could it alter the five-year price forecast?

- Covid-19 may mean that miners have reduced capital to spend in the coming five years, thereby putting expansion plans on hold. Are the raw materials markets reliant on expansion investment in this timeframe and, if so, how might this change impact prices? Could there be a new phase of consolidation and M&A activity?

Behind the Scenes: How CRU Consulting Classifies Uncertainties in a Volatile Market

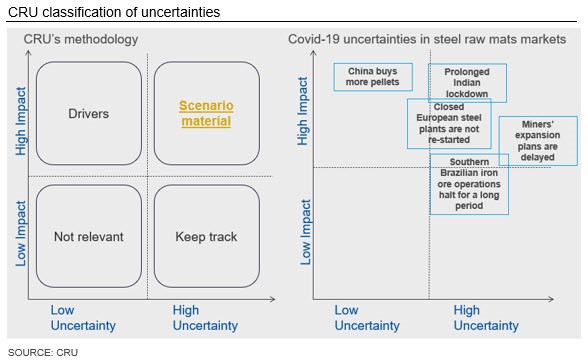

The matrix below shows CRU Consulting’s methodology, which we have used to categorize these uncertainties in order to identify which are the most important ones to run as scenarios.

The Next Steps…

In this Insight, we’ve shared just five out of what is undoubtedly a long list of uncertainties that the steel raw materials markets currently face. Through the coming weeks and months, these uncertainties will evolve, and we will all inevitably be faced with new questions and challenges. Here at CRU Consulting, we will continue to track these uncertainties and progress our thinking around the potential market reactions and their impacts, and we look forward to sharing our thoughts with you again in the near future.

Please do contact us to discuss the analysis above – we value your views on the points raised and would welcome an open discussion on how they might specifically impact your business.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com