Market Data

May 3, 2020

CRU Global Economic Outlook: Month of Lockdown Lowers GDP by 2-3%

Written by Jumana Saleheen

By CRU Chief Economist Jumana Saleheen and CRU Economist Ippolito Tarabini, from CRU’s Steel Sheet Products Market Outlook

Lockdowns continued into April. They resulted in a fall in activity, particularly in the hospitality, entertainment and travel sectors. Using estimates of the loss of output by sector, we find that one month of lockdown lowers the level of annual GDP by 2-3 percent and annual GDP growth by 2-3 percentage points. This has led us to lower our forecasts this month. There are large revisions to our U.S., Eurozone and India forecasts, but little change to China. World GDP is forecast to contract by 3 percent in 2020, and IP is expected to fall by 4.4 percent (both significantly larger falls than forecast last month). We expect a U-shaped recovery for the world economy and a strong bounce back in 2021, but not strong enough to recover the lost output of 2020.

The Great Lockdown has Successfully Flattened the Curve

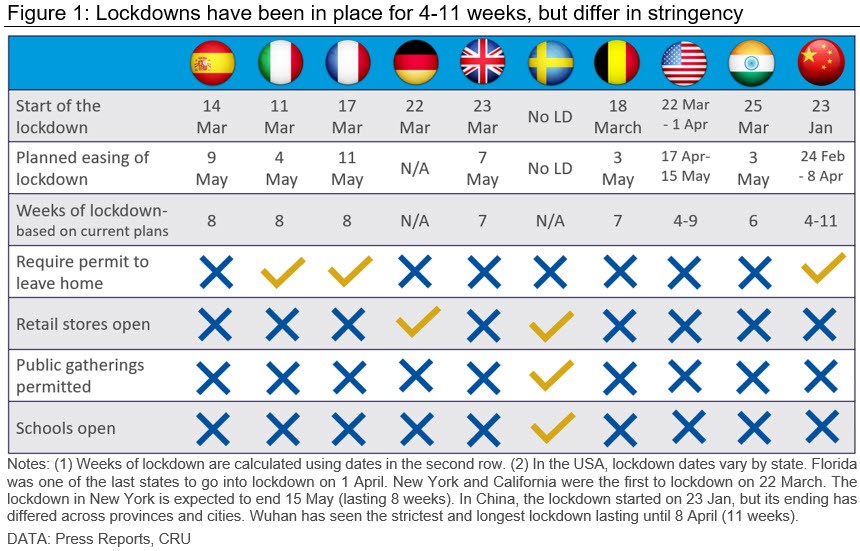

In April, one-third of the world’s population was in lockdown. The table below shows that most economies have been in lockdown for 6-8 weeks. While lockdowns have varied in their degree of stringency, they have been successful in flattening the virus transmission curve, as captured by the daily death rate. Some countries have started to outline their phased exit strategy from the lockdown. For example, Italy has set out a phased approach to re-opening its economy; factories open from May 4, retail shops from May 18 and personal care (beauty salons) from June 1.

The lockdown is known to have had a differential impact on economic activity across different sectors of the economy. Worst hit are the entertainment, hospitality and travel industries. In other sectors, such as financial services, remote working with digital communication (Zoom, Skype) has led to a small loss in output.

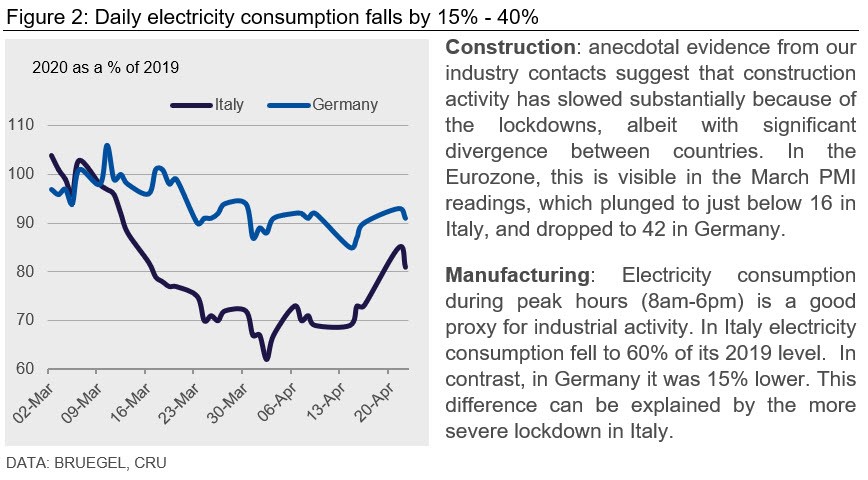

Drawing on high frequency data, we can assess the extent to which activity has fallen by sector during the lockdown period. That information, together with the size of each sector, can be used to estimate the loss in output for each month of lockdown. The focus is on the Eurozone and the USA where lockdowns are still in place. The lockdown has ended in China, where it led to China’s first ever quarterly decline in GDP since the Chinese growth story started.

Lockdowns Lower Output; Auto and Construction are Hit Hard

This section considers the evidence on the loss in economic activity by sector. It focuses on the sectors of most interest: auto production, construction, manufacturing, real estate and agriculture.

Agriculture: Demand is robust and governments across the globe are acting in accordance with the fact that food security is a priority. The loss in overall output has been close to zero. That said, there inevitably will be pockets of disruption, offset by pockets of opportunity.

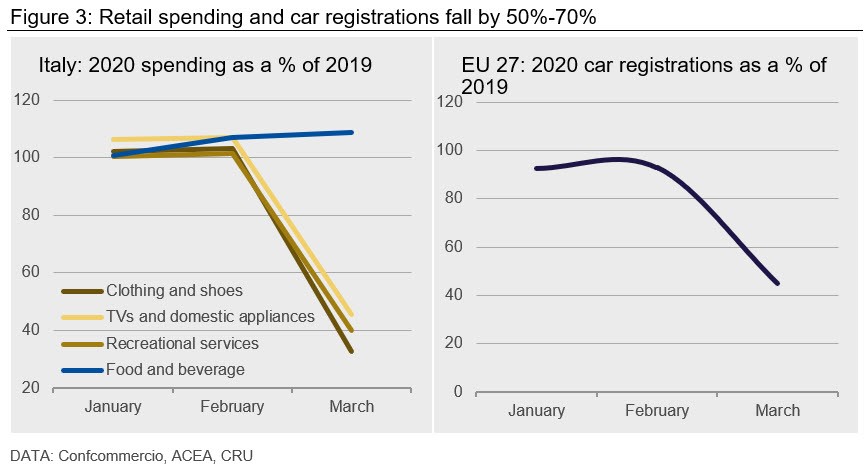

Wholesale, retail, and motor trade: Preliminary data on March expenditure in Italy suggests that consumer spending on several discretionary items (e.g. clothing, domestic appliances and recreational services) fell by as much as 70 percent compared to a “pre-lockdown” level. The motor trade is also suffering from the lockdown. In March, car registrations in the EU-27 dropped by 55 percent y/y. The falls are worse for the countries where the lockdown was implemented earlier: 85 percent y/y in Italy, 72 percent y/y in France, and 69 percent y/y in Spain. With more countries in lockdown during April, we expect car registrations to be even lower in April. Thereafter things may improve, as some car plants across the EU are beginning to re-open after more than a month of shutdown. The ACEA estimates that production losses because of the shutdowns in March and April amount to ~2 million motor vehicles.

Real estate: High frequency data suggests that lockdown measures are taking a heavy toll on the real estate sector. Even though a surge in online viewings suggests that consumers continue to be interested in buying a new house or apartment, the overall picture is grim. According to Redfin, U.S. pending home sales were down 54 percent in the first week of April, compared to a year ago. The picture appears worse in the UK where Zoopla reported that demand from sales applicants (a proxy for buyer demand) has declined by 70 percent since the first week of March.

One Month of Lockdown Lowers Annual GDP by 2-3 Percent

The previous section showed that lockdowns affect the activity of different sectors to different degrees. Most sectors have been damaged, and few have benefitted from greater activity. Countries with more stringent lockdowns experience a greater loss in output.

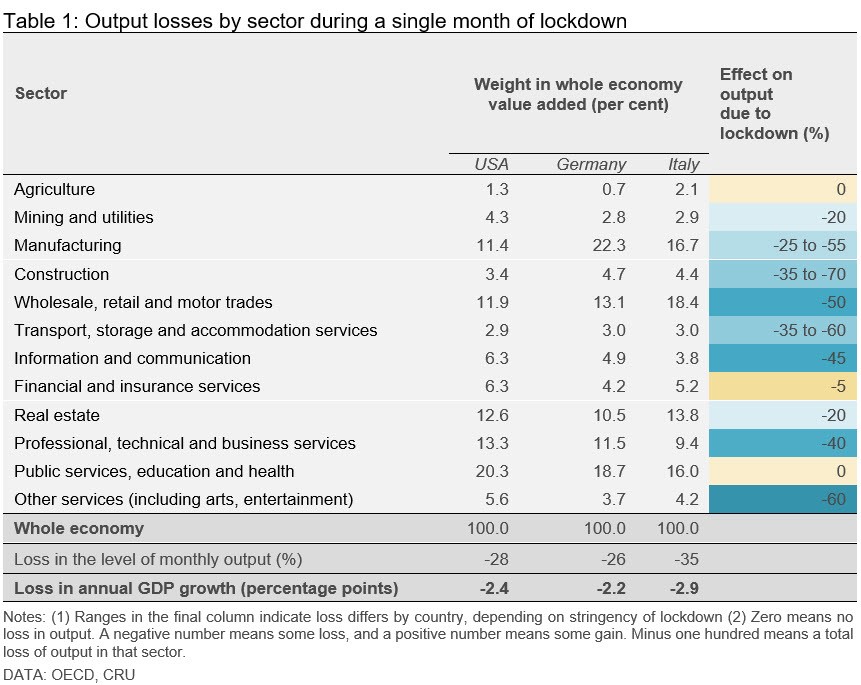

Table 1 sets out estimates of the impact of a lockdown on the level of economic activity in a single month by sector (final column). These estimates are informed by OECD research.

The sector definition is determined by national data sources. Some categories are broadly defined. They can combine a sector that is heavily disrupted by the virus (e.g. education) with a sector where the virus has given rise to greater opportunities (e.g. health research). The effect on output due to lockdown takes account of these differences across sectors. The total loss in economic output is calculated by adding up the loss by sectors, weighted by the importance of each sector in the economy.

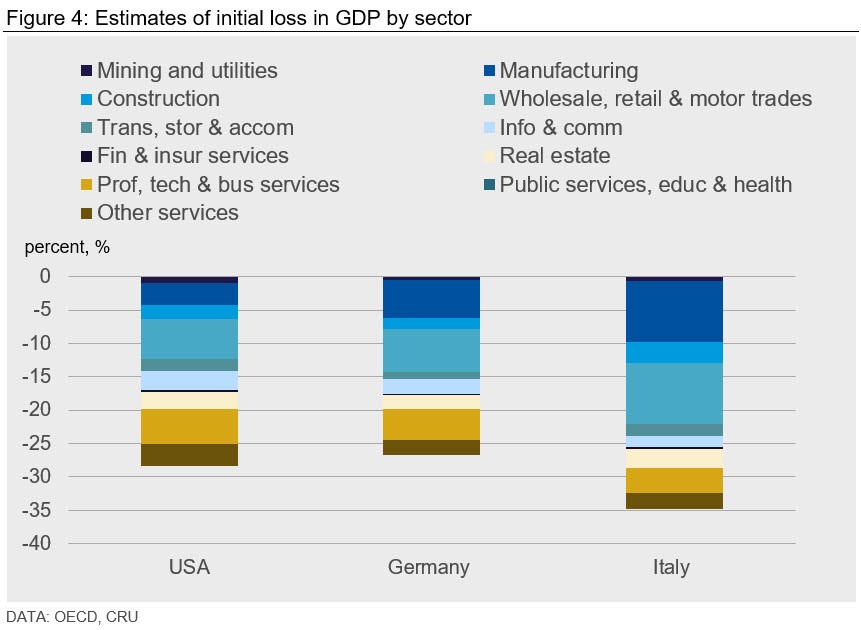

This method suggests that each month of lockdown will lower monthly output in the USA by 28 percent. In Germany, the loss is lower at 26 percent; in Italy it is 35 percent. The differences across countries are due to different assumptions on output loss (determined by the stringency of lockdown) and different sectoral structure (e.g. Germany has a larger manufacturing sector).

The total loss broken down by sector is shown in Figure 5. Unsurprisingly, the fall is largest in wholesale, retail and motor trades (this includes the sale and repair of cars, retailing of clothing and footwear, and wholesale distribution of items to retailers). Some service sectors, e.g. professional, technical and scientific, have also taken a hit—this category includes legal, accounting, photographic, consulting, advertising and translation services.

The scale of the estimated decline in the level of output is large. It is equivalent to a decline in annual GDP growth by 2-3 percentage points for each month of lockdown. If the shutdown ends after two months, with no offsetting factors, annual GDP growth could be between 4-6 percentage points lower than it otherwise might have been.

To give an example, in January our forecast for U.S. GDP growth in 2020 was 1.7 percent. It has now been revised to a fall of 5 percent. That is an overall drop of 6.7 percentage points. For 2020, the Eurozone GDP growth forecast has been lowered from growth of 1 percent to a fall of 6 percent; and India’s forecast has gone from 6 percent growth to a fall of 1 percent in 2020, a revision of 7 percentage points in both cases. These forecasts are consistent with a two-month lockdown, followed by a phased opening up of the economies.

Unlocking Lockdowns is a Tricky Business

This month we have used activity loss by sector to gauge the economic damage that follows from lockdowns. That analysis has led us to lower our global growth forecasts. For the Eurozone, U.S. and India, we are now forecasting deeper downturns in 2020; the path to recovery is also expected to be longer and lasting well into 2022. In contrast, our China forecast remains broadly unchanged from last month, mainly because the GDP data for Q1 – capturing the output loss from lockdown – was broadly in line with our projections.

In these uncertain times, the risks around macro forecasts are larger than usual. Our base case forecasts assume that major economies will gradually re-open after 2-3 months of strict lockdown. The U.S. and Europe are preparing to ease lockdown restrictions starting in May. That will lift economic activity. However, getting the pace of “opening up” right is a tricky balance. Go too fast, and the virus takes hold. Go too slow, and the economy gets left behind.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com